The Presidential Cycle is now over. Instead, worries about the recession and the US debt ceiling talks are moving centre-stage. But Asian currency markets are sending a warning signal. A rising US dollar and US interest rates, and a falling yen and yuan, could soon raise the risks of a major Asian debt crisis.

Chemicals and the Economy

Chart of the Year – CAPE Index signals negative S&P 500 returns to 2030

Each year, it seems there is only one candidate for Chart of the Year. And 2020 is no exception. It has to be the CAPE Index developed by Nobel Prize winner, Prof Robert Shiller. As the chart shows, it is nearly at an all-time high with Tesla’s addition to the S&P 500. Only the peak […]

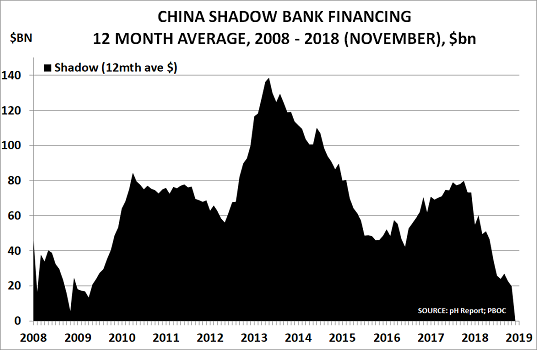

Chart of the Year – China’s shadow banking collapse means deflation may be round the corner

Last year it was Bitcoin, in 2016 it was the near-doubling in US 10-year interest rates, and in 2015 was the oil price fall. This year, once again, there is really only one candidate for ‘Chart of the Year’ – it has to be the collapse of China’s shadow banking bubble: It averaged around $20bn/month […]

Interest rates and London house prices begin return to reality

Global interest rates have fallen dramatically over the past 25 years, as the chart shows for government 10-year bonds: UK rates peaked at 9% in 1995 and are now down at 1%: US rates peaked at 8% and are now at 2% German rates peaked at 8% and are now down to 0%: […]

Chemical industry downturn challenges stock market optimism

Stock markets used to be a reliable indicator for the global economy, and for national economies. But that was before the central banks started targeting them as part of their stimulus programmes. They have increased debt levels by around $30tn since the start of the Crisis in 2008, and much of this money has gone […]

Monetary policy reaches sell-by date for managing the economy

Monetary policy used to be the main focus for running the economy. If demand and inflation rose too quickly, then interest rates would be raised to cool things down. When demand and inflation slowed, interest rates would be reduced to encourage “pent-up demand” to return. After the start of the Financial Crisis, central banks promised […]

Central banks defy slowing global economy by destroying markets’ power of price discovery

Markets have one main function in life – price discovery. If I want to buy, and you want to sell, the existence of a market allows us to discover the price at which the market will balance in terms of supply and demand. History, however, provides many examples of times when rulers decided they knew […]

Central bankers create debt, not growth, by ignoring demographic reality

The world’s 4 main central bankers love being in the media spotlight. After decades climbing the academic ladder, or earning millions with investment banks, they have the opportunity to rule the world’s economy – or so they think. But their background is rather strange preparation to take on this role – even if it was […]

US 10-Year interest rates suggest Great Reckoning may be near

“History doesn’t repeat itself, but it often rhymes“, Mark Twain Bob Farrell of Merrill Lynch was rightly considered one of the leading Wall Street analysts in his day. His 10 Rules are still an excellent guide for any investor. Equally helpful is the simple checklist he developed, echoing Mark Twain’s insight, to help investors avoid […]

Bank of England’s new stimulus policy creates bankruptcy risk for corporate pension funds

The Western BabyBoomers (born between 1946-70), have been one of the luckiest generations in history. By and large, they have escaped the major wars that have plagued society down the ages. They have also lived in a world where living standards and material wealth have made astonishing gains. Equally priceless has been the rise in […]