Last November, I wrote one of my “most-read posts”, titled Global smartphone recession confirms consumer downturn. The only strange thing was that most people read it several weeks later on 3 January, after Apple announced its China sales had fallen due to the economic downturn. Why did Apple and financial markets only then discover that smartphone sales […]

Chemicals and the Economy

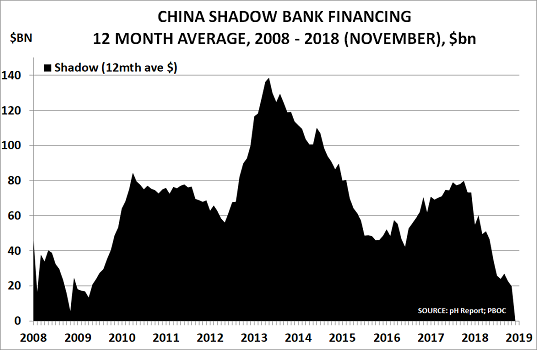

Chart of the Year – China’s shadow banking collapse means deflation may be round the corner

Last year it was Bitcoin, in 2016 it was the near-doubling in US 10-year interest rates, and in 2015 was the oil price fall. This year, once again, there is really only one candidate for ‘Chart of the Year’ – it has to be the collapse of China’s shadow banking bubble: It averaged around $20bn/month […]

Financial markets party as global trade wars begin

More people left poverty in the past 70 years than in the whole of history, thanks to the BabyBoomer-led economic SuperCycle. World Bank and OECD data show that less than 10% of the world’s population now live below the extreme poverty line of $1.90/day, compared to 55% in 1950. Globalisation has been a key element in […]

Chart of the Year: Bitcoin, the logical end for stimulus policies

Last year it was the near-doubling in US 10-year interest rates. In 2015, it was the oil price fall. This year, there is really only one candidate for ‘Chart of the Year’ – it has to be Bitcoin: It was trading at around $1000 at the start of 2017 and had reached $5000 by August […]

Central banks’ reliance on defunct economic theory makes people worry their children will be worse off than themselves

“Average UK wages in 2022 could still be lower than in 2008” UK Office for Budget Responsibility While Western stock markets boom under the influence of central bank money-printing, wages for ordinary people are not doing so well. So it is no wonder that Populism is rising, as voters worry their children will be worse […]

Debt, demographics set to destroy Trump’s GDP growth dream

Unsurprisingly, Friday’s US GDP report showed Q1 growth was just 0.7%, as the New York Times reported: “The U.S. economy turned in the weakest performance in three years in the January-March quarter as consumers sharply slowed their spending. The result fell far short of President Donald Trump’s ambitious growth targets and underscores the challenges of […]

Markets doubt Carney’s claim to have saved 500k UK jobs

Last week as the BBC reported, Bank of England Governor, Mark Carney, explained to an audience in Birmingham that the Bank had saved the UK economy after the Brexit vote in June: “Between 400,000 and 500,000 jobs could have been at risk if the Bank had not taken action after the referendum, he said. “We are willing […]

Tokyo, Shanghai stock markets fall; yen rises 8% in 2 weeks

Pity poor Janet Yellen, you might say. The head of the US Federal Reserve told the Senate last week that she had been “quite surprised” by the collapse of oil prices since mid-2014. And she added that the rise of the US$ was similarly “not something that we had expected” (you can see the testimony […]

Coppock, Farrell indicators suggest financial market downturn underway

They don’t ring bells to warn of financial market tops and bottoms. But there are 2 very good substitutes in terms of the Farrell and Coppock Indicators, as the above chart for the UK stock market since 1973 shows: It is based on the Financial Times All-share Index (FTA), as the FTSE 100 only began […]

Yellen offers hostage to fortune on US growth

Previous chairs of the US Federal Reserve had a poor record when it came to forecasting key events: Alan Greenspan, at the peak of the subprime housing bubble in 2005, published a detailed analysis that emphasised how house prices had never declined on a national basis Ben Bernanke, at the start of the financial crisis […]