I worked for many years at a world-leading chemical company, ICI. But sadly, it lost its way as senior management began to focus more on financial metrics than market developments. In 2007, it disappeared. Today, other companies including the once-mighty ExxonMobil risk making similar mistakes: EM was the world’s most valuable company just 9 years ago It […]

Chemicals and the Economy

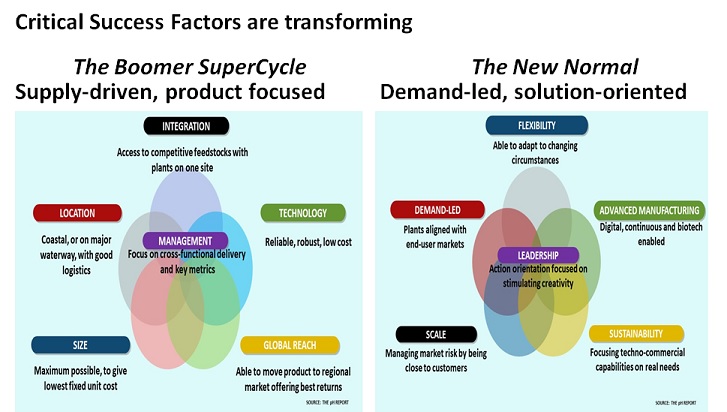

Paradigm shifts create Winners and Losers

MY ANNUAL BUDGET OUTLOOK WILL BE PUBLISHED NEXT WEEK Next week, I will publish my annual Budget Outlook, covering the 2020-2022 period. The aim, as always, will be to challenge conventional wisdom when this seems to be heading in the wrong direction. Before publishing the new Outlook each year, I always like to review my […]

Chemical output signals trouble for global economy

A petrochemical plant on the outskirts of Shanghai. Chinese chemical industry production has been negative on a year-to-date basis since February Falling output in China and slowing growth globally suggest difficult years ahead, as I describe in my latest post for the Financial Times, published on the BeyondBrics blog Chemicals are the best leading indicator for the […]

Budgeting for the end of “Business as Usual”

Companies and investors are starting to finalise their plans for the coming year. Many are assuming that the global economy will grow by 3% – 3.5%, and are setting targets on the basis of “business as usual”. This has been a reasonable assumption for the past 25 years, as the chart confirms for the US economy: […]

High-flying “story stocks” hit air pockets as credit finally tightens

“Nobody could ever have seen this coming” is the normal comment after sudden share price falls. And its been earning its money over the past week as “suddenly” share prices of some of the major “story stocks” on the US market have hit air pockets, as the chart shows: Facebook was the biggest “surprise”, falling […]

China’s lending bubble is history

As China’s shadow banking is reined in, the impact on the global economy is already clear, as I describe in my latest post for the Financial Times, published on the BeyondBrics blog China’s shadow banking sector has been a major source of speculative lending to the global economy. But 2018 has seen it entering its […]

Chart of the Year: Bitcoin, the logical end for stimulus policies

Last year it was the near-doubling in US 10-year interest rates. In 2015, it was the oil price fall. This year, there is really only one candidate for ‘Chart of the Year’ – it has to be Bitcoin: It was trading at around $1000 at the start of 2017 and had reached $5000 by August […]

China’s lending bubble sees Beijing home prices jump 63%

Greed and fear are the primary emotions driving China’s housing and auto markets today, as China’s lending bubble hits new heights. For ordinary citizens, greed is the key driver: Average home prices in Beijing rose an eye-popping 63% between October 2015 – February 2017 In Shanghai, one enterprising estate agent (realtor) […]

US watchdog warns on today’s “quicksilver markets”

What could go wrong in today’s financial world? Many stock markets in the West are hitting new highs, and central banks are promising they will do nothing to spoil the party. But as Gillian Tett of the Financial Times warned on Friday: “Before anyone gets too thrilled about equities, they should read a sobering research document from […]

The Great Unwinding of policymaker stimulus has begun

Large economies are like supertankers. There are no brakes to use if you want to change direction in a hurry. Instead, you have to put the engine into reverse, and hope you can slow down fast enough to avoid the rocks. That is what happened in China last month, as the new leadership began to […]