Everyone who has ever played the Beer Distribution Game on a training course knows what is happening in supply chains today. A small increase in underlying demand is rapidly leading to a massive increase in ‘apparent demand’. As the New York Times reports, “the pandemic has disrupted every stage of the (supply chain) journey.” And […]

Chemicals and the Economy

Weak demand – and the illusion of a return to “normal”

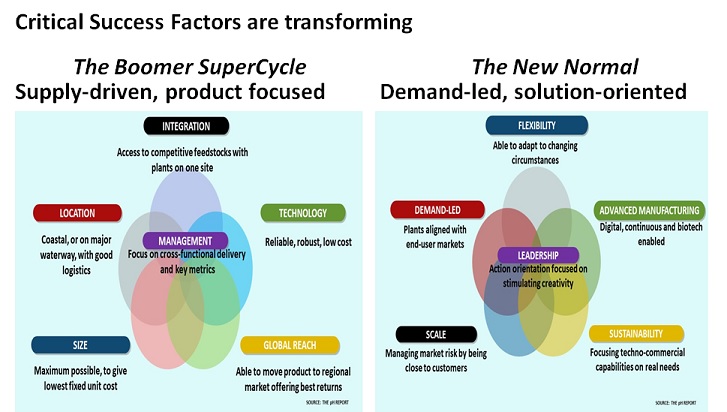

My new interview with Real Vision focuses on the major changes underway in the economy. Our analysis of the chemical industry, auto market, and technology sector, suggests a return to the “old normal” is highly unlikely. Instead, major changes are underway in Demand Patterns, Reshoring, Energy Abundance, the Circular Economy and in Advanced Manufacturing. For […]

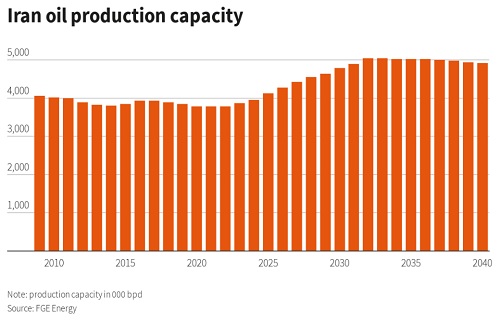

Iran highlights OPEC’s dilemma on output cuts

Saying you “won’t do something” may stop you digging a bigger hole for yourself. But it doesn’t help in deciding what you should do instead. That’s OPEC’s dilemma today on raising oil output. Everything seemed simple enough a year ago, as the pandemic took hold: Saudi Arabia’s first reaction was to assume it would have […]

Look for Winners and Losers in 2021

“There are decades where nothing happens; and there are weeks where decades happen”. Lenin’s famous insight was highly relevant to 2020. It was full of such weeks as the coronavirus pandemic became a catalyst for major paradigm shifts in the economy. Of course, some sceptics still expect a quick V-shaped return to ‘business as usual’, […]

US chemical companies face ‘wake-up call’ as Biden focuses on the Climate Change agenda

I worked for many years at a world-leading chemical company, ICI. But sadly, it lost its way as senior management began to focus more on financial metrics than market developments. In 2007, it disappeared. Today, other companies including the once-mighty ExxonMobil risk making similar mistakes: EM was the world’s most valuable company just 9 years ago It […]

OPEC set to lose out as Biden, EU and China focus on Climate Change opportunities

OPEC used to dominate global oil markets. In the early 1980s, there was even talk of another OPEC cartel to control gas prices. But those days are long gone. Instead OPEC members such as the UAE are increasingly aware they have only a limited time left to monetise their vast reserves of fossil fuels. This is […]

Welcome to the New Normal – a look ahead to 2030

10 years ago, I took a look ahead at what we could expect in the next decade, as discussed last week. Unfortunately, we now face the major economic and social crises that the chart predicted, if policymakers continued with ‘business as usual’. This week, I want to look ahead at what we can expect to […]

If you don’t want to know the future, look away now

Next week, I will publish my annual Budget Outlook, covering the 2021-2023 period. It will highlight how the pandemic is accelerating major paradigm shifts in society, politics and the global economy. I have been publishing these Outlooks since 2007, and they disprove the idea that forecasting is a waste of time. They highlight instead that […]

Global chemical industry – key trends for success in today’s New Normal

The chemical industry is the best leading indicator for the global economy. On Friday, I had the privilege of discussing a wide range of key issues with Ajaya Sharma in a lunchtime interview for India’s main business station, ET Now. Our interview focused on a number of critical areas and why the future is going […]

“They may ring their bells now, before long they will be wringing their hands”

The wisdom of Sir Robert Walpole, the UK’s first premier, seems the only possible response to this weekend’s headline from the Wall Street Journal. How can a National Emergency ever be the basis for a major rise in stock markets? Of course, we all know that stock markets have become addicted to stimulus. But the […]