Major new opportunities are starting to appear in today’s New Normal world, as I describe in a new analysis for the Institution of Chemical Engineers. Please click here to read the full article. We are set to enter a “New Normal” world as economies slowly reopen again with the arrival of Covid-19 vaccines. This will […]

Chemicals and the Economy

Biden’s Earth Day Summit puts plastics recycling on the fast track

Plastics has long been the ‘odd one out’ in terms of recycling. Steel, aluminium, glass, cardboard, rubber and paper routinely have up to a 70% rate of recycling. But plastics has been stuck at around 10% for a long time. President Biden’s Earth Day Summit is likely to change this picture, and quickly. The reason […]

Businesses face “biggest imposition of red tape in 50 years” as Brexit begins

Most companies had closed when the new EU-UK Trade and Cooperation Agreement (TCA) was finally announced on Christmas Eve. And they are only now starting to get their heads around what it all means. Essentially, it creates the biggest shake-up to the UK’s trading relationships since 1973. As the BBC’s Economics Editor reported: “It is […]

Welcome to the New Normal – a look ahead to 2030

10 years ago, I took a look ahead at what we could expect in the next decade, as discussed last week. Unfortunately, we now face the major economic and social crises that the chart predicted, if policymakers continued with ‘business as usual’. This week, I want to look ahead at what we can expect to […]

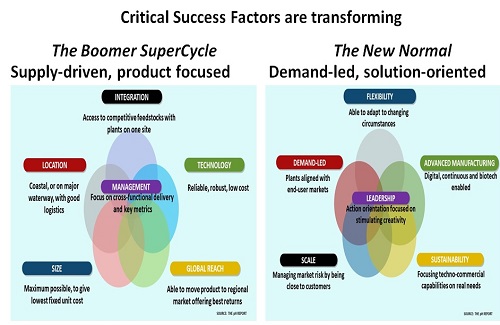

Local circular plastics solutions to replace mega projects business model

NEW YORK (ICIS)–There will be a paradigm shift away from mega crackers producing massive volumes of plastics for export, and toward local recycling of plastic waste for local finished goods production. Joe Chang, editor of ICIS Chemical Business, summarises my presentation earlier this month to the Societe de Chimie Industrielle in New York. “The industry […]

Global chemical industry – key trends for success in today’s New Normal

The chemical industry is the best leading indicator for the global economy. On Friday, I had the privilege of discussing a wide range of key issues with Ajaya Sharma in a lunchtime interview for India’s main business station, ET Now. Our interview focused on a number of critical areas and why the future is going […]

China’s lockdown makes global debt crisis now almost certain

Beijing has a population of 21.5 million, but you wouldn’t know it from this BBC video from last Thursday. Normally busy streets and transport systems are eerily empty, with food deliveries often the main traffic on the roads. It’s the same picture in industry, with the Baidu Migration Index reporting only 26% of migrant workers […]

Europe’s auto sector suffers as Dieselgate and China’s downturn hit sales

Trade wars, Dieselgate and recession risk are having a major impact on the European auto industry, as I describe in my new video interview with ICIS Chemical Business deputy editor, Will Beacham. One key pressure point is created by the downturn in China’s auto industry. As the chart shows, it has been a fabulous growth […]

CEOs need new business models amid downturn

Many indicators are now pointing towards a global downturn in the economy, along with paradigm shifts in demand patterns. CEOs need to urgently build resilient business models to survive and prosper in this New Normal world, as I discuss in my 2019 Outlook and video interview with ICIS. Global recession is the obvious risk as we start […]

Trump’s trade war should set warning bells ringing for every company and investor

There should be no surprise that President Trump has launched his trade war with China. The real surprise is that financial markets, and business leaders, are so surprised it is happening. He was, after all, elected on a platform that called for a trade war, as I noted originally back in November 2016 – and […]