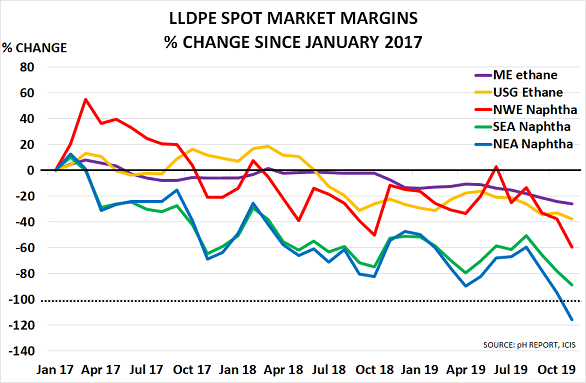

Polyethylene markets (PE) are moving into a crisis, with margins in NE Asia already negative, as I have been forecasting. Scenario planning is now a matter of potential life or death for companies likely to be impacted over the next 12-18 months. The collapse in margins is already quite dramatic as the chart based on […]

Chemicals and the Economy

Portugal shows the way to climate neutrality by 2050

Portugal shows the way to climate neutrality by 2050

Day of reckoning approaches for US polyethylene expansions, and the European industry

Planning for future demand in petrochemicals and polymers used to be relatively easy during the BabyBoomer SuperCycle. The team would consult the latest IMF forecast for global and regional growth, and then debate the right ratio to use to calculate product demand. For polyethylene (PE), the ratio was generally just above GDP at around 1.1x, […]

Stormy weather ahead for chemicals

Four serious challenges are on the horizon for the global petrochemical industry as I describe in my latest analysis for ICIS Chemical Business and in a podcast interview with Will Beacham of ICIS. The first is the growing risk of recession, with key markets such as autos, electronics and housing all showing signs of major […]

$60bn opportunity opens up for plastics industry as need to eliminate single-use packaging grows

150 businesses representing over 20% of the global plastic packaging market have now agreed to start building a circular economy for plastics with the Ellen MacArthur Foundation. As a first step, Coca-Cola has revealed that it produced 3MT of plastic packaging in 2017 – equivalent to 200k bottles/minute, around 20% of the 500bn PET bottles used every […]

Asian downturn worsens, bringing global recession nearer

The chemical industry is the best leading indicator for the global economy. And my visit to Singapore last week confirmed that the downturn underway in the Asian market creates major risks for developed and emerging economies alike. The problem is focused on China’s likely move into recession, now its stimulus policies are finally being unwound. […]

Petrochemicals must face up to multiple challenges

Europe’s petrochemical sector must prepare now for the trade war, US start-ups, Brexit and the circular economy, as I discuss in this interview with Will Beacham of ICIS news at the European Petrochemical Association Conference. With higher tariff barriers going up between the US and China, the market in Europe is likely to experience an influx of […]

Ethane price hikes, China tariffs, hit US PE producers as global market weakens

Sadly, my July forecast that US-China tariffs could lead to a global polyethylene price war seems to be coming true. As I have argued since March 2014 (US boom is a dangerous game), it was always going to be difficult for US producers to sell their vastly increased output. The expansions were of course delayed […]

US-China tariffs could lead to global Polyethylene price war

I was interviewed on Friday about the likely impact of President Trump’s trade wars on the global chemical industry by Will Beacham, deputy editor of ICIS Chemical Business. His interview is below. The introduction on Friday of trade tariffs by China and the US is the first step in a trade war that could turn into […]

Oil prices flag recession risk as Iranian geopolitical tensions rise

Today, we have “lies, fake news and statistics” rather than the old phrase “lies, damned lies and statistics”. But the general principle is still the same. Cynical players simply focus on the numbers that promote their argument, and ignore or challenge everything else. The easiest way for them to manipulate the statistics is to ignore […]