THE LATEST DATA on linear low-density polyethylene (LLDPE) China CFR (cost & freight) pricing spreads over CFR Japan naphtha costs underlines the evidence from the other grades of polyolefins, that China is a long way from a full economic recovery.

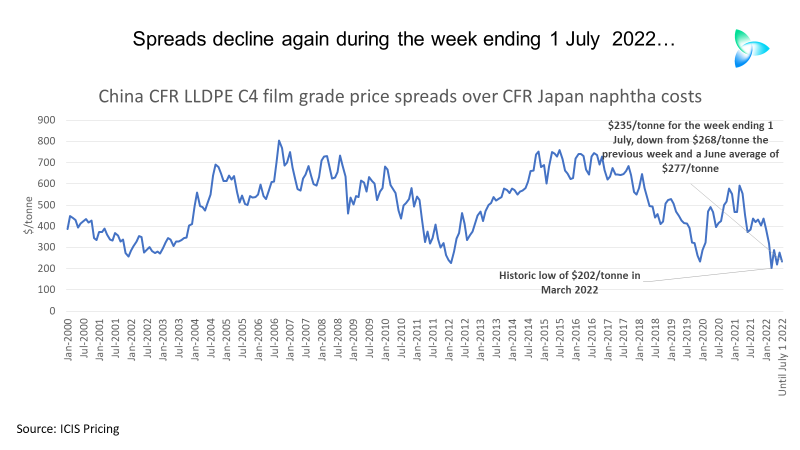

The chart below shows per tonne CFR China LLDPE C4 film grade monthly price spreads over CFR Japan naphtha costs from January 2000, when our assessments began, until the week ending 1 July 2022.

Spreads reached a record low in March 2022 of $202/tonne. They have moderately rebounded since then, but in the week ending 1 July they fell to $235/tonne from the previous week’s $268/tonne and from a June average of $277/tonne.

This decline reflects commentary in the latest ICIS Asia Pacific PE price report that said confidence early in the week ending 1 July fizzled out because of persistently bearish market sentiment.

Now let us look at CFR China LLDPE spreads on an annual basis. Spreads in 2000-2021 averaged $513/tonne, were $452/tonne in 2021, but so far this year have averaged just $276/tonne.

Let us next look at actual CFR China LLDPE pricing versus actual CFR Japan naphtha costs rather than the differentials.

There is nothing new, of course, about this year’s rapid run-up in oil prices and thus naphtha costs. But, delving into the above chart, here are some important differences:

- Oil prices along with naphtha costs rose very steeply from January 2003 until October 2008, when they collapsed because of the Global Financial Crisis. During this prolonged period of higher costs, CFR China LLDPE spreads averaged $568/tonne.

- Another long period of mainly rising oil prices and naphtha costs occurred from January 2009 until November 2014. During this period, LLDPE spreads averaged $492/tonne.

- Briefly in April 2020, oil prices turned negative. But from that month until December 2021 they again rose. In this period, LLDPE spreads averaged $465/tonne.

- But, as mentioned above, so far this year spreads have averaged just $276/tonne.

China LLDPE 2022 demand outlook worsens

In order to complete my latest round of posts on China’s polyolefins market – which have examined what the January-May 2022 net import and local production data tell us about the full year – consider the LLDPE chart below.

In January-April on an annualised basis (divided by four and multiplied by 12), the ICIS estimate of local production and the China Customs department net import number suggested a 2% decline in LLDPE demand in 2022 over last year. This is Scenario 1, which is my best case.

But the January-May data indicates a 4% decline. This is the basis for Scenario 2, my medium-case outcome. Scenario 3, the worst case, indicates a 6% contraction.

And finally, as always, see my latest estimate for China’s LLDPE net imports in 2022.

Scenario 2 is again based on the January-May data – the China Customs department net import number and the annual operating rate indicated by our assessment of local production. This year’s net imports would fall to some 4.9m tonnes from 5.5m tonnes in 2021 and 6.6m tonnes in 2020 .

Scenario 1 factors in my best-case demand result and again follows the 83% operating rate suggested by our January-May estimate of local output. Net imports decline to 5.1m tonnes.

Under Scenario 3, I assume higher production later this year as the year’s average operating reaches 85% – the base case forecast in the ICIS Supply & Demand Database. Demand is minus 6%. Net imports decline to just 4.3m tonnes.

History tells us that China often runs its chemicals and polymers capacity hard in times of weak demand growth in order to reduce dependence on imports and to raise export earnings.

China’s LLDPE exports may receive support during the rest of this year from further yuan weakness versus the US dollar. So far this year, the yuan has declined in value against the greenback.

We have already seen a pick-up in China’s small volumes of LLDPE exports. In January-May 2022, exports were 57,944 tonnes versus 38,504 tonnes during the same months last year.

China’s LLDPE import and export story will also be shaped by how much new capacity comes on-stream during the rest of this year. In 2021, local capacity jumped by 20% with a further 11% increase due in 2022.

The economic muddle continues

In contrast to the clarity of the ICIS data, the muddle surrounding China’s macroeconomic statistics continues. Take the May official purchasing managers’ indices (PMI) as an example.

The manufacturing index, which mainly covered larger businesses and state-owned companies, rose to 50.2 in June, the first time it had crossed 50 since February this year, wrote CNN in a 30 June article.

“The non-manufacturing PMI, which includes construction and services industries, jumped to 54.7 in June compared with 47.8 in May. It was also the first time the index has moved back into expansion territory in four months, and its strongest reading since May 2021,” wrote CNN in the same article.

The improved PMI results were seen by economists as signs that economic activity was picking up due to relaxation of lockdowns in major cities such as Shanghai.

But ING, in analysing the PMI readings, wrote: “The rebound of the non-manufacturing PMI was mainly due to more construction activity. This indicates the resumption of infrastructure construction and some state-backed real estate developers also resuming home and office building.

“The employment sub-index showed further decreases in workers in both PMI series. This will continue to put pressure on retail sales and selling prices.

“The selling price sub-index in both non-manufacturing and manufacturing PMIs, from which we can infer demand for both goods and services, remained weak, even though lockdowns were more localised in June.

“There could be a further squeeze on profit margins as costs are now edging up while selling prices are falling.”

And as this 4 July Wall Street Journal article reminded us, China’s strict adherence to its zero-COVID policies means there is always the risk of renewed lockdowns.

“China is imposing fresh restrictions in some eastern cities as COVID-19 cases have spiked to near their highest levels in more than a month,” wrote the WSJ as it reported new lockdowns in the provinces of Anhui and Jiangsu.

And I worry that, even if coronavirus remains largely under control during the rest of this year, retail sales will be negatively affected by economic restructuring (mainly the deflation of the real estate bubble) and strict testing and quarantine regulations.

Conclusion: keep watching our numbers

As I said, the ICIS chemicals data offers clarity amidst the economic confusion, provided you subscribe to our data with the support of market intelligence from our analysts and editors.

And what seems clear rom the latest data on China is something very unusual is happening. The country could be close to or already in recession for the first time I can recall in 25 years of following chemicals data and China’s economy.

Let’s hope the chemicals numbers to move in the right direction, but I am afraid this may well not happen during the rest of this year.