Even our base case sees global PE capacity in excess of de</mand at 22m tonnes in 2023 compared with a 10m tonnes/year annual average in 2000-2022. We forecast this year’s global operating rate at 79% versus the average annual 2000-2022 operating rate of 86%. Downside One would see 28m tonnes of excess capacity and a global operating rate of 77%; Downside Two would be 30m tonnes and 76% respectively.

Asian Chemical Connections

China HDPE 2023 demand and net import forecasts

Scenario 1 for next year assumes that China successfully transitions from its zero-COVID policies. Consumer confidence comes roaring back. Demand grows by 4% year-on-year to a market of 17.6m tonnes.

Scenario 2 assumes that high infection rates and lack of healthcare resources keep consumer confidence depressed but that the global economy recovers, supporting China’s exports. Growth is minus 2%, leaving demand at 6.6m tonnes.

The worst-case outcome is Scenario 3 where the impact of zero-COVID continues, and the global economy gets weaker. Consumption falls by 4% to 16.1m tonnes.

Europe, re-globalisation of PE prices and the challenges for 2023

AGAIN, PLEASE DON’T SAY I didn’t warn you. The chart below is an example of how PE prices have started to re-globalise. as I said they would when they began to de-globalise from March 2021 onwards.

What applies to the declining polyethylene (PE) price differentials between Europe and China applies to all the other countries and regions versus China. The pattern has been the same in polypropylene (PP) over recent months.

China economy, PP demand, may see no benefit from zero-COVID exit until 2024

A SELECTIVE READING of the news is giving polyolefins market participants confidence. They see the relaxation of zero-COVID restrictions in some Chinese cities as a sign that the worst is over. But a recovery in PP and PE demand seems unlikely until 2024.

Why European chemicals can emerge from this crisis as a winner

IT REALLY ISN’T doom and gloom if you take the longer-term view. Instead, for the chemical companies with the right strategies, the opportunities to build new sustainable business models are huge. The winners will make an awful lot of money while also doing the right things for humanity and our natural environment.

China HDPE: 2023 demand and net import outlook

China’s HDPE in demand in 2023 could fall by as much as 4% over 2022. Next year’s net imports may slip to as low as 3.8m tonnes from around 5.7m tonnes in 2022.

Overseas HDPE price premiums over China remain at historic highs, but maybe for not much longer

HDPE film grade price premiums for selected countries and regions over China recovered in September and October of this year. In 2020, premiums averaged just $36/tonne compared with $248/tonne in January 2021-October 2022.

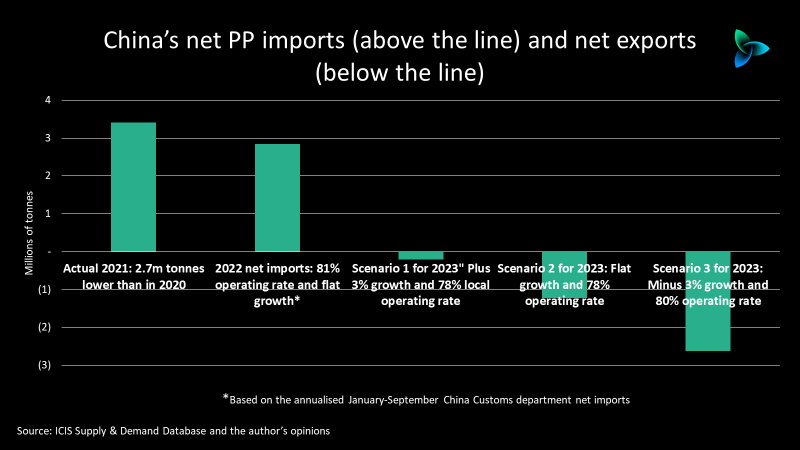

China PP demand and net import outlook for 2023

China[s PP demand growth in 2023 could be as low as minus 3% as it swings into a 2.6m tonnes net export position from this year’s likely net imports of around 3.4m tonnes.

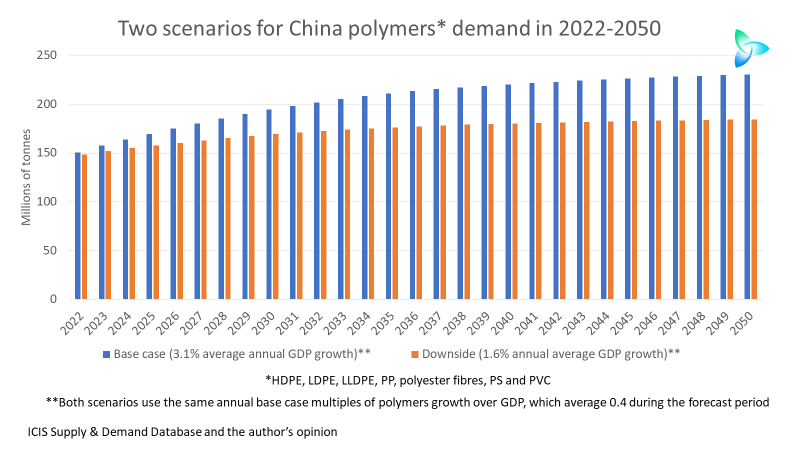

China’s long-term GDP growth risks and polymers demand

Cumulative downside demand in the above chart would total 5bn – 91m tonnes lower than our base case.

China chemicals growth and the 20th Communist Party Congress

China’s share of global demand growth in the seven big resins jumped to an astonishing 67% in 2002-2021. Northeast Asia ex-China’s share of demand fell to minus 1% with Europe and North America worth just 4% and 2% of growth respectively. The chemicals world had become dangerously lopsided.