IT WILL NOT be easy to estimate what could be higher-than-expected levels of European petrochemicals imports during the rest of 2022. But in the context of a China that might even be in recession, the extra effort necessary to figure calculate shifts in European trade flows is very, very worthwhile.

Asian Chemical Connections

Major China PE and PP rate cuts fail to halt slide in spreads to historic lows

Reductions in production seem to have been forced by the logistics and demand challenges caused by Zero-COVID.

Europe petrochemicals demand weakness may have bigger impact than any production cuts

Lower refinery operating rates on a lack of Russian oil and naphtha -– and reduced electricity supply to refineries and petrochemicals plants -– may be more than offset by weaker European petrochemicals demand.

China polyolefins 2022 growth and import risks increase

WE HAVE BEEN here before, of course. In April 2020, pessimism abounded about China’s growth prospects that turned out to be unfounded because of the extraordinary strength of its post peak-pandemic recovery. But circumstances that led to the economic rebound in the second half of 2020 were very different.

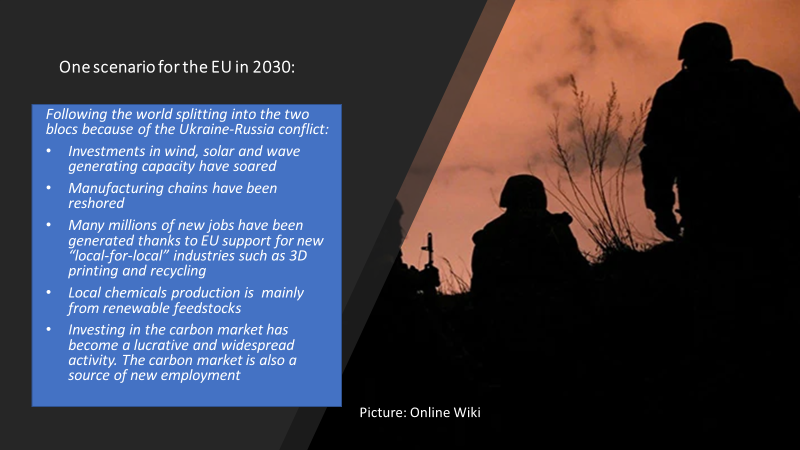

The EU in 2030: How Ukraine-Russia could reshape its chemicals industry and economy

”. Manufacturing cost pressures and the climate change and plastic -waste clean-up imperatives have created a new chemicals business model. No longer is financial success driven by sales-volume growth in chemicals.

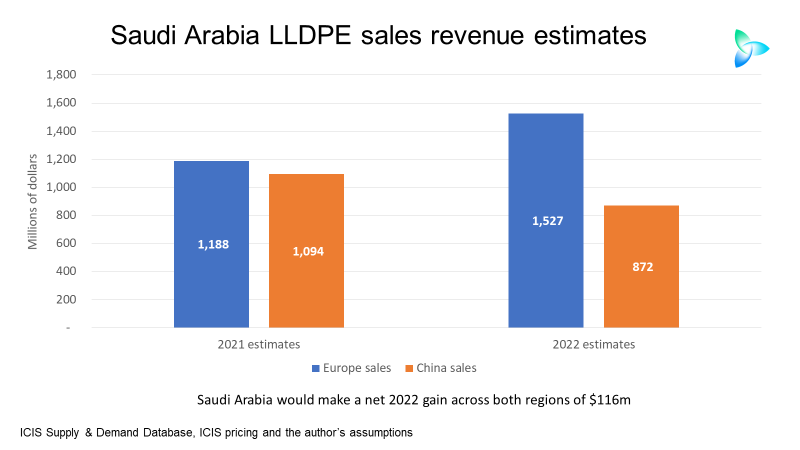

New global LLDPE demand scenarios in the context of Ukraine-Russia

How on earth does one respond to the daily news flow? The answer must be headline scenarios – best, – medium and worst-case scenarios

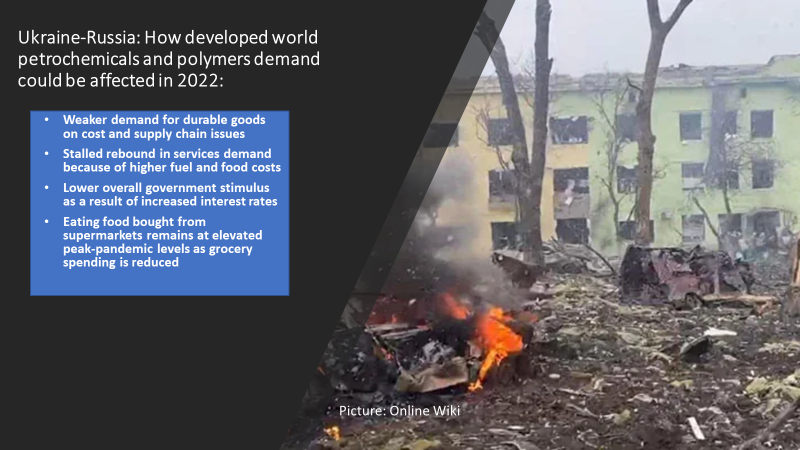

Ukraine-Russia: how the crisis could reshape petrochemicals demand

I hope what follows helps as a first pass at describing the new environment in which our industry is operating as a result of the Ukraine-Russia conflict.

Geopolitics have always shaped the petrochemicals industry

THE HEADLINE IN the above slide has always been the case. But why it was forgotten could be because many of us spent most, if not all, of our professional careers in the benign period between the end of the Cold War in 1991 and the pivot in the US approach to China, which happened some four years ago.

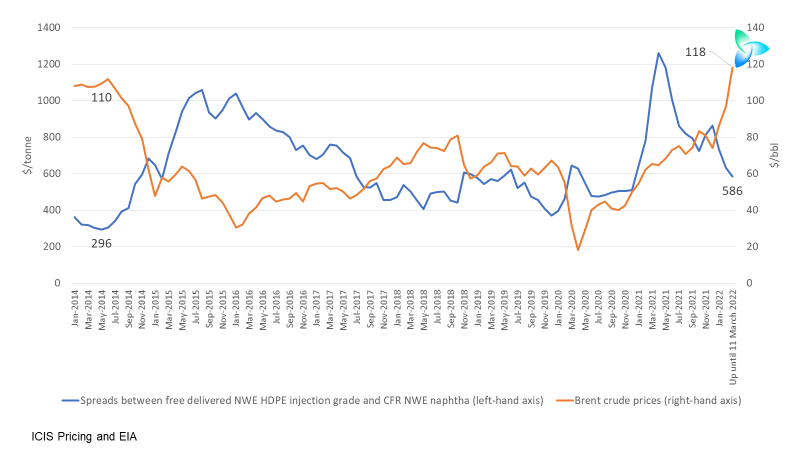

European polyethylene and Ukraine: a new set of challenges

A NEW NORMAL for European (PE) markets could be underway, replacing the divided world of the last 10 months, as the chart below suggests.

Global inflation may matter more than China’s latest supply chain disruptions

IF THE REPORTED new problems at Yantian container port –- the third largest in the world –- had happened before 24 February, the only concern would have been further disruptions to the global container business.

Back then, I would have only worried this would have caused yet another delay to in the fall in of east-west freight rates to much more manageable levels.

Under the Old Normal, high freight rates had created a divided polyolefins world – very strong pricing and margins in Europe and the US versus comparatively very weak pricing and margins in Asia.

High container freight rates had limited the ability of Middle East and Asian producers to relieve oversupply in the dominant China market through exporting to the West. The oversupply was the result of a China demand slowdown caused by Common Prosperity and big capacity increases in China and South Korea.

But does it now even matter that much that Yantian is said by CNBC to be effectively shut down because of the coronavirus-related lockdown affecting Shenzhen –- the city of 17m people where the port is located?

Not if we are already amid a collapse in demand for Chinese exports more significant than any reductions in container-freight shipments, the result of high inflation.

Or maybe China will, as it has done in the past, subsidise its exporters to keep the China price cheap enough to sustain its export trade. There are reports of this already happening.