EVEN if China’s PP demand growth is 14% this year – double our forecast – and growth in other regions is higher than we expect:

Global capacity in excess of demand would be 18m tonnes in 2023 compared with a 8m tonne/year average in 2000-2022,

Asian Chemical Connections

Global PE new supply and China spreads tell the real story

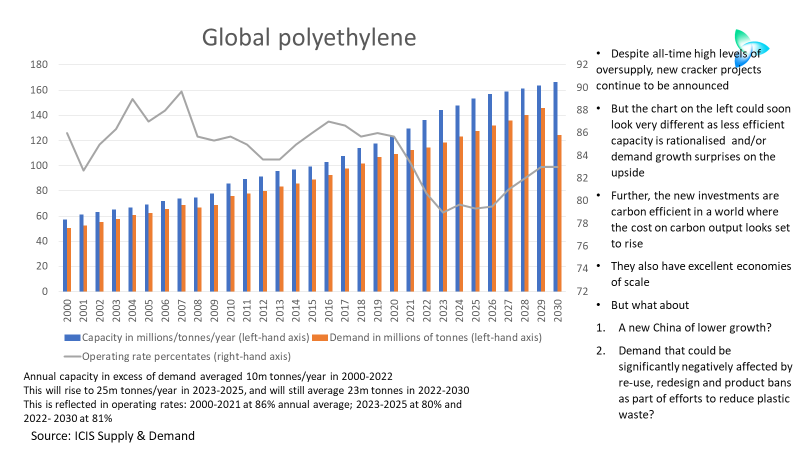

Global PE capacity in excess of demand is forecast to average 24m tonnes/year in 2022-2025, and to reach 26m tonnes this year

Operating rates are expected to average 81% in 2022-2025. This would compare with a 10m tonnes annual average capacityexceeding demand in 2000-2021 and an operating rate of 85%.

Your complete and updated outlook for global polyethylene in 2023

The strength of China’s post zero-COVID recovery in 2023 will be crucial, as will local operating rates as self-sufficiency further increases.

Another important factor: European gas supply next winter and the effect on local PE production.

Assessing confidence and the China PE demand recovery: More scenarios are needed

Scenario 2, my preferred scenario, would see China 2023 PE demand at approximately 38.5m tonnes – an average of 2% higher across the three grades than in 2022.

Cracker project announcements continue despite all-time high oversupply

Companies behind the crackers due on-stream over the next four years emphasise the low-carbon output. The planned new plant also have excellent economies of scale

China polyolefins in 2023: Demand and supply workshops crucial

This year is a great deal harder to predict than 2022,, hence my latest outlook for China’s PP demand (see the chart below), which includes the two extremes of our ICIS base case for 6% growth versus my worst-case downside of minus 5%.

China PE market in 2023: Recovery threatened by economic inequality, real estate decline

Under Scenario 1, China’s PE demand in 2023 would total 39.1m tonnes, 4% higher than last year; Scenario 2 would see demand at 36.4m tonnes, 3% lower; and Scenario 3 would involve a contraction of 5% to 35.7m tonnes.

China HDPE 2023 demand and net import forecasts

Scenario 1 for next year assumes that China successfully transitions from its zero-COVID policies. Consumer confidence comes roaring back. Demand grows by 4% year-on-year to a market of 17.6m tonnes.

Scenario 2 assumes that high infection rates and lack of healthcare resources keep consumer confidence depressed but that the global economy recovers, supporting China’s exports. Growth is minus 2%, leaving demand at 6.6m tonnes.

The worst-case outcome is Scenario 3 where the impact of zero-COVID continues, and the global economy gets weaker. Consumption falls by 4% to 16.1m tonnes.

Europe, re-globalisation of PE prices and the challenges for 2023

AGAIN, PLEASE DON’T SAY I didn’t warn you. The chart below is an example of how PE prices have started to re-globalise. as I said they would when they began to de-globalise from March 2021 onwards.

What applies to the declining polyethylene (PE) price differentials between Europe and China applies to all the other countries and regions versus China. The pattern has been the same in polypropylene (PP) over recent months.

China LLDPE: New demand and net import outlook for 2023

China’s LLDPE demand in 2023 could either grow by 3% or contract by as much as 6%, depending on whether or not China successfully exits zero-COVID