You might think it impossible for China to reach complete self-sufficiency in PE, PP, EG and PX. History suggests otherwise.

Asian Chemical Connections

Why the rest of the developing world cannot follow in China’s growth footsteps

The developing world outside China cannot repeat China’s economic growth model because of climate change, ageing populations in the West and sustainability

A fundamental shift in thinking on petrochemical plant closures

Environmental, social and political factors – along with integration into upstream petrochemicals – have held back plant closures. Now, things seems very different.

Details of how Saudi Aramco COTC and other advantaged feedstock projects could redraw the petrochemicals map

There is a big new wave of lower-carbon and very advantaged cracker projects on the way, including Saudi Aramco’s crude-oil-to-chemicals investments.

The China and global PP downturns mean CEOs should be asked some tough questions

HOW many PP company CEOs saw this coming, and what their plan now?

Overstocking may have boosted China PE demand as the US continues to win while others lose

THE US gains $296m in China HDPE sales as Asian and Middle East exporters lose $1.4bn.

Winners and losers as demographics, debt, sustainability, geopolitics and crude-to-chemicals rewrite the rules of success

I BELIEVE WE are heading for the biggest period of change in the global petrochemicals industry since the 1990s.

This was when globalisation took off with the formation of the World Trade Organisation (WTO), when China’s economic boom began, when the global population was more youthful and before climate change became a major threat to growth.

China PP demand looks set to grow by just 1% in 2023 as sales losses increase

CHINA’S PP demand could grow by only 1% this year, while major producers saw their January-August 2023 sales in China decline by $796m versus the same months last year.

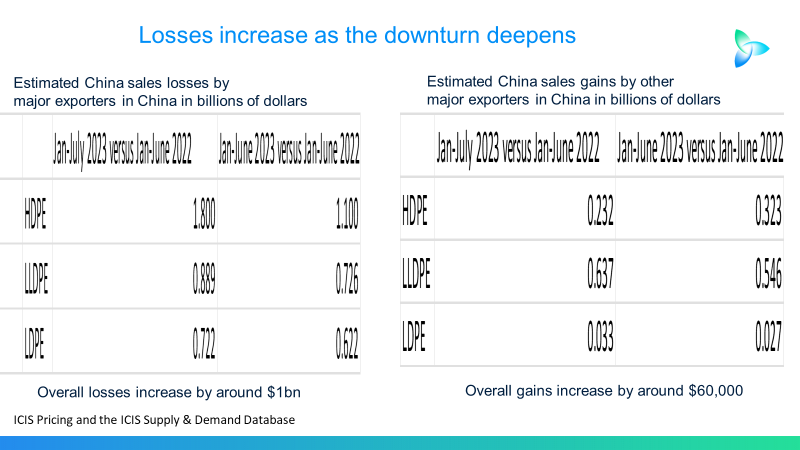

Major PE exporters to China see their sales fall by a further $1 billion

THE BIG PE exporters to China saw their sales to country decline by a further $1bn year-on-year in January-July 2023 versus January-June 2023.

China could be a net exporter of 9m tonnes of PP by 2040

CHINA’S PP net imports could total 5m tonnes in 2040, or the country may instead be in a net export position of 9m tonnes.