CHINA’S annual average PX exports in 2024-2030 could average as much as 7.4m tonnes a year or as little as 700,000 tonnes

Asian Chemical Connections

South Korea may have to shut 48% of its PP capacity in 2024-2030 to return to healthy operating rates

If South Korea kept all its PP plants open, 2024-2030 operating rates would average just 58% compared with 94% in 1990-2023. Profitability would obviously be very poor.

Or South Korea may permanently close an annual average of 430,00 tonnes/year of capacity – a total of 3m tonnes/year or 48% of capacity as of 2023. 2024-2030 operating rates would average a healthy 85%.

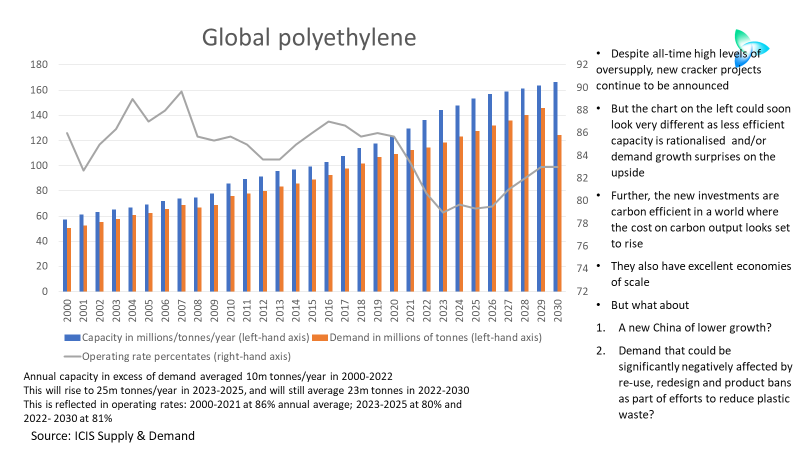

Why HDPE and other petchem operating rates could remain at record lows until 2030

UNTIL I FULLY understood the potential supply and industry economics implications of converting a lot more oil into petrochemicals, what’s happening to demand and the extent of China’s future self-sufficiency, I used to present charts such as the one above to clients with the proviso: “The good news is that this chart will almost certainly be wrong”. NOW I AM NOT SO SURE

The scale of plans to turn oil into petrochemicals may radically reshape this industry

A petrochemicals world dominated by Supermajors, especially those running COTC plants, or one where greater regional cooperation (more on this in later posts) and increased protectionism allow older, smaller and less carbon efficient plants to survive.

Details of how Saudi Aramco COTC and other advantaged feedstock projects could redraw the petrochemicals map

There is a big new wave of lower-carbon and very advantaged cracker projects on the way, including Saudi Aramco’s crude-oil-to-chemicals investments.

Cracker project announcements continue despite all-time high oversupply

Companies behind the crackers due on-stream over the next four years emphasise the low-carbon output. The planned new plant also have excellent economies of scale

Debate about refinery closures, re-configurations a harmful distraction for the petrochemicals business

In the second of a four-part series of blog posts that examines the paradigm shift confronting the petrochemicals industry – rising public and legislative pressure over plastic rubbish – I look at the harmful distraction of conventional thinking. Far too much of the debate within our industry is whether or not there will be enough […]

Risk of stagflation and recession from drone attack on Saudi oil facilities

By John Richardson ANY major change in US government foreign policy always carries major risks because, for the time being at least, the US remains the world’s No1 economic and geopolitical Superpower. This is the point I’ve been making since January 2017, when it first became evident that Donald Trump’s election rhetoric on confronting China […]

Success And Failure In Polyolefins Redefined By Sustainability

By John Richardson YOU DON’T have to be an oil and gas producer to be successful in polyolefins. Anyone with integration upstream as far as refining is in a strong commercial position. It is also good enough to be integrated from the steam cracker downwards; in fact, more than good enough given the strength of […]

Benefits, Risks Of Petronas/Aramco Deals Serving As Template

By John Richardson THE PETRONAS and Saudi Aramco joint ventures in the RAPID refining-to-petrochemicals project in Malaysia may serve as a template for further “win/win deals”. Whilst these deals will substantially benefit the companies and countries involved, there are broader risks that I’ll discuss at the end of this blog post. Back in February, Aramco […]