Saying you “won’t do something” may stop you digging a bigger hole for yourself. But it doesn’t help in deciding what you should do instead. That’s OPEC’s dilemma today on raising oil output. Everything seemed simple enough a year ago, as the pandemic took hold: Saudi Arabia’s first reaction was to assume it would have […]

Chemicals and the Economy

Oil market weakness suggests recession now more likely than Middle East war

Oil markets remain poised between fear of recession and fear of a US attack on Iran. But gradually it seems that fears about a war are reducing, whilst President Trump’s decision to ramp up the trade war with China makes recession far more likely. The chart of Brent prices captures the current uncertainties: It shows […]

Recession risk rises as Iran tensions and US-China trade war build

Oil markets are once again uneasily balanced between two completely different outcomes – and one again involves Iran. Back in the summer of 2008, markets were dominated by the potential for an Israeli attack on Iranian nuclear facilities, as I summarised at the time: “Nothing is certain in life, except death and taxes. But it […]

Oil prices flag recession risk as Iranian geopolitical tensions rise

Today, we have “lies, fake news and statistics” rather than the old phrase “lies, damned lies and statistics”. But the general principle is still the same. Cynical players simply focus on the numbers that promote their argument, and ignore or challenge everything else. The easiest way for them to manipulate the statistics is to ignore […]

Oil market rebalancing myth looks close to its sell-by date

The myth of oil market rebalancing has been a great money-maker for financial markets. Hedge funds were the first to benefit in H2 last year, as Reuters has reported, when: “OPEC and some of the most important hedge funds active in commodities reached an understanding on oil market rebalancing during informal briefings held in the […]

6 impossible things not to believe about oil before breakfast

“Sometimes I’ve believed as many as six impossible things before breakfast.” Oil traders know how the Queen felt in Lewis Carroll’s famous book, Alice Through the Looking-Glass. The list of impossible things that they are being asked to believe grows almost by the day: Last week, prices jumped 4% on the basis that strong […]

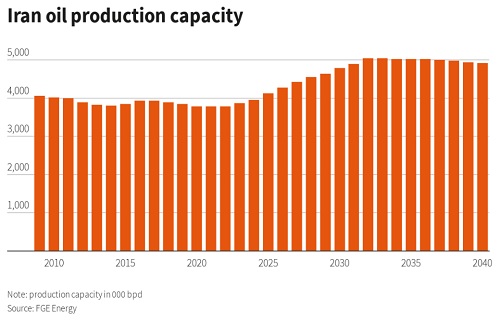

US, Iran to sell oil in January as Libya ramps up volumes

Both the US and Iran are likely to be moving oil into world markets early in the New Year. The lifting of the US export ban has led to early announcements of oil sales: Vitol will move the first cargo via the Enterprise terminal in Houston in early January. Iran is expecting to have sanctions lifted around the same […]

Iran deal highlights “massively oversupplied” oil market

The oil market was the first to feel the impact of the Great Unwinding of policymaker stimulus nearly a year ago. It had completely lost its key role of price discovery due to the liquidity being supplied by the central banks. This had overwhelmed the fundamentals of supply/demand. And we are still living with the consequences […]

H1 sees worst-ever number of chemical plant force majeures

The first half of 2015 was the worst half-year for force majeures in the chemical industry since reliable data became available via ICIS news in 2005. As the chart shows, there were 479 reports of outages, more than double H1 2014 and well above the previous peak of 375 in H1 2011. This is absolutely […]

Hedge funds moving away from ‘buy on the dips’ strategy

In recent years, financial markets have believed that “everything is for the best in this best of all possible worlds“. Good news has taken markets higher. So has bad news – as investors assume policymakers will apply more stimulus. As a result, a whole generation of managers and analysts has grown up without having to learn the fundamentals of supply/demand analysis. And […]