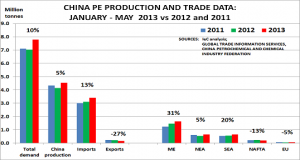

Latest data on China’s demand for polyethylene continues the recent trend of slow growth. The chart, based on official industry figures and Global Trade Information Services data, shows overall demand (red column) is up just 10% versus 2011 (blue). This, of course, is better than the decline seen this time last year (green).

Caution is necessary, however, as fellow blogger John Richardson suggests “downstream demand remains essentially poor“, and thus some of the apparent demand increase may be due to inventory factors. This caution is reinforced by data on export sales, which were down 27%.

The data also confirms the different fortunes of different regions:

- Middle East imports were up 31%, due to the ‘energy for markets’ strategic corridor

- Saudi sales were up 34%, and Iran’s up 53%

- SEA imports were up 20% due to the free trade area

- Thailand was up 27%, and Singapore up 14%

- NEA was up just 5%, with Japan down 8% and S Korea up 4%

- NAFTA was down 13%, with the US down 10%

This loss of market share in China is clearly bad news for those planning new US investments to take advantage of shale gas developments.

Equally worrying is that the US seemes to have been squeezed out of the market as a supplier of commodity resins. Its average price this year is $1760/t, 27% higher than Saudi and Iranian prices. Instead, it is currently positioned as a supplier focused on higher-cost resins.