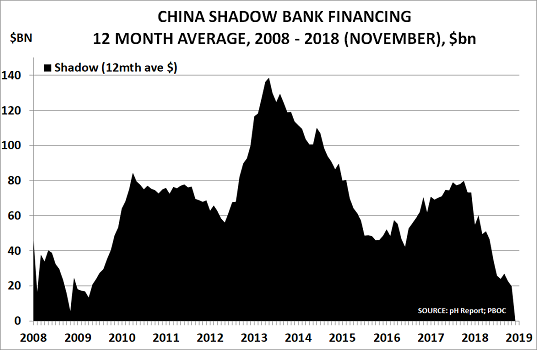

Last year it was Bitcoin, in 2016 it was the near-doubling in US 10-year interest rates, and in 2015 was the oil price fall. This year, once again, there is really only one candidate for ‘Chart of the Year’ – it has to be the collapse of China’s shadow banking bubble:

- It averaged around $20bn/month in 2008, a minor addition to official lending

- But then it took off as China’s leaders panicked after the 2008 Crisis

- By 2010, it had shot up to average $80bn/month, and nearly doubled to $140bn in 2013

- President Xi then took office and the bubble stopped expanding

- But with Premier Li still running a Populist economic policy, it was at $80bn again in 2017

At that point, Xi took charge of economic policy, and slammed on the brakes. November’s data shows it averaging just $20bn again.

The impact on the global economy has already been immense, and will likely be even greater in 2019 due to cumulative effects. As we noted in this month’s pH Report:

“Xi no longer wants China to be the manufacturing Capital of the world. Instead his China Dream is based on the country becoming a more service-led economy based on the mobile internet. He clearly has his sights on the longer-term and therefore needs to take the pain of restructuring today.

“Financial deleveraging has been a key policy, with shadow bank lending seeing a $609bn reduction YTD November, and Total Social Financing down by $257bn. The size of these reductions has reverberated around Emerging Markets and more recently the West:

- The housing sector has nose-dived, with China Daily reporting that more than 60% of transactions in Tier 1 and 2 cities saw price drops in the normally peak buying month of October, with Beijing prices for existing homes down 20% in 2018

- It also reported last week under the heading ’Property firms face funding crunch’ that “housing developers are under great capital pressure at the moment”

- China’s auto sales, the key to global market growth since 2009, fell 14% in November and are on course for their first annual fall since 1990

- The deleveraging not only reduced import demand for commodities, but also Chinese citizens’ ability to move money offshore into previous property hotspots

- Real estate agents in prime London, New York and other areas have seen a collapse in offshore buying from Hong Kong and China, with one telling the South China Morning Post that “basically all Chinese investors have disappeared “

GLOBAL STOCK MARKETS ARE NOW FEELING THE PAIN

As I warned here in June (Financial markets party as global trade wars begin), the global stock market bubble is also now deflating – as the chart shows of the US S&P 500. It has been powered by central bank’s stimulus policies, as they came to believe their role was no longer just to manage inflation.

Instead, they have followed the path set out by then Federal Reserve Chairman, Ben Bernanke, in November 2010, believing that:

“Higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.”

Now, however, we are coming close to the to the point when it becomes obvious that the Fed cannot possibly control the economic fortunes of 325m Americans. Common sense tells us that demographics, not monetary policy, drive demand. Unfortunately, vast amounts of time and money have been wasted by central banks in this failed experiment.

The path back to fiscal sanity will be very hard, due to the debt that has been built up by the stimulus policies. The impartial Congressional Budget Office expects US government debt to rise to $1tn.

Japan – the world’s 3rd largest economy – is the Case Study for the problems likely ahead:

- Consumer spending is 55% of Japan’s GDP. It falls by around a third at age 70+ versus peak spend at 55, as older people already own most of what they need, and are living on a pension

- Its gross government debt is now 2.5x the size of its economy, and with its ageing population (median age will be 48 in 2020), there is no possibility that this debt can ever be repaid

- As the Nikkei Asian Review reported in July, the Bank of Japan’s stimulus programme means it is now a Top 10 shareholder in 40% of Nikkei companies: it is currently spending ¥4.2tn/year ($37bn) buying more shares

- Warning signs are already appearing, with the Nikkei 225 down 12% since its October peak. If global stock markets do now head into a bear market, the Bank’s losses will mount very quickly

CHINA MOVE INTO DEFLATION WILL MAKE DEBT IMPOSSIBLE TO REPAY

Since publishing ‘Boom, Gloom and the New Normal: how the Ageing Boomers are Changing Demand Patterns, Again“, in 2011 with John Richardson, I have argued that the stimulus policies cannot work, as they are effectively trying to print babies. 2019 seems likely to put this view to the test:

- China’s removal of stimulus is being matched by other central banks, who have finally reached the limits of what is possible

- As the chart shows, the end of stimulus has caused China’s Producer Price Inflation to collapse from 7.8% in February 2017

- Analysts Haitong Securities forecast that it will “drop to zero in December and fall further into negative territory in 2019“

China’s stimulus programme was the key driver for the global economy after 2008. Its decision to withdraw stimulus – confirmed by the collapse now underway in housing and auto sales – is already putting pressure on global asset and financial markets:

- China’s lending bubble helped destroy market’s role of price discovery based on supply/demand

- Now the bubble has ended, price discovery – and hence deflation – may now be about to return

- Yet combating deflation was supposed to be the prime purpose of Western central bank stimulus

This is why the collapse in China’s shadow lending is my Chart of the Year.