These are difficult times, and there is no guarantee that they may not get worse. But they also remind us of the critical need to move beyond the Age of Oil, and develop more sustainable energy resources for the future.

Chemicals and the Economy

Oil markets, OPEC, enter the endgame for the Age of Oil

2 major events shocked oil markets last week. They marked the start of (a) the endgame for the Age of Oil and (b) the paradigm shift to the Circular Economy and the new Age of Energy Abundance. The new ‘Net Zero by 2050’ report from the International Energy Agency (IEA) was the first shock: It […]

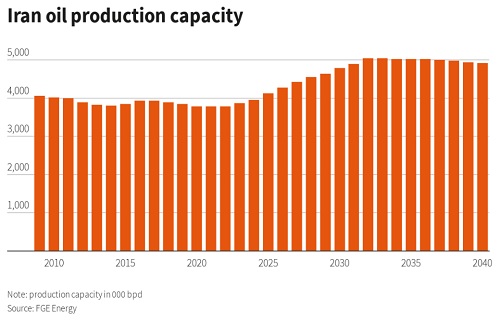

Iran highlights OPEC’s dilemma on output cuts

Saying you “won’t do something” may stop you digging a bigger hole for yourself. But it doesn’t help in deciding what you should do instead. That’s OPEC’s dilemma today on raising oil output. Everything seemed simple enough a year ago, as the pandemic took hold: Saudi Arabia’s first reaction was to assume it would have […]

Automakers face stiff headwinds in big emerging markets

Brazil, Russia, India and China disappoint as manufacturers face investment demands of EVs © Bloomberg Less than a third of China’s 31,000 auto dealers were profitable in the first half of 2019, as I describe in my latest post for the Financial Times, published on the BeyondBrics blog Auto markets in the Bric countries are […]

Oil market weakness suggests recession now more likely than Middle East war

Oil markets remain poised between fear of recession and fear of a US attack on Iran. But gradually it seems that fears about a war are reducing, whilst President Trump’s decision to ramp up the trade war with China makes recession far more likely. The chart of Brent prices captures the current uncertainties: It shows […]

Déjà vu all over again for oil markets as recession risks rise

Back in 2015, veteran Saudi Oil Minister Ali Naimi was very clear about Saudi’s need to adopt a market share-based pricing policy: “Saudi Arabia cut output in 1980s to support prices. I was responsible for production at Aramco at that time, and I saw how prices fell, so we lost on output and on prices […]

Oil prices flag recession risk as Iranian geopolitical tensions rise

Today, we have “lies, fake news and statistics” rather than the old phrase “lies, damned lies and statistics”. But the general principle is still the same. Cynical players simply focus on the numbers that promote their argument, and ignore or challenge everything else. The easiest way for them to manipulate the statistics is to ignore […]

Economy faces slowdown as oil/commodity prices slide

Oil and commodity markets long ago lost contact with the real world of supply and demand. Instead, they have been dominated by financial speculation, fuelled by the vast amounts of liquidity pumped out by the central banks. The chart above from John Kemp at Reuters gives the speculative positioning in the oil complex as published […]

Oil heads back below $30/bbl as hedge funds give up on OPEC

“Those who cannot remember the past are condemned to repeat it“. George Santayana 9 months ago, it must have seemed such a good idea. Ed Morse of Citi and other oil market analysts were calling the hedge funds with a sure-fire winning strategy, as the Wall Street Journal reported in May: “Dozens of hedge-fund managers […]

Oil prices under pressure as US oil/product exports ramp up

On Monday, I discussed how OPEC abandoned Saudi Oil Minister Naimi’s market share strategy during H2 last year. Naimi’s strategy had stopped the necessary investment being made to properly exploit the new US shale discoveries. But this changed as the OPEC/non-OPEC countries began to talk prices up to $50/bbl. As CNN reported last week: “Cash is pouring […]