Cuts to Dutch gas production, French nuclear troubles and a court case impacting Russian pipe flows combined to give a sharp upwards boost to spot gas prices in Europe in mid-September. This fed through to spot LNG prices worldwide as Asian buyers raised their bids to ensure they could compete for required winter supplies.

As a team of London-university scientists warned the UK could soon be facing its coldest winter in 30 years, the price spike raised questions as to whether the LNG market would be content to hibernate in its recent bearish mood over the season ahead, or whether a combination of unexpected events could lead to more volatile trade than had previously been expected.

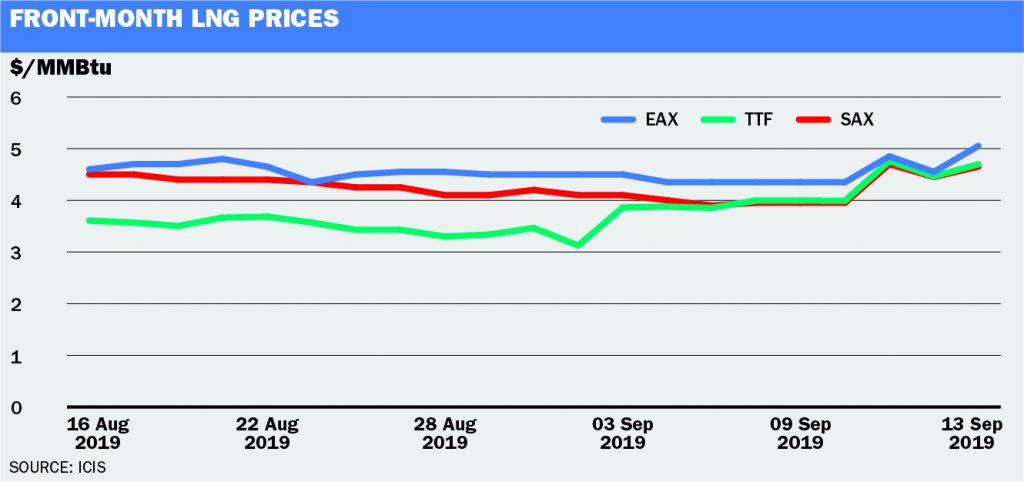

The ICIS East Asia Index (EAX) for deliveries to China, Japan, South Korea and Taiwan was trading in the mid $4.00s/MMBtu during late August/early September. It peaked at $5.05/MMBtu on 13 September, rising above the period’s $4.552/MMBtu average, in reaction to strong gains in European gas markets. The front-month EAX average was up 6% from the previous month, though still down 61% from the previous year.

The Dutch TTF October price, the benchmark for pipe gas and LNG supplies to mainland Europe, made record day-on-day gains 10 September to close at $4.76/MMBtu, up from $3.99/MMBtu the day before. It was driven higher by a series of bullish developments all arising on the same day.

The Dutch government announced it would halt production from the country’s giant Groningen gas field from mid-2022, eight years earlier than previously planned, and reduce the production cap for October 2019-September 2020 to 11.8 billion cubic metres (bcm), compared with a previously expected 15.9bcm.

French power producer EDF launched an investigation into potentially defective steam generator welds at a number of its nuclear reactors, which could lead to increased gas-fired generation to compensate for outages.

And finally, the European court ruled that Russia’s Gazprom should no longer be able to access as much capacity in a key German gas pipeline as previously, reducing the volumes that Russia could flow into the country through its Baltic Sea Nord Stream route. The outcome of the case may also disrupt key ongoing discussions between Russia, Ukraine and the EU about the overall shape of future Russian supplies. An existing transport agreement between Russia and Ukraine expires at the end of 2019.

Full storage, new supply

The fundamentals of the global market had been looking very bearish before the latest news, chiefly on the back of continued strong increases in supply. The 5.0 million tonnes per annum (mtpa) US Freeport LNG train one loaded its first two cargoes in the past month, adding to a market which has already seen strong increases in supply from the US, Australia and Russia over the past year.

Freeport has two more trains due on by the end of 2020, as does the US Cameron LNG plant. Other potential additions to supply over the next year include the 2.5mtpa Elba Island plant also in the US, which has been delayed from an expected May 2019 start-up, and the 0.9mtpa Yamal train four in Russia.

This year’s oversupply has seen producers “dumping” surplus cargoes into the liquid trading markets of northwest Europe, boosting onshore gas storage levels. These already started the summer high after a mild winter, resulting in Europe’s conventional storage now being at high stock levels not seen since 2014.

In the key LNG demand region of east Asia, meanwhile, China’s growth rate has been slowing down, reducing its ability to soak up new additions to supply. The world’s largest LNG importer, Japan, is seeing a slight reduction in imports. South Korea’s nuclear generator KHNP meanwhile brought a new reactor at Shin-Kori online into commercial service at the end of August, further reducing the need for gas-fired generation.

Weaker demand growth combined with strong new supply additions means it would take a lot of extra stress on the market to push prices significantly higher. There are always potential risk factors though, including unexpected breakdowns at older production facilities, or unusually cold winters. For example, output from Papua New Guinea has been reduced in recent weeks after bad weather resulted in damage to loading facilities.

It remains too early to have a clear view of upcoming winter weather, but there have been some early reports. South Korea’s APEC Climate Center said it expected temperatures around 0.8°C warmer than usual during December 2019 to February 2020 in east Asia.

In Europe, however, scientists from University College London presented a long-range forecast of the North Atlantic Oscillation predicting a 65% chance that temperatures in central England will be colder than the 1981-2010 mean this winter, bringing headlines warning of the coldest winter for thirty years.