NPE ’18: Latin America PS prospects flat-to-bearish in May

George Martin

07-May-2018

HOUSTON (ICIS)–Latin America polystyrene (PS) buyers expect price reductions in May and beyond on lower feedstock prices, heading into this year’s National Plastics Exposition (NPE).

After several consecutive months of price increases, buyers enjoyed flat prices in April and expect prices to decline in May with the return of some key styrene plants in the US Gulf.

As it happened at the start of 2017, diminished styrene supply in the US Gulf has caused prices to soar, affecting the downstream chain.

The US Gulf provides styrene to several producers in Latin America. Exports of this material have declined in the US Gulf, producing significant disruption for Latin America producers.

Although local refiners are the main suppliers of styrene in each country, Latin America styrene supply is not enough to cover all needs, and US Gulf product fills the gaps.

Four back-to-back price increases that started in December last year caused disruption in the downstream chain because transformers are frequently unable to transfer the extra costs to their clients.

Payment terms, usually 90 days in South America, start stretching, creating financial problems for the sellers.

When final consumers fall behind demand declines; when that happens, the pressure goes back up to the upstream chain.

That has been the situation in several Latin American PS markets, where transformers are seeking price reductions, or at least price stability.

Inflationary pressures and currency devaluations cause price increases, too. A decline in raw material prices may lower costs, but other factors remain in place, diminishing sellers’ ability to lower prices.

This is happening in Argentina, where the currency devaluation has been about 17% from December 2017 to March 2018. After some stability in April, the dollar is spiking again despite efforts from the Central Bank to contain the rise.

In Brazil, the Videolar-Innova plant in Manaus is highly dependent on styrene imports from the US Gulf for its PS production, currently at 85%. Production has improved there after months of operations at lower capacity. Currency woes are also an issue in Brazil.

In the Pacific coast of South America, where most countries are net importers, prices skyrocketed until March and went down a bit in April. Buyers have lacked viable alternatives from other regions.

Demand in the region is now slowing down with lower temperatures and with buyers’ expectations of lower prices ahead.

Styrene supply is stabilising in the US Gulf and that may provide the break that many PS buyers are seeking in Latin America.

This is already happening in Mexico, where May PS prices are poised to decline by 3 cents/lb ($66/tonne), under pressure from lower US prices.

Sponsored by the Plastics Industry Association (PLASTICS), NPE2018: The Plastics Show takes place on 7-11 May in Orlando, Florida.

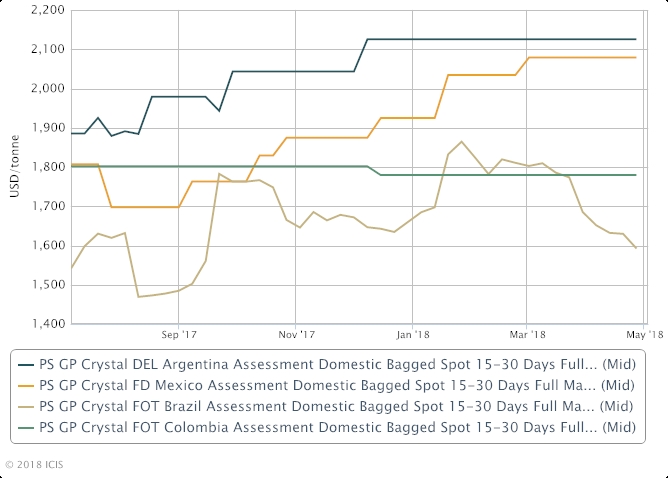

Latin America Polystyrene

prices have been mostly steady, but likely to

decline in May. Prices in Brazil have declined

mostly on currency fluctuations, but also on long

supply.

Latin America Polystyrene

prices have been mostly steady, but likely to

decline in May. Prices in Brazil have declined

mostly on currency fluctuations, but also on long

supply.

Global News + ICIS Chemical Business (ICB)

See the full picture, with unlimited access to ICIS chemicals news across all markets and regions, plus ICB, the industry-leading magazine for the chemicals industry.

Contact us

Partnering with ICIS unlocks a vision of a future you can trust and achieve. We leverage our unrivalled network of industry experts to deliver a comprehensive market view based on independent and reliable data, insight and analytics.

Contact us to learn how we can support you as you transact today and plan for tomorrow.

READ MORE