Power Perspective: Subsidy-free renewables in Europe: Market data and outlook

ICIS Editorial

09-Sep-2019

This story has originally been published for ICIS Power Perspective subscribers on 21 August 2019 at 17:29 CET.

The market for subsidy-free renewable projects continues to expand in Europe, with 12.5GW of projects announced over the past three years, according to our new subsidy-free data page launched earlier this month. In this story we define subsidy-free renewables, examine the data on projects announced to-date and analyse the key factors that will affect the uptake of unsubsidised renewables across Europe over the coming decade.

Defining subsidy-free

- “Subsidy-free renewables” is an elusive term with many potential definitions depending on the context

- For instance, for a two-way Contract-for-Difference (CfD) project, if the market price is anticipated to be on average above the strike price across the lifetime of the subsidised period, this could be described as “subsidy-free” despite there being significant periods of time in which the project received subsidy

- A more stringent definition would be for the market price to be anticipated to remain above the strike price for the entire length of the project, such as for a price floor provided in an auction. However, since the price floor itself helps to de-risk an investment even if it never kicks in, this could still be considered a subsidy of sorts

- The most stringent definition of subsidy free – which we use for our data – is for a project to be without government subsidy irrespective of movements in the market price. This can come from projects approved outside of an auction structure, or by bidding a €0/MWh strike price into an auction

- Even with this latter definition there are still potentially other forms of implicit or explicit subsidy, such as projects that benefit from being located next to a subsidised project and sharing infrastructure, or governments paying the grid connection costs for offshore wind projects. However, we do not consider these factors in determining if a project is “subsidy-free”, instead focussing our definition on whether a project could theoretically receive subsidy payments based on market price movements

Current market

- Spain currently leads the subsidy-free

market in terms of both the highest number of

projects and total capacity announced. Spain

has more than twice the total capacity of

announced unsubsidised renewables projects as

the next largest market: Germany. Spain

accounts for around 40% of all subsidy-free

renewables announced in terms of volume

- This is due to the excellent conditions

for solar in Spain, which reduces the

Levelized Costs of Energy (LCOE) to the

lowest levels in Europe, and the lack of an

attractive subsidised route to market with

only a price floor available in auctions

(with the government having the ability to

revise the floor level

downwards)

- The dominance of Spain means that the total capacity of solar projects outstrips onshore and offshore wind, with 45% of total capacity represented by solar technology

- This is due to the excellent conditions

for solar in Spain, which reduces the

Levelized Costs of Energy (LCOE) to the

lowest levels in Europe, and the lack of an

attractive subsidised route to market with

only a price floor available in auctions

(with the government having the ability to

revise the floor level

downwards)

- Most solar projects announced are either already online, or due online before 2022. In contrast, all subsidy-free offshore wind projects announced to date are expected online after 2022. This can be attributed to the much longer time period taken to construct an offshore wind farm compared with a solar park

- Unsurprisingly, there is a split between

northern-European countries that have announced

a greater volume of wind projects, and southern

European countries with a higher concentration

of solar

- Countries leading the way in subsidy-free wind are the Nordic nations, Germany, the Netherlands and the UK

- The largest subsidy-free projects by capacity have tended to be wind situated in the north of Europe with solar projects more numerous but smaller in volume. There are a few examples of large solar parks announced in Spain that contravene this trend

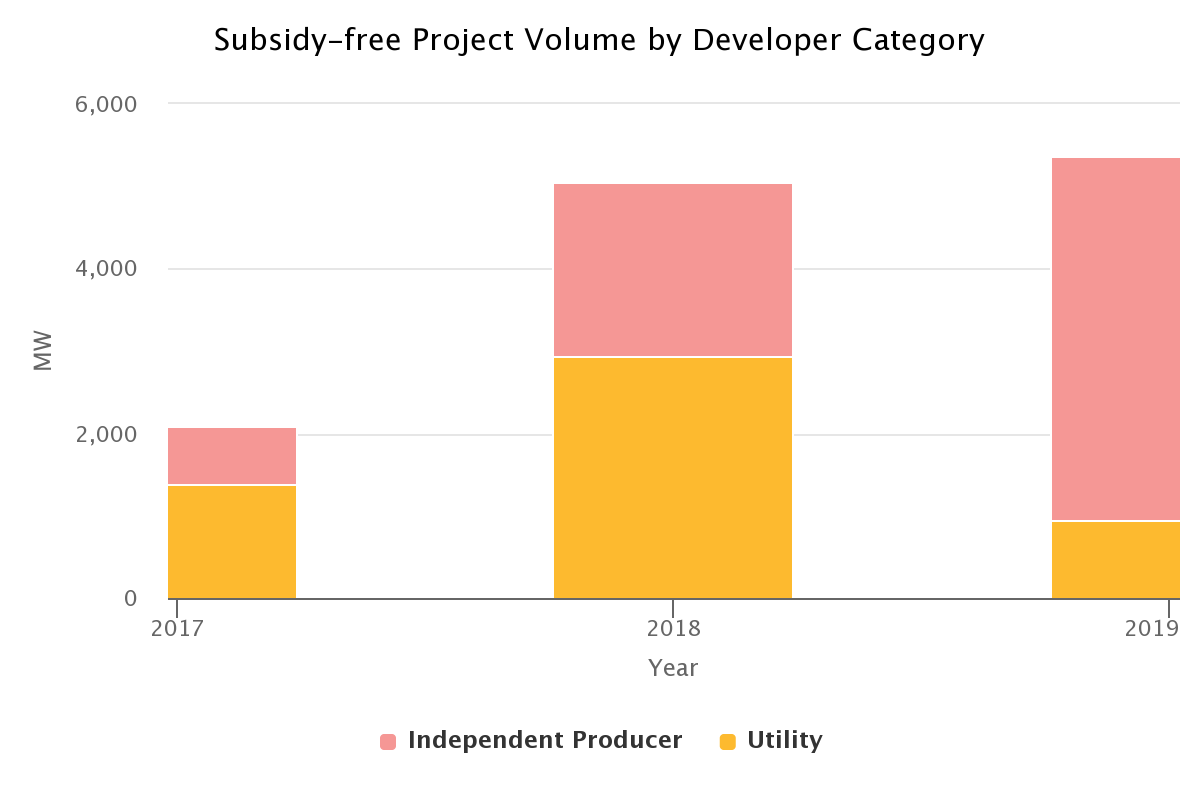

- Just under 60% of capacity announced has

been from independent producers and these

companies have overwhelmingly overshadowed

utilities in terms of the number of projects

- Utilities, such as Vattenfall which has announced more than 1.5GW alone, tended to have entered into fewer projects totalling a higher volume

- There is evidence that the interest of independents has increased in 2019 with more than four times the capacity announced this year from independent producers compared with less than 1GW announced by utilities

Future

drivers

Future

drivers

- Government plans

- The most important factor in determining the level of unsubsidised renewable capacity over the next decade will be the plans of governments across Europe. If governments continue to hold auctions that offer competitive subsidies, then the majority of renewable developers will see this as a more attractive route to market than attempting to deliver a subsidy-free project

- However, if governments decide to withdraw their support for new renewable projects (such as for onshore wind and solar in the UK) or to introduce support systems that are of negligible benefit (such as the most recent floor prices in Spain), then developers will increasingly seek unsubsidised routes to market

- There is currently little clarity on the long-term plans of governments across Europe in terms of the quantity of renewable capacity they plan to support or the subsidy schemes that will be used

- Each EU member state is obliged to release a final version of the national energy and climate plan (NECP) by the end of the year. These documents should give more clarity on the plans for each government, though it is not yet clear how detailed each of the plans will be in regard to subsidy schemes

- Capture prices

- In the absence of subsidies or any other de-risking mechanism (see PPA section below), the revenues of renewable generation assets are entirely dependent on the price they can achieve in the market, known as the “capture price”

- While capture prices for solar and wind across Europe tend to be close to the wholesale price at present, the increasing quantity of renewable capacity will push down prices during periods of high renewable output, leading to “price cannibalisation”

- The cannibalisation impact can be seen in the graph below, which highlights the capture price for solar PV in France. Under our base case assumption, the impact of increasing solar capacity from 10.9GW in 2019 to 40.9GW by 2030 will reduce the capture price by 47% in 2030, compared to 2019

- The impact of renewable price cannibalisation has the potential to outweigh technology cost reductions in some markets and could make unsubsidised projects uneconomic

- Due to cannibalisation, the more capacity a country brings online through the traditional subsidised route, the harder it will become for subsidy-free projects to earn adequate income from the capture price alone

- PPA market developments

- In the absence of government subsidies, many projects will attempt to secure a long-term revenue stream for their projects by signing a power purchase agreement (PPA) with either a corporate or utility buyer

- Our data suggests that 40% of all announced subsidy-free projects have also signed a PPA for the project. We expect that the vast majority of the remainder will be seeking a PPA, meaning that very few unsubsidised projects are attempting to come online at full merchant risk currently

- In total, the PPA market (which includes both subsidised and unsubsidised projects and both corporate and utility buyers) totalled 8.2GW in 2018 and is at around 6.7GW so far in 2019

- While the PPA market will expand further in the coming years, there are limitations to this upside potential and the total capacity will continue to be dwarfed by the anticipated 31.6GW of solar and wind capacity that we anticipate being added per year on average between 2019 and 2030 in Europe

- The market for unsubsidised renewables is expected to continue expanding at a rapid rate as technology costs fall, governments increasingly step back from subsidy schemes and the PPA market develops

- However, given the dangers of price cannibalisation as capacities expand, and limits to the potential of PPAs to help de-risk projects, governments will not be able to rely on the private sector alone

- Unsubsidised projects can certainly help contribute to the EU’s 2030 renewable target, but we anticipate that governments will have to continue playing the lead role in supporting new renewable capacity over the next decade

Matthew Jones is Senior Analyst – EU Carbon & Power Markets at ICIS. He can be reached at Matthew.Jones@icis.com

Roy Manuel is Market Reporter at ICIS. He can be reached at Roy.Manuel@icis.com

Our ICIS Power Perspective customers have access to extensive modelling of different options and proposals. If you have not yet subscribed to our products, please get in contact with Justin Banrey (Justin.Banrey@icis.com).

Global News + ICIS Chemical Business (ICB)

See the full picture, with unlimited access to ICIS chemicals news across all markets and regions, plus ICB, the industry-leading magazine for the chemicals industry.

Contact us

Now, more than ever, dynamic insights are key to navigating complex, volatile commodity markets. Access to expert insights on the latest industry developments and tracking market changes are vital in making sustainable business decisions.

Want to learn about how we can work together to bring you actionable insight and support your business decisions?

Need Help?