ICIS Long-Term Power – Rapid solar expansion to drive Spanish market to discount to France and Germany by 2050

Roy Manuell

22-Mar-2021

This story has originally been published for ICIS Long-Term Power Analytics subscribers on 17 March 2021.

With very strong growth rates for subsidy-free capacity additions in recent years, as well as a new set of already-competitive auctions, Spain is likely to strengthen its position as a dominant renewables investment market in Europe over the coming decade. Further out to 2050, we expect Spain to expand its renewable capacity at one of the fastest rates in Europe due to particularly strong solar growth. ICIS’s new 2050 long-term power forecast that we expand across to Southern Europe at the end of March explores three possible scenarios for emissions reduction pathways in Spain: a Base Case outlook, a High RES and a Low RES pathway. ICIS modelling shows that the rapid rate of solar expansion in Spain will have a consistently depressive impact on solar capture prices and capture rates over the next three decades as well as pressuring Spanish wholesale prices to a discount to France and Germany.

2050 country extensions

- We have expanded our coverage of several north and western European countries out to 2050 from November 2020 and will launch our extensions for Spain, Portugal, Italy, Switzerland, Greece and Cyprus at the end of Q1 2021

- Within these forecasts we have created three different scenarios that each represent a different pathway for GHG reduction, capacity build-out and prices, and the scenarios are differentiated by carbon prices, demand, technology developments and cost assumptions

-

- Long-term capacity build-out for renewables and gas plants is determined by our investment model, which considers financing and operating costs, lifetime and load factor assumptions, investor hurdle rates and natural resources and is linked to the Horizon model to determine when and where capacity will be added. See our investment model description for more information

- In terms of emission reductions, in our base case we assume that a 2050 net zero GHG target is put in place at a European level, but that only a 90% reduction is achieved. This is in contrast to the High RES scenario, where a net zero GHG European economy is achieved, and the Low RES scenario, where only a 75% reduction in emissions is achieved

- The analysis in this update is based on provisional data for Spain and we will provide a list of our full assumptions and access to finalised data once we launch the countries at the end of March

Analysis

Renewable expansion

- In Spain we see one of highest rates of

renewable capacity build-out among the large

northern, western and southern European markets

- Portugal and Italy, with similar conditions as in Spain, also expand their solar capacity at an extremely fast rate over the coming decades which we will explore further once we fully release our 2050 forecasts for the countries at the end of Q1 2021

- In our Base Case scenario, Spain will

increase its installed solar capacity by 300%

by 2030, more than 400% by 2040 and almost 600%

by 2050 relative to the total installed in 2021

- In our High RES scenario the rate of growth is even faster

- In both scenarios, Spain expands its solar capacity at a faster rate than all northwestern European markets

- This is due to our low investment and technology cost assumptions for solar in Spain, which has the best solar conditions in Europe

-

In our High RES scenario, the solar build-out rate is even stronger compared with the equivalent scenario for France

- While in our Base Case we assume a similarly low Levelised Cost of Energy (LCOE) for France and Spain out to 2050, in our High RES scenario we see much lower costs on the near term that drive Spain to grow solar capacity at a very fast rate, particularly in the late 2020s, and maintain a stable rate of strong growth thereafter

- The overall result is that Spain will have 120GW of solar capacity installed by 2050 in our High RES scenario and 80GW in our Base Case, more than France in each pathway

-

With low offshore wind buildout and ample space in Spain to build we expect steady onshore wind growth in Spain

- That said, the rate of capacity build-out

in both our Base Case and High RES is much

slower than solar and the total wind capacity

increase is lower relative to other northern

and western European markets due to relatively

higher costs and a weaker offshore market

– see previous analysis

- In both the Base Case and High RES pathways, Spain reaches just over 80GW of onshore wind capacity by 2050, though the rate of growth in the High RES pathways is much faster in the 2030s and early 2040s

- Offshore wind growth occurs mainly post-2040

Generation

- As a result, the share of solar generation

in Spain is much higher than in neighbouring

countries in both scenarios, rising from a

similar level to Germany in 2021, to almost

double the German share from 2030 onwards, and

a consistently much higher share than in France

- The share of Spanish onshore wind generation also remains high throughout the next 30 years

- The impact of the additional solar capacity

build-out in our High RES pathway is that solar

generation reaches a near-parity with onshore

wind at around 2030 with both accounting for a

combined 70% of total generation in Spain,

equal to around 210TWh

- Production from each technology then rises steadily at a similar rate to each generate around 40% of Spain’s total generation in 2040 and this share remains constant to 2050

- While high, in our Base Case outlook the share of solar generation remains consistently below that of onshore wind through to 2050, though combined they both account for around 80% of Spanish output from 2040 onwards

- We see evidence of significant curtailment

for solar with load factors averaging 15% lower

between 2031-2035 than in 2026-2030 in our Base

Case

- The drop is almost 30% in our High RES between the two periods

-

The effect of the fast renewable expansion is that gas generation falls to below 10TWh in the mid-2030s in our High RES scenario and early 2040s in our Base Case pathway – around 5 years earlier than in France

- As a result, emissions will fall below 10mt of CO2 by 2033 in our High RES and 2038 in our Base Case from more than 25mt of CO2 in 2021

- Similarly, we expect Spain to switch to a

net exporter in the late 2030s in our High RES

and late 2040s in our Base Case

- We expect it to import 20TWh in 2021 as a point of comparison

Price analysis

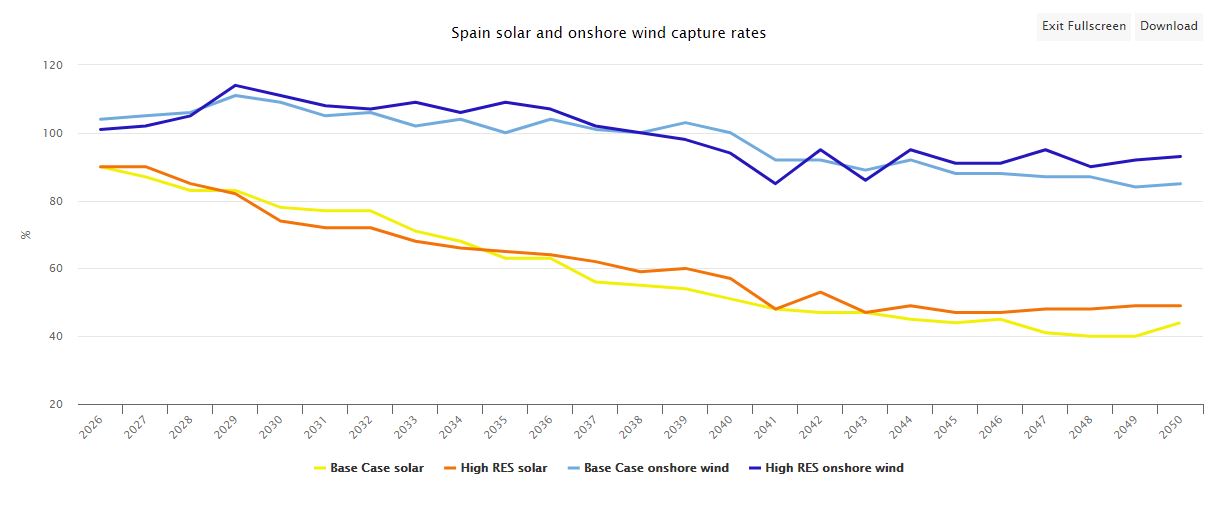

- The price impact is depressive on technology-specific capture prices and capture rates, particularly those for solar

- While our outlook for the price trajectory

of Spanish prices in our Base Case is generally

expressed in an uptrend through to 2050, as is

the case for other markets due to bullish

carbon prices, our solar capture price

forecasts trend down from 2021 onwards

- Our price outlook is less bullish for Spain in our High RES pathway from 2035 onwards due to faster renewable expansion, but solar capture prices trend downwards at a similar rate to as in our Base Case

- The result of the rapid capacity expansion

is that we see fast divergence of solar capture

prices from wholesale prices, currently at

similar levels in Spain and most countries

- As Spain adds more solar as a proportion of its capacity and generation mix, the zero-marginal cost of these assets displaces higher-cost generation sources in the mix, exerting downward pressure on Spanish prices and in particular capture prices, relative to other markets

- The overall effect, known as price cannibalisation, is that with each new solar project connected to the grid, the price all solar generation units are able to achieve on the market is diluted

- With onshore wind capacity expected to grow at a more moderate rate than solar in both Base Case and High RES scenarios than solar, the impact on its capture price is far less dramatic and can only be observed post-2040 in our Base Case

- With solar generating 40% of Spanish power output in our High RES pathway for much of the 2030s and 2040s, this will mean a significant number of hours during which the wholesale price is under such heavy pressure

- Despite the tumbling capture price, due to

low LCOEs in Spain for solar we expect

investment margins for the technology to remain

attractive but to a lesser extent than in

neighbouring markers

- Overall, the impact of solar growth on average annual Spanish prices will be bearish and tighten spreads to neighbouring markets

Market

impact

Market

impact

- Overall, we are bearish for the Spanish market relative to other large European markets in the 2030s and 2040s due to its rapid renewable and in particular solar capacity expansion and we expect Spain to become cheaper than Germany and France in both our Base Case and High RES pathway by 2050

Our ICIS Long-Term Power Analytics customers have access to extensive modelling of different options and proposals for European countries out to 2050. If you have not yet subscribed to our products, please get in contact with Justin Banrey (Justin.Banrey@icis.com) or Audrius Sveikys (Audrius.Sveikys@icis.com).

Global News + ICIS Chemical Business (ICB)

See the full picture, with unlimited access to ICIS chemicals news across all markets and regions, plus ICB, the industry-leading magazine for the chemicals industry.

Contact us

Partnering with ICIS unlocks a vision of a future you can trust and achieve. We leverage our unrivalled network of industry experts to deliver a comprehensive market view based on independent and reliable data, insight and analytics.

Contact us to learn how we can support you as you transact today and plan for tomorrow.

READ MORE