OUTLOOK ’18: Europe shipping players face more of the same in 2018

Melissa Bartlett

05-Jan-2018

LONDON (ICIS)–Participants in the European shipping market are pessimistic of the odds that 2018 will bring a notable improvement to conditions seen in 2017.

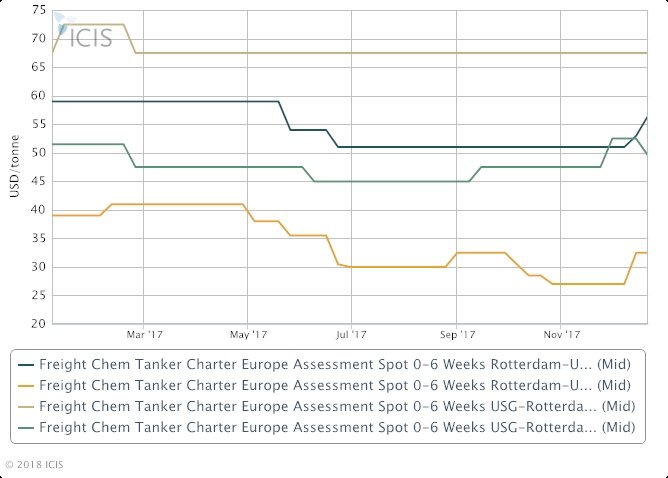

The transatlantic westbound route experienced an extremely sluggish 2017, with spot movements limited.

Looking ahead to 2018, the market will probably start the year with ample supply of vessel space as players believe an outside ship operator could begin to start operating regularly along the route.

If this is the case, any recovery in rates from Rotterdam to the US Gulf coast, which hit their lowest point in years during 2017, could be thwarted.

Ship operators are already under pressure due to the weak rates along the transatlantic westbound route. If crude oil prices remain above $60/bbl next year or increase, their margins could be squeezed even further, as crude oil can impact bunker fuel prices.

On a more positive note, should oil prices show signs of rising further, market players believe that it could prompt greater trading activity as petrochemical players look to secure product at lower prices. This in itself could see shipping movements along the transatlantic westbound route increase, but this as yet remains to be seen.

Most players along the transatlantic westbound route believe that further scrappage of vessels and further consolidation are the only answer to freight rates woes for ship owners but, with a number of new vessels entering the market in 2017, it is unclear as to whether this will happen.

The routes from Europe to Asia are likely to continue to largely see contractual movements, with vessel supply and enquiries usually fairly balanced. During 2017, greater shipments to Asia were seen from the US rather than from Europe and there is no significant sign that this will change during 2018.

Intra-European freight rates remained notably steady throughout 2017, amid disappointing activity for ship owners. Anticipated seasonal peaks and lulls expected through the year did not materialise amid persistently quiet market conditions.

Any small changes in activity had limited impact on freight rates, with the small upticks that did occur failing to find the traction needed to be sustained across any routes.

Open vessel space was ample on intra-European routes, but not excessive. Players noted that contract and private business appeared to be keeping some vessels employed despite lacklustre conditions on the spot market.

Looking ahead, players are generally expecting very little change to conditions. Some players were hopeful through the fourth quarter that 2018 could start in a more dynamic way than 2017.

When freight rates ticked up slightly in December following some bad weather related delays, and some pre-holiday fixing activity, players continued to be cautiously optimistic but with the uptick short lived and rates returning to their previous levels the next week, leaving market participants even more unconvinced that 2018 can see any sustainable change to conditions.

There are some players who say an uptick in trading activity amongst chemical players, on the back of changes in crude oil pricing, could boost the market but many also note that given the persistence of the intra-European lull in 2017, it would take a significant shift in conditions to bring rates and activity out it their rut in 2018.

One thing is for sure, and that is that ship owners will be keeping a keen eye on crude oil prices during 2018.

By Sarah Trinder and Melissa Bartlett

Global News + ICIS Chemical Business (ICB)

See the full picture, with unlimited access to ICIS chemicals news across all markets and regions, plus ICB, the industry-leading magazine for the chemicals industry.

Contact us

Now, more than ever, dynamic insights are key to navigating complex, volatile commodity markets. Access to expert insights on the latest industry developments and tracking market changes are vital in making sustainable business decisions.

Want to learn about how we can work together to bring you actionable insight and support your business decisions?

Need Help?