Indian PVC markets near-bottom, to firm up in January

Veena Pathare

05-Dec-2017

SINGAPORE (ICIS)–The Indian polyvinyl chloride (PVC) market is now poised for a recovery – with prices expected to bottom out soon – on the back of seasonal growth in demand.

Seasonally stronger demand for pipes is expected to push resin consumption, supporting January prices whose offers will be announced later this month, market participants said.

“We are not expecting PVC prices to go any lower than this and January by all accounts looks higher than December,” an Indian importer said.

Mandatory

Credit: Photo by FLPA/REX/Shutterstock

(3442362a)Turmeric (Curcuma longa) crop, with

irrigator system watering field, Gundelpet,

Karnataka, IndiaNature

Mandatory

Credit: Photo by FLPA/REX/Shutterstock

(3442362a)Turmeric (Curcuma longa) crop, with

irrigator system watering field, Gundelpet,

Karnataka, IndiaNature

Market players in India have been hopeful of an uptick in resin demand but have largely failed to see any improvement since June this year.

Seasonally slow pipe sales during the monsoon season largely weighed on demand for resin in the typically slow months of June to September.

Demand failed to improve after September, owing to an extended monsoon across different parts of the country.

A majority of regional processors held sufficient stocks of finished pipes, and this curbed demand and hampered resin prices in October and November.

Separately, companies, particularly plastics processors also took time to adjust to the new goods and service tax (GST) structure in place from July this year.

Adjusting to the new workflows surrounding the new GST structure also meant tighter cash flows, curtailing PVC resin purchases, market sources said.

The Indian PVC market is now poised for a recovery, as processors would look to stock up for the pipe-laying season that begins in December, regional importers said.

About 70% of the total demand for PVC in India comes from the pipes sector as PVC is widely used in the manufacture of underground irrigation and water distribution pipes.

The first quarter of 2018 is also expected to see improved demand, spurred by a need to replenish stocks after the year-end break, lending a firmer outlook to prices.

Export offers from the US are also close to bottoming out by mid-December, as suppliers resist further price reductions in view of sufficient drawdown in inventories, and strong sales in markets such as Africa.

Stronger demand from the US domestic markets is also set to emerge early in 2018 after the Christmas and New Year holidays, further limiting the possibility of a price drop in the new year.

Furthermore, stronger demand from China to restock inventories ahead of the Lunar New Year holidays in February is also likely to bring buyers to the fore in late December and January, market sources said.

The tightening of environmental regulations towards reducing emissions and pollution in China is also likely to impact China’s domestic carbide-based PVC production, and could possibly increase its reliance on imports, market sources said.

“Increased Chinese demand is likely to fuel greater demand for Asian cargoes within the region, impacting prices to India since suppliers’ allocations may be impacted”, an Indian trader said.

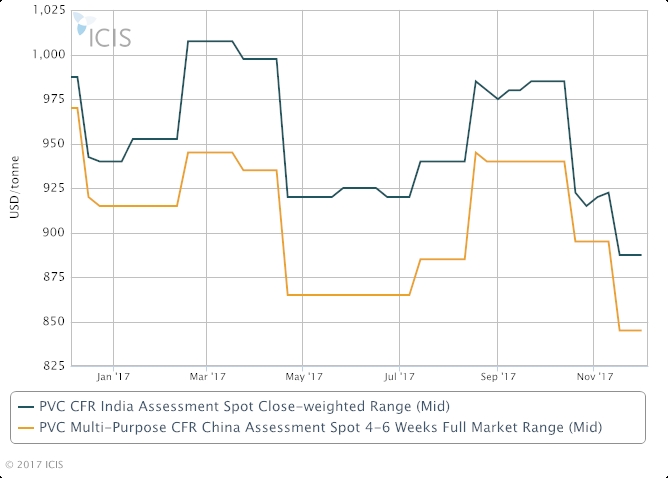

On 1 December, ICIS assessed PVC prices in India at $875-900/tonne CFR India, stable from the week before.

Top

image: Indian Turmeric crop being irrigated.

(Photographer FLPA/REX/Shutterstock)

Top

image: Indian Turmeric crop being irrigated.

(Photographer FLPA/REX/Shutterstock)

Focus article by Veena Pathare

Global News + ICIS Chemical Business (ICB)

See the full picture, with unlimited access to ICIS chemicals news across all markets and regions, plus ICB, the industry-leading magazine for the chemicals industry.

Contact us

Partnering with ICIS unlocks a vision of a future you can trust and achieve. We leverage our unrivalled network of industry experts to deliver a comprehensive market view based on independent and reliable data, insight and analytics.

Contact us to learn how we can support you as you transact today and plan for tomorrow.

READ MORE