Power Perspective: Lithuania announces redesigned renewable energy auctions

ICIS Editorial

12-Sep-2019

This story has originally been published for ICIS Power Perspective subscribers on 12 September 2019 at 12:46 CET.

On 2 September 2019, Lithuania launched the first renewable electricity auctions to take place in the country since 2015. The auctions, which will close on 25 November 2019, were redesigned since the previous auctions to be technology-neutral rather than technology-specific and to distribute a Feed-in Premium (FiP) rather than a Feed-in Tariff (FiT). Our analysis shows that average solar PV captured revenue per MWh (from both the market and state support) in is forecast to be above the average market prices, and significantly above the captured onshore wind revenue. However, due to the lower costs and a pipeline of auction-ready projects, onshore wind is more likely to win the first auctions.

Background

- Lithuania has an ambitious renewable target

for a 45% share of final consumption by 2030

- The government plans to meet its mid-term RES target for a 38% share in final consumption by 2025 – which includes reaching 5TWh per year of renewable generation in 2025

- The ministry expects the auctions the reduce the reliance on electricity imports by 30% over the same period

- A total budget of €385m was made available for interested RES producers, to be financed by a pubic obligation levy, which is a government-imposed tariff on end consumers

- The Energy Ministry plans to procure 0.3TWh per year of renewable generation under the first auction round this autumn; subsequent auctions will be for 0.7TWh/year in 2020, 2021 and 2022, altogether raising the level of renewable electricity by 2.4TWh/year

- Lithuania is highly reliant on imports; in 2018 they accounted for around 70% of final energy consumption, according to data from the statistics agency

- Renewable capacity additions have slowed down recently and grew just 16% between 2015 and 2018, the latest data from IRENA shows

Auctions

- The auctions will be in general technology-neutral and open to solar, onshore wind, biogas and biomass projects of any size, but offshore wind is not included

- Support will be a hybrid FiP, which

involves the interaction between the awarded

bid, the maximum price set up by the energy

regulator (VERT), and the captured (hourly)

day-ahead price on the Nord Pool exchange

- Producers will bid for a premium, which

the regulator has capped for this auction

with the reference price set at €45.07/MWh,

the maximum price at €48.93/MWh, and the

maximum premium (the difference between the

two) at €3.86/MWh

- The lowest premium bids will be awarded subsidies

- Projects will only receive the premium

if the sum of the day-ahead price and the

premium is lower than or equal to the

maximum price, and the premium will be

fixed or floating depending on the hourly

market price:

- In a hypothetical example of a renewable project owner being awarded a €1.00/MWh premium, she would receive a fixed premium of €1.00/MWh if the market price is equal or below to €47.93/MWh (maximum price minus the premium)

- When the hourly price is between €47.93/MWh and the maximum price of €48.93/MWh, she would receive a gradually decreasing floating premium: the higher the market price is, the lower the premium is until no premium paid at the market price of €48.93/MWh or above

- This support system is less predictable for investors in terms of income compared to Feed-in Tariffs, Contracts-for-Difference or classical FiPs, but more predictable than the Certificates of Origin (green certificates) systems

- Producers will bid for a premium, which

the regulator has capped for this auction

with the reference price set at €45.07/MWh,

the maximum price at €48.93/MWh, and the

maximum premium (the difference between the

two) at €3.86/MWh

- Successful projects will be guaranteed this feed-in premium for a 12-year period

- Producers are responsible for covering the grid connection costs and have to take on balancing responsibilities if installed capacity is larger than 0.5MW(or 3MW for wind demonstrational projects)

- Only projects that have not yet started operating will be able to compete in the auction

Next steps

- Potential auction participants have 70 days to receive preliminary grid connections, sign letters of intent with the TSO and make other steps

- Bids will be accepted between 11 November 2019 and 25 November 2019

- A committee including representatives from VERT, the Ministry of Energy, the Lithuanian Energy Agency and Vilnius University will assess the bids and decide on the winning projects in November

- Results will be announced in early 2020

Analysis

Capacity assumptions

- We assume that the 2019-2022 auctions could

bring around 655MW onshore wind and 240MW solar

PV

- Onshore wind has a significant

pipeline of projects and the

lowest levelized cost of technologies in

the auction. As a result, we expect

onshore wind to be awarded all the

capacity in the first auction

- With a 35% load factor for onshore wind, it could result in around 98MW wind

- For the same reasons, we assume that all 0.7TWh of the 2020 auction will go for onshore wind and result in around 228MW of additional capacity

- Due to the bullish ICIS Power Horizon

mid-term price forecast in Lithuania until

the peak in 2025, the maximum auction

prices will likely increase, while at the

same time wind will start facing

difficulties in obtaining grid permits due

to the increasing need to invest into the

grid

- Therefore, we assume that the 2021

and 2022 auctions will be subscribed

90%, and solar PV will win 1/5 of the

support with wind winning 4/5

- This would bring around 164MW of wind (assuming 35% load factor) and around 120MW of solar (assuming 12% load factor) in each of the two years

- Compared to our 2019-Q2 base case assumptions, more wind is expected to come online in earlier years, but the total capacity is similar

- Therefore, we assume that the 2021

and 2022 auctions will be subscribed

90%, and solar PV will win 1/5 of the

support with wind winning 4/5

- Onshore wind has a significant

pipeline of projects and the

lowest levelized cost of technologies in

the auction. As a result, we expect

onshore wind to be awarded all the

capacity in the first auction

Capture price and auction revenue

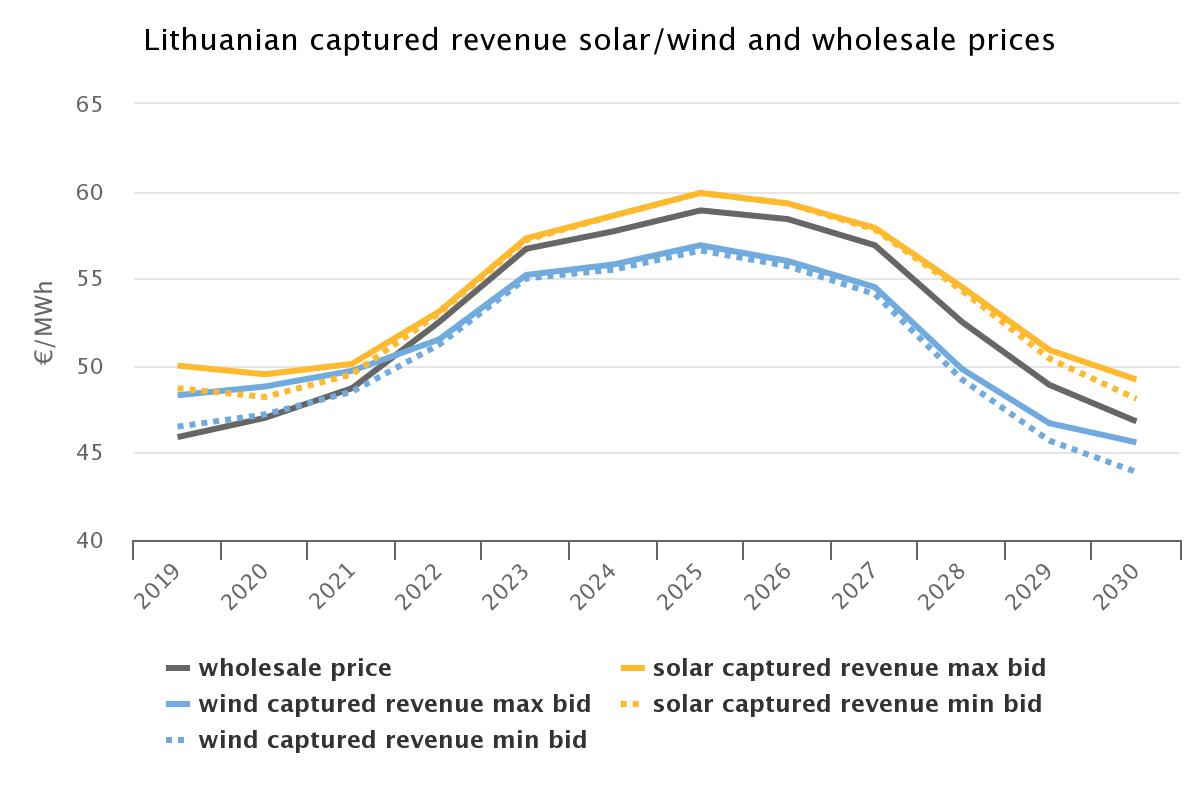

- Using our hourly Lithuanian price and generation forecast with new assumptions and assuming that the solar and wind are already in the support system, we compared captured revenue, consisting of market revenue and forecast premium revenue of solar and onshore wind, using two scenarios – both technologies bidding the maximum premium €3.86/MWh and both bidding €1/MWh from 2019 to 2030

- Capture prices (without premium) for both wind and solar follow the curve of our market price trend forecast, hitting a peak in 2025, when wholesale prices are expected to reach €58.90/MWh due to a price increase in other interconnected markets and fuel prices

- Because of the number of forecast hours being above the maximum auction price of €48.93/MWh in 2023-2027 we forecast that more than 90% of the hours per year will result in zero subsidy to either of the two technologies. Please see in more detail below

-

- As shown in the graph below, average annual solar PV captured revenue per MWh from both market and state support in both scenarios is forecast to be above the average market prices, and significantly above the captured onshore wind revenue

-

- This is largely due to the fact that solar generates during the higher priced peak hours compared to wind production, which tends to produce predominately during less expensive off-peak periods

- Our current solar capacity forecast shows that solar PV in Lithuania does not risk price cannibalisation and will keep producing during high priced hours

- Lower wind capture prices mean that on average the annual premium per MWh paid to wind will be slightly higher than to solar

Outlook

Outlook

-

-

- We expect that onshore wind will dominate Lithuanian renewable auctions in 2019 and 2020, due to better placed LCOEs and the relatively low maximum auction price set by the regulator

- Due to the Lithuanian government organising auctions for fewer years but larger volumes than we previously anticipated, we expect onshore wind capacity to increase faster than in the 2019-Q2 base case, but the overall impact on wholesale prices will be small as Lithuania is heavily influenced by interconnected markets

- In the 2021-2022 auctions the maximum price, which is a function of historical prices and other criteria, is due to rise following our bullish electricity price forecast for Lithuania, and solar PV will have more room for bidding

- Average captured revenue until 2030, which consists of captured prices and estimated premium per MWh, is forecast to be more beneficial to solar PV compared to wind, which is mainly due to solar PV selling power during higher priced periods and less due to the forecast average premium collected by solar

-

Vija Pakalkaite is Analyst – EU Carbon & Power Markets at ICIS. She can be reached at Vija.Pakalkaite@icis.com

Tasmin Chowdhary is Market Reporter at ICIS. She can be reached at Tasmin.Chowdhary@icis.com

Our ICIS Power Perspective customers have access to extensive modelling of different options and proposals. If you have not yet subscribed to our products, please get in contact with Justin Banrey (Justin.Banrey@icis.com).

Global News + ICIS Chemical Business (ICB)

See the full picture, with unlimited access to ICIS chemicals news across all markets and regions, plus ICB, the industry-leading magazine for the chemicals industry.

Contact us

Partnering with ICIS unlocks a vision of a future you can trust and achieve. We leverage our unrivalled network of industry experts to deliver a comprehensive market view based on independent and reliable data, insight and analytics.

Contact us to learn how we can support you as you transact today and plan for tomorrow.

READ MORE