Geopolitical and economic woes weigh on sustainability targets and polyolefins trends

Unprecedented global events have shaken up industry norms in 2022 and created a murky outlook for the future of chemicals markets. Ahead of key industry event K Fair in Dusseldorf, ICIS editors analyse some of the major trends in the wider chemicals markets. These include the likelihood of meeting recycling targets and the slowing progress of zero-emissions targets, as well as honing in on the impact of economic woes in key polyolefins markets.

High energy costs,

weak economy weigh

on PE/PP sentiment

Ahead of the major polymer event K Fair, the backdrop for October prices is volatile to say the least, from European polyethylene (PE) and polypropylene (PP) energy surcharges, to sharp propylene and ethylene drops in September, to a fractious natural gas supply outlook and currency volatility.

After the unprecedented effect of Covid-19 on markets and the global economy, Russia’s invasion of Ukraine had a huge knock-on effect on gas, power, and oil prices; demand; and trade flows that are still being felt today.

Economic woes across the globe are weighing heavily on PE and PP demand for the fourth quarter, while high energy costs are putting pressure on production margins.

Energy surcharges expected during Q4

Extremely high energy costs in Europe have had a major impact on PE and PP markets for the fourth quarter.

Several suppliers announced energy surcharges kicking in from September, and more were announced starting from October.

Austrian polyolefins producer Borealis announced an energy surcharge of €180/tonne on PE and PP orders in Europe "until further notice", according to a letter to its customers. The surcharge starts 1 October 2022 for orders delivered on or after this date.

Borealis – which makes PE in Austria, Sweden and Finland and PP in Austria, Germany, Belgium and Finland, blamed “the unprecedented scale of developments” which “now exceeds our ability to completely absorb these additional costs internally.”

It comes in the wake of other moves from European producers who are independently looking to mitigate pressure on production costs from energy, which mounted in late 2021 but spiralled in March 2022 after Russia’s invasion of Ukraine.

Differing energy costs across Europe have sparked concern about internal competition, for example in light of the "Iberian exception" for Spain and Portugal.

Market players are following developments in short-term EU-wide energy policy and Russian gas supply developments closely.

Analyst view: Energy crisis in Europe - A closer look

It is not a surprise that Europe is amid an energy crisis driven by natural gas prices and supply risk. Even though this is a transversal turmoil since natural gas is the European marginal power generation fuel in most EU countries, some polyolefin producer countries are more exposed than others, mainly depending on two factors: the reliance of its energy matrix on Russian gas and the share of natural gas in its energy matrix.

According to historical energy and gas utilisation data at country level, under these criteria, the four most exposed polyolefin producer countries (PP and PE in this context) represent 32% and 28% of the PP and PE regional installed capacity, respectively. Therefore, it is possible to conclude that almost a third of the regional PP and PE production is located in countries most exposed to skyrocketing energy prices and potential gas disruptions from Russia.

Powerful insights to manage costs and protect profitability.

But what are the implications on regional producers? The answer is not straightforward because the petrochemical industry is highly interconnected and there are many variables affecting margins and cost structures. However, by using the correct data and understanding the industrial cost drivers, it is possible to isolate the energy variable to assess the producer cost structure. In that sense, ICIS Plant Cost Evaluator (PCE) provides the cost structure of every single producer in Europe and, selecting the proper periods, it is possible to make a sensible comparison.

As stated above, by comparing the current period (August 2022) with a similar period with similar feedstock prices and energy prices closer to historical averages. In this case, the first half of 2019, from ICIS PCE, is it possible to infer that the average unit cost structure of HDPE European producers has increased by 20% and the PP one by almost 13%, it means, only by energy prices! Therefore, current energy surcharge announcements have been expected and widely anticipated by ICIS analysts since the energy crisis started.

Lukewarm global demand anticipated

Globally, demand has been weak heading into the fourth quarter and there are no expectations of a rebound any time soon.

Buying interest has been hit across the world by worsening economies and recession fears in several countries.

Rising inflation, a poor exchange rate and rising energy costs have put pressure on countries around the world and demand across all key regions looks set to remain limited through the winter months.

The strengthening of the US dollar has impacted most markets, with the exchange rate limiting purchasing power in areas like Europe, Asia, Africa and Turkey.

There are also issues securing dollars in countries like Egypt, Nigeria and Tunisia, where a lot of buyers are unable to buy any material without the currency.

Recession fears in areas like North America, Latin America and Europe have limited end-consumer purchasing of key applications like durable goods, with industrial packaging demand taking a hit as a result.

Food and healthcare applications are still seeing stable demand and these sectors are likely to be some of the last to see any impact due to the essential nature of the end-use products.

Global availability remains ample, with no issues securing any volumes for October. There are no concerns about supply levels for the fourth quarter, with some markets lengthier than others.

There are several shutdowns scheduled for the fourth quarter across multiple regions, with Asia and the US seeing the most planned maintenances during the quarter for PE. There are fewer maintenances planned at PP units globally.

This could ease some of the length being felt in the markets, but there are no expectations that the maintenances could lead to any severe tightness.

Market sentiment is fairly weak approaching the end of 2022, with economic woes and the cost-of-living crises on the forefront of most players’ minds.

Analyst view: Global Supply and Demand outlook

With overall worsening economic conditions in Europe, polyolefin demand projections have been revised downward not only in the very short-term but also in 2023, as purchasing power deteriorates amid high inflation.

Following recent demand outlook revisions, ICIS analysts now expect European polyolefin demand to shrink by around 2% in H2 versus H1 2022, with PE demand expected to shrink by 2% in Q4 versus Q3 2022.

On the supply side, polyolefin production in Europe is forecast to be around 4% lower in H2 2022 versus the same period last year as both PE and PP producers are expected to carefully manage operating rates, monitoring demand trends while production costs should remain elevated.

Looking at the European supply and demand fundamentals, the region is not self-sufficient in PE and PP and the regional total polyolefin imports surpassed 10m tonnes in 2021. Consequently, the global context plays a crucial role on the regional supply and demand balance.

In particular, China has contributed to the length in the European PE market, because China's lockdowns have depressed plastic consumption between Q1 and Q2 2022, causing a fall in imports and then an increase in re-exports and offers redirected from China to Europe from the Middle East and other parts of Asia.

PE demand in China is forecast to recover during the next few months, pulling increasing PE volumes. But 2022 growth rates have been strongly revised and PE consumption in the country is forecast around 1% lower versus last year. From a regional standpoint, PE imports in northeast Asia are expected to fall by more than 8% year on year in 2022, which is approximately a volume of more than 1 million tonnes.

While overall polyolefin consumption is forecast to increase in 2023 versus 2022, mainly driven by Asia, demand recovery is not expected to keep pace with increasing supply. Indeed, global PE and PP capacity is forecast to increase by as much as 6% and 10% year on year in 2023, with projects mainly in North America and Asia.

Powerful insights to manage costs and protect profitability.

Authors:

Samantha Wright is a Senior Editor Manager at ICIS, covering base oils, polyethylene, polypropylene and EVA. Since joining ICIS in 2017 Samantha has covered a wide range of chemical markets as well as leading a number of data analysis and visualisation projects.

Emiliano Basualto joined ICIS as Senior Analyst in 2021. He is the author of the Polypropylene Short-Term Price forecast in Europe and the global coordinator of the ICIS Supply and Demand Database on polypropylene. Before joining ICIS, he worked for more than 8 in the petrochemical industry, managing diverse industrial projects on polypropylene production and product development. He has also evaluated and managed energy, injection mounding, and mechanical recycling projects within the industry.

Emiliano is a Chemical Engineer and MBA. He holds a diploma in Integrated Project Evaluation and a Petrochemical Industry specialisation degree.

Lorenzo Meazza is Senior Analyst in the Petrochemical Division, with experience in chemistry, polymeric materials, market research, analysis and reporting, focusing on polyethylene market.

He is author of the ICIS Polyethylene Europe Price Forecast Report launched in May 2014. He is also responsible for LDPE, LLDPE, HDPE and EVA copolymers analytics in the ICIS Supply and Demand Data Service and contributes to single-client engagements and consulting projects.

Lorenzo is a chemical engineer with a PhD in Industrial Chemistry and Chemical Engineering and before joining ICIS in 2017 he spent several years as a researcher for the Polytechnic University of Milan and for the Italian National Research Council, in the field of applied chemistry, synthetic chemistry, chemical engineering, renewable energy, advanced materials and polymers. His research has been published in journals including Nature Chemistry and Angewandte Chemie.

Vicky Ellis is a senior editor, manager at ICIS covering European markets for polyolefins. She has presented at several industry conferences across Europe on topics including base oils. In over seven years at ICIS she has also covered benchmark fuel and commodity markets including methanol, benzene, styrene, toluene and xylenes, jet fuel, MTBE, ETBE and ethanol.

Her previous newsroom experience writing and producing videos about the energy industry took her to power stations, German coalmines, wind turbines at a prison and even down London’s sewers for Energy Live News, where she also hosted webinars and conferences for the British B2B energy market.

Waste access now key battleground for chemical recycling growth

The only current certainty for the European recycling chain is uncertainty. Uncertainty typically leads to nervousness, which in turn leads to volatility, as markets react to each fluctuation in underlying conditions to a degree they wouldn’t normally.

On the one hand, macroeconomic conditions are weak and there is a growing threat of recession across Europe. Demand from non-packaging grades fell sharply in September across all recycled polymers – particularly demand from the key construction sector.

High energy costs also bring the risk of potential bankruptcies in the chain, which would make sustainability targets increasingly even harder to achieve, as industry association Packaging Recyclers Europe (PRE) warned on 22 September.

The recycling industry typically operates on narrow margins and on smaller cash reserves, placing companies at greater risk of bankruptcy in any sustained downturn. Currently, the market is faced with the spectre of rising costs and falling demand.

Comparatively low virgin values have also been encouraging a shift away from recycled materials in non-packaging grades – which typically work on a cost saving basis – while high energy costs have limited recyclers’ ability to reduce flake and pellet prices without risking negative margins.

Geopolitical shifts remain unpredictable given the ongoing conflict in Ukraine. Energy prices – and government measures to tackle energy prices – also remain difficult to forecast.

On the other hand, sustainability commitments from the packaging sector remain high, and there has been no significant slowdown in consumption from packaging – for the time being.

The gap between fast moving consumer goods (FMCG) sustainability commitments – many of which are due to mature in 2025 – and available supply has seen recycled polymer markets decouple from virgin price movements and macroeconomic conditions in all packaging-dominated grades over the past few years.

Structural shortages are likely to become even more endemic if negative macroeconomic conditions persist – which appears likely – because this has the potential to lead to greater hesitancy in investment throughout the chain from waste management, through sorting, and for both mechanical recycling and emerging technologies such as chemical recycling.

So far, investment in chemical recycling from industry has continued at pace in the months leading up to K Fair, despite growing negative macroeconomic conditions.

In part, this is because pyrolysis-based players – currently the leading form of chemical recycling in Europe – can generate electricity as part of the process, although for PET chemical recycling processes electricity costs this is not generally possible.

Nevertheless, even for pyrolysis, electricity costs remain a potential challenge – depending on set-up – and particularly in the initial months of operation when throughput is limited. Some players have speculated that this could also lead to delays in plant start-ups, as players await more favourable energy costs

As a result, the sector is facing additional unexpected cost burdens that may result in additional funding requirements.

In recent weeks, some players have noted a slowdown in private investment, and that preparing business plans to present to potential investors is becoming increasingly difficult due to the uncertainty of future energy costs.

At present, pyrolysis is the dominant form of chemical recycling in Europe, although much of the existing capacity remains pre-commercial. Waste managers remain concerned over a growing disconnect between available waste material with high enough quality for pyrolysis-based chemical recyclers and announced future capacity.

Some players expect advances in mechanical recycling sorting technology and number of sorting stages to lead to reductions in reject volumes and non-mechanically recycled waste available for chemical recycling.

Pyrolysis typically requires the minimisation of chlorine content (typically to 0.1% or less) due to its corrosive effect, the removal of polyethylene terephthalate (PET) because it oxygenates the process and does not depolymerise using pyrolysis, and the avoidance of nylon and flame retardants.

There has also been speculation that lack of sufficient feedstock availability in the mid-term could increasingly place chemical recyclers in competition with mechanical recyclers – something that chemical recyclers have generally been keen to avoid historically, both from an economical perspective and environmental impact perspective.

Chemical recycling typically has a higher production cost than mechanical recycling, although this could change with economies of scale and the gap between the two has narrowed for some pyrolysis-based processes because pyrolysis can – depending on set-up – generate its own electricity to partially off-set rising energy costs, while mechanical recyclers cannot. Although there remains an absence of independent, directly comparable life cycle analyses (LCAs), chemical recycling is broadly seen as having a higher environmental impact than mechanical recycling.

Coupled with this, the narrow geographical spread of new plant locations could intensify competition between chemical recyclers chasing the same pool of local waste volumes.

The first half of 2022 had already seen many chemical recyclers pushed out of the mixed polyolefins waste sector, because of increased captive use by waste managers, and material being contracted by mechanical recyclers due to shortages of monomaterials. The influx of mechanical recycling demand pushed mixed polyolefin prices to record highs during the first half of 2022, and saw chemical recyclers increasingly look to source other grades of material such as refuse derived fuel (RDF).

Chemical recyclers require RDF bales with high plastic content – typically more than 90% plastic content – while demand from the burn for energy sector has led to increased biomass in RDF bales. As a result, the market for RDF has fractured into multiple grades.

RDF with higher biomass, that typically serve traditional burn-for-energy applications such as cement and lime, and unsorted bales, which typically serve burn-for-energy units which have sorting-centres attached, continue to trade at negative values, with buyers paid to remove waste based on saving for the waste manager against alternative disposal costs.

RDF with high plastic content, suitable for recycling, meanwhile, has been trading at positive values throughout 2022. Prior to Q4 2021, this material had always traded at negative values.

Since July, monomaterial availability has been lengthening due to macroeconomic bearishness, particularly in non-packaging grades, and there has been downward pressure in the market, with the low-end of high-density polyethylene and polypropylene bale prices falling substantially since the start of the third quarter. As monomaterial prices have fallen, mixed polyolefin bales have also seen downward pressure – although not to the same degree.

Despite weak demand, the market remains structurally tight following increased captive use by waste managers following the onboarding of sorting capacity in the first half of 2022, which has left more limited volumes of mixed polyolefins on the market.

Coupled with this, with monomaterials in tight supply throughout the second half of 2021 and first half of 2022, many players in non-packaging sectors turned to mixed polyolefins to try to bridge shortfalls of monomaterials, with multiple players signing volume framework agreements, which has also counterbalanced the falls in ad hoc activity. As a result, spot prices remain stable.

This has pushed access to waste up the agenda for many in the market and has seen recent moves such as LyondellBasell’s joint venture with 23 Oaks Investment to build a new waste sorting plant to feed its planned Wesseling pyrolysis-based chemical recycling plant.

Unlock a comprehensive view of the recycling value chain to achieve sustainable growth.

Authors:

Mark Victory is one of the Senior Editors for recycling at ICIS and is dedicated to expanding our coverage across this vital and growing sector. Mark has been with ICIS since 2008, and has covered recycling markets throughout his time with the company – including 8 years as the editor of the R-PET report .

Mark is currently the editor of the R-PE and R-PP reports, which he launched in 2019, and the mixed plastic waste report, which he launched in November 2021. Mark also has extensive experience across petrochemical and fertilizer markets, having been the regular editor for more than 25 separate markets, and managed several teams of editors. Mark was also the chief editor of the Global Automotive report.

Prior to joining ICIS, Mark covered structured products, international bonds, and commercial paper markets.

Helen McGeough is Senior Analyst and Team Lead on Plastics Recycling for ICIS, with extensive experience of the recycling industry and business having worked in the sector for over 18 years. She specialises in recycled PET (R-PET) with in-depth knowledge and analysis in this commodity plastic. Helen leads market analysis and research for global recycled polymer markets, working with contacts across the supply chain from collection, reclamation through to end users. She has experience in developing supply demand database for R-PET markets, including forecasts for collection, reclamation and end use of R-PET products. Helen is the author of the RPET Europe Analytics Service, including price discovery and forecasting, analysis of market developments and regulatory developments. Helen has delivered multiple custom studies in the recycling area, assisting investment and strategy development for parties within the recycle supply chain. Helen has a Degree in Business Studies from Nottingham Trent University, UK.

Clearing the air:

Understanding Scope 3

Emissions for Chemical

Markets

The data problem slowing down progress on climate targets in the chemical industry.

There is a global race to become carbon neutral. Currently more than 70% of the world’s economy have committed to achieve net zero emissions by the middle of the century, and at least one fifth (21%) of the world’s 2,000 largest public companies have committed to meeting net zero targets.

The chemical industry hasn’t been any different. A survey of chemical companies across seven sub-sectors in five continents, found that 97% have environmental impact reduction targets.

But how can these targets be reached? Infrastructure upgrades and disruptive technologies can help reduce emissions, but they require large investments and lengthy implementation periods. As a result, businesses are looking for ways to remain financially competitive while also complying with new legislation and responding to pressure from stakeholders in the short-to-medium term. For chemical companies, a huge proportion of carbon emissions occur across the supply chain but without a good understanding of overall carbon footprint as a basis, it is difficult to find ways to reduce it.

The chemical industry is the largest industrial consumer of energy, but in terms of direct emissions, it ranks third after cement and iron and steel. Almost half of the chemical industry's energy consumption, and thus emissions, are related to feedstock obtained from the oil and gas industry, implying that a significant portion of the emissions are associated with upstream Scope 3 activities.

Currently, the most difficult issue for the industry is the availability and quality of emissions data, particularly those related to upstream and downstream activities, or Scope 3 emissions. Without resolving this issue, the industry will struggle to meet increasing regulatory pressures and stakeholder demands while remaining competitive. Though many chemical companies have announced targets for emissions reduction, achieving those targets will require a systemic change across the supply chain.

Could data be the key to identifying opportunities that result in real change in the chemical industry's emissions-reduction efforts?

The demand for transparency

Emissions transparency has never been more vital, especially in the chemical industry. The US Securities and Exchange Commission (SEC) proposed rule changes earlier this year that, if implemented, will require companies registered with it (including publicly traded companies as well as many private ones) to disclose a variety of climate-related risks to the business as well as information about direct, indirect, and value chain greenhouse gas (GHG) emissions.

According to the SEC, “(t)hese proposals for GHG emissions disclosures would provide investors with decision-useful information to assess a registrant’s exposure to, and management of, climate-related risks, and in particular transition risks.”

There are more examples of proposals like these emerging globally. The European Commission implemented its Carbon Border Adjustment Mechanism for certain product imports in 2021, and many companies that operate globally or regionally have become increasingly concerned about their carbon footprints. Large investors expect businesses to be as forthcoming about their environmental performance as they are about their financial performance. When assessing the long-term risks of investing in a particular company, such "responsible investors" will consider environmental data.

In 2020, 253 European funds modified their investment strategy or portfolio due to increased demand for sustainable investments. But it's not just investors who are becoming more interested in carbon-conscious businesses. Customers are increasingly demanding more environmentally-friendly products. 1 in 3 customers claim to have stopped purchasing certain brands or products due to ethical and sustainability concerns. To succeed in today’s global marketplace, sustainability must be a pillar in the way organisations do business.

Get exclusive insights to help unveil opportunities for Scope 3 emission reduction.

The data gap

As regulatory, investor and consumer pressures mount, there is a need for the chemical industry to move faster. Firms can accelerate their efforts to meet their green targets by developing a clear plan. However, companies can only begin to make decisions that promote change once they have accurate baseline data on their carbon footprint. But how accessible is this data?

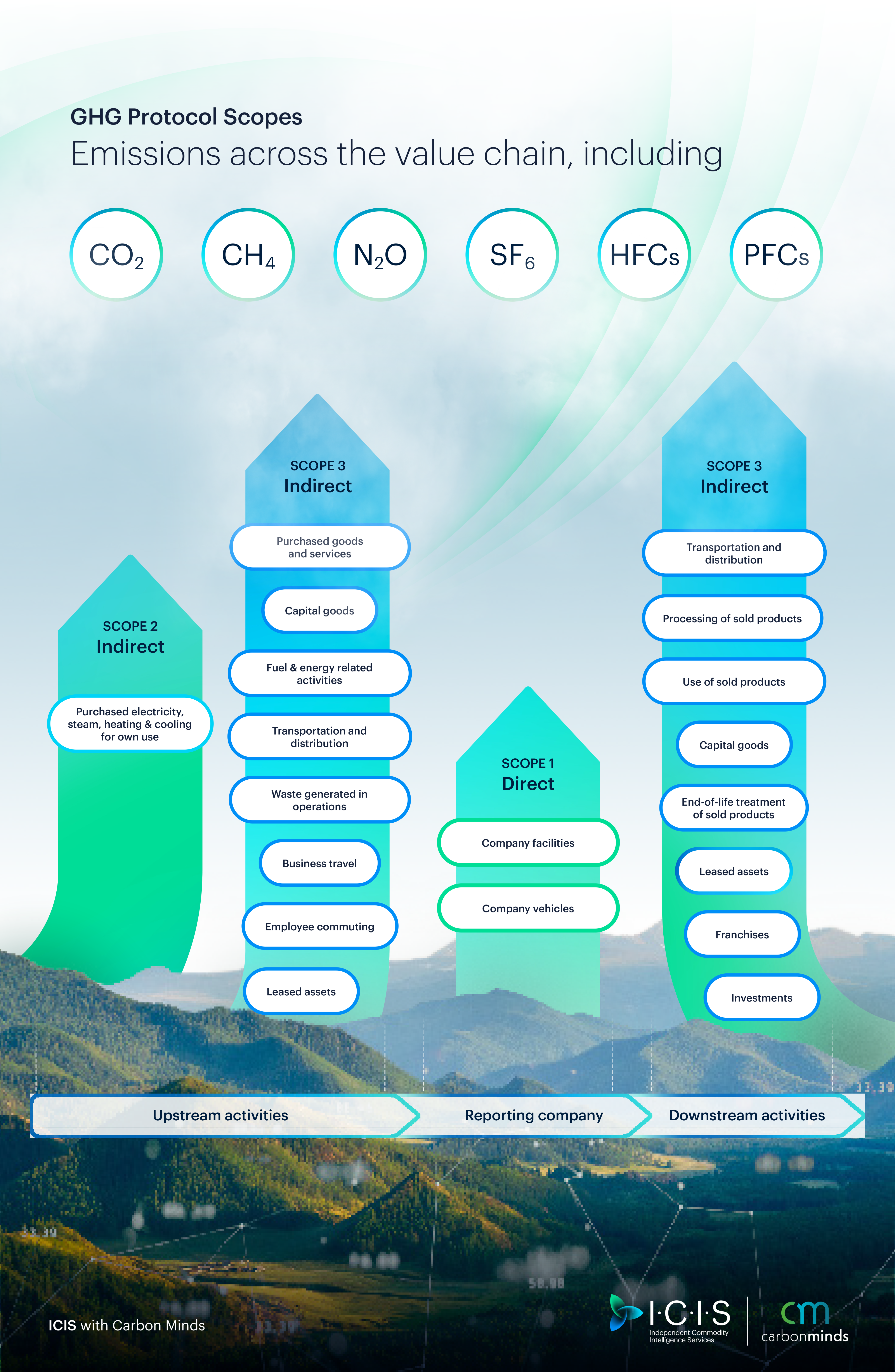

Companies report their carbon footprint by collecting data on the emissions in their operations. This is where Scopes 1, 2, and 3 of the Green House Gas Protocol (GHG) come into play. Consider it in terms of three types of emissions:

While a large proportion of carbon emissions for chemical companies occur throughout Scope 3, finding ways to reduce them is difficult without a good understanding of overall carbon footprint as a foundation.

For example, a converter of polypropylene (PP) resin should be able to calculate Scope 1 carbon emissions from processing pellets into a molded part or container. Obtaining a Scope 2 footprint from an electricity provider may be similarly more accessible.

But what about visibility into all the carbon used to make and transport those PP pellets, the Scope 3 emissions? Those pellets did not magically appear out of thin air — the molecules originally came from sources such as a barrel of crude oil or propane gas buried deep in the ground that was extracted and transformed into propylene and then into PP.

A variety of processes took place upstream to make that pellet, all of which have a carbon footprint. Figuring that out independently would be time-consuming at best and near impossible for most because there is not a one-size-fits-all answer to the Scope 3 carbon footprint of a carbon pellet.

As a result, while Scope 1 and 2 data is relatively accessible, Scope 3 visibility is virtually nonexistent.

Emissions transparency

While infrastructure and technology can provide solutions, these can take time and may require large investments. There is an urgent need for a method that can help bridge the gap and effect real change in the chemical industries' emissions reductions within supply chains.

For the first time, chemical and plastic companies can visualise the carbon emissions in their supply-chain right down to plant and supplier level. ICIS, chemical data specialists, working in partnership with Carbon Minds, environmental impact experts, have developed Supplier Carbon Footprints, a unique data set covering 71 chemicals that helps identify carbon emission hotpots and as such the opportunities for their reduction.

The data sheds light on CO2 emissions such as ethylene, propylene, styrene, and others, and it aids in meeting the reporting requirements of the chemical industries. It also identifies opportunities for reducing climate impacts within supply chains – and within that data lies the opportunity for business growth and resilience in a low-carbon future.

Take ethylene as an example; the various upstream processes involved in producing it vary both intra-regionally and internationally. According to ICIS and Carbon Minds analysis, the North American ethylene producer with the lowest Scope 3 emissions has a 21% lower carbon footprint than the most carbon-intensive. The global market has a much wider range, with the lowest emitter producing more than 11 times less carbon-intensively than the worst offender.

The movement toward carbon-footprint transparency in the supply chain provides an opportunity for those at the lower end of the carbon-intensity scale to market their products as "premium" or even "specialty," bringing with it additional margin and competitiveness.

Carbon-intensive producers of the same material, on the other hand, will struggle to maintain or grow business without offsetting high carbon-footprint material with lower prices. In many chemical markets, such stratification already exists around material purity, with high-purity grades commanding premiums.

This will also provide low-carbon commodity chemical producers with numerous opportunities to differentiate or rebrand their products with an environmentally conscious message.

Conclusion

There has been a worldwide call and response to reduce environmental impact, and despite the challenges of the sustainability transition, the chemical industry has demonstrated a strong willingness to respond. The inaccessibility of Scope 3 data has inhibited the progress and accuracy of reduction targets. It is impossible to make important decisions without a clear understanding of your impact. There is still much work to be done, but access to data is an important step forward that will allow the industry to be transparent and accountable.

Unlock key data insights to help identify Scope 3 reduction opportunities.

Author:

Ropa Mugadza is a content writer at ICIS, working across energy, chemicals and sustainability to tell the story of market movements.

She has previously worked as a writer and content strategist in the fields of green infrastructure, sustainable development, and environmental technology.

Related Content

Speak with ICIS

If you want to find out how our decision-making tools can help you navigate market shifts, contact us today. Simply fill in your details, submit the form and a member of our team will get in touch with you.