Benzene, PET markets highlight need to reimagine scenario planning for an uncertain landscape

The petrochemical world that we have known and loved for the past 30 years is disappearing into history. As a result, companies, investors and policymakers are having to adapt to a new and far more uncertain landscape. This makes it essential to develop new scenarios for the future that map out what might happen in key parts of the landscape. Otherwise, we risk finding ourselves adrift on a small boat in the middle of the ocean, with no map to guide us to harbour.

It is also crucial to move on from the scenario planning concept of recent decades. This reflected a more settled landscape where upside and downside cases could be relatively close to the base case. Today, as the chart shows, we have returned to the chaos of the 1970s and early 1980s. ‘Business as usual’ is now no longer a simple extension of the past. Economic growth has stalled. Major wars are underway in key regions. Essentially we are having to learn, or relearn, how to live with the levels of international tension last seen during the Cold War. In turn, this leads to a focus on three core scenarios:

In the background, as the chart also highlights, defence spending is on the rise due to the escalation of the wars in Ukraine and the Middle East – and rising tensions in the South China Sea. A decade ago, it didn’t seem to matter if a Western nation failed to meet the NATO target of defence spend representing 2% of GDP.

Today, however, governments are uncomfortably aware that we are moving back to Cold War days. Defence spend was then often 8% of GDP, while taxes were much higher and social spend much lower. The same logic applies outside the West. China’s defence budget is set to rise 7.2% this year.

How does this impact petrochemicals?

It is perhaps helpful at this point to look back at the past three decades to understand where we have been for most of our working lives. This underlines the magnitude of the changes now underway:

The example of benzene

Benzene markets provide a great case study for the impact of these developments on petrochemicals, as the chart shows. Benzene is used in a very wide set of applications and it has been around for over a century. Originally it was made from coal but volume really started to lift off in 1960, when cheaper and better oil-based feedstocks such as naphtha became more widely available. This production was initially concentrated in North America and Western Europe, along with Eastern Europe and Japan. Output had trebled by the mid-1970s before the disruption of the 1974-6 and 1979-1983 oil crises led growth to stall. In the background, of course this economic turbulence also ramped up Cold War tensions with the Soviet Union.

Oil prices reached a peak of $130/bbl (in today’s money) in 1980 and interest rates rose to double figures, causing consumer spending to struggle. But then prices fell back and the economy began to motor as the ‘demographic dividend’ created by the Baby Boomers developed. In 1989, the fall of the Berlin Wall added a ‘peace dividend’ to the expansion:

By 2023, benzene volumes had reached 53 million tonnes per year, almost thirteen times the 1960 output. In terms of market share, China had grown from zero in 1960 to 39% in 2023, while the US had fallen from 36% to 10%.

New challenges are emerging

Today’s landscape seems set to become even more complex than in the 1970s, as major new challenges are emerging:

The miracle of modern medicine means people are no longer dying at around pension age. Incredibly, the increase in life expectancy means that the Perennials 55+ generation are now the main source of population growth in 8 of the world’s 10 largest economies, and in the world itself. This has massive implications for economic growth as the Perennials already own most of what they need, and their incomes reduce as they enter retirement.

In turn, these dramatic changes in the wider landscape have enormous implications for petrochemicals. They demand a new approach and new strategies:

Petrochemicals are returning to a local-for-local focus

It is easy to forget that global supply chains are a very recent invention. In the early 1990s, I recall congratulating an industry friend on his new role as Supply Chain Manager at DuPont, and then asking what his job would involve. Until then, most product had been made and supplied locally. Today, we may well be returning to this simpler way of operating.

Global supply chains have simply become too unreliable, as recent developments in polyethylene terephthalate (PET) and purified terephthalic acid (PTA) markets confirm. Europe, for example, is currently very reliant on imported product as local supply has shut down. The Covid-related disruptions are now being followed by the disruption of the Red Sea shipping route. Mexico is also reducing PET output and exports to safeguard water availability for residential use. Clearly, something needs to change, as these disruptions are now becoming ‘normal’ rather than the exception.

The Antwerp Declaration developed by CEFIC, Europe’s chemical industry sector group, in early 2024 highlights the way forward. It calls for industrial policy to be developed on the basis of the Green Deal established since 2020. Its call has already been answered by the EC, which includes government heads of all 27 EU countries.

In May 2024, the EC unanimously agreed to develop “a new horizontal single market strategy” based on “a strategic geopolitical vision”. The US and China are already well down this track, and offering major incentives to companies to refocus on the practicalities of operating a more local-for-local business model. South Korea’s example is also relevant, with the government launching a “last chance” restructuring plan.

Petrochemicals need to become demand-led

We are moving into more turbulent times, where geopolitics is replacing economics as the key driver for decisions. The successful strategies of the past 30 years based on globalisation are no longer relevant. But equally, changing demographics mean we cannot simply return to the world-view of the Cold War period. The rise of the Perennials means an end to expectations of constant growth, with petrochemical demand able to be forecast as a multiple of GDP growth.

These twin pressures require a move away from the supply-driven strategies of the past 60 years. Instead, we need to become demand-led, focused on the opportunities created by the need to combine sustainability with affordability. This paradigm shift highlights the need for robust scenario planning. In today’s more uncertain world, nobody can be sure what might happen over the next 12-18 months, let alone the next 5–10 years.

New thinking is therefore essential, starting with a re-evaluation of Europe’s position in this new landscape. Many imagine that deindustrialisation is now inevitable. But over the centuries, Europe has learnt to reinvent itself many times. And petrochemicals has the opportunity to be a showcase for this development.

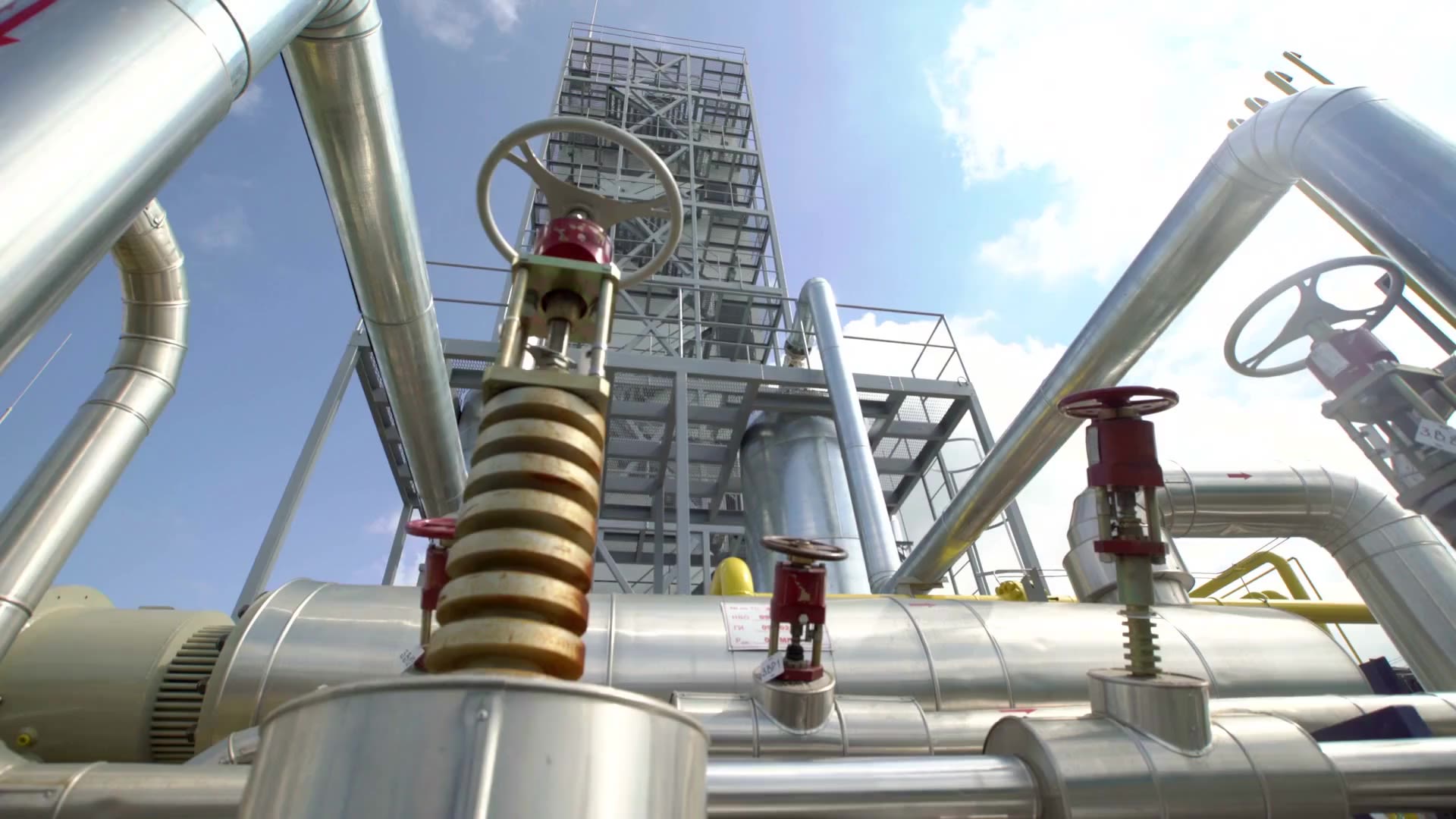

Plants in the region are generally smaller-scale and well-located in terms of serving the major population centres on a cost-effective basis. Recycling of plastic and other waste can also help to increase sustainability and feedstock security. One example of this is MOL in Hungary, with its major involvement in the management of municipal waste.

Fortune, as they say, tends to favour the bold. The petrochemical industry is clearly at a crossroads, where the business models of the past are no longer fit for purpose. The winners of the future will be those who recognise the need for major change and craft innovative new strategies that will deliver revenue and profit growth for the future.

ICIS Foresight enables businesses to develop demand-driven strategies. Foresight enables you to plan effectively by providing a clear view of the chemical value chain, both now and in the future. It also includes a supply and demand database to help you plan for different scenarios. Speak to a member of our team to learn more about ICIS foresight.

Author:

Paul Hodges is chairman of New Normal Consulting and the Advisory Board for Infinity Recycling. He publishes The pH Report and writes the ICIS Chemicals & the Economy Blog.

Related content

Speak with ICIS

If you are interested in learning about how our specialist insight can help you make better business decisions, contact the ICIS team today. Simply complete the form and we will get in touch with you as soon as possible.