Roman Emperors used to distract people with “bread and circuses”. Today, it seems Bitcoin is playing this role. The Tariff War is at major risk of repeating 1930’s Smoot Hawley Tariff Act. It introduced tariffs to “protect” the economy. And it led directly to the Great Depression.

Chemicals and the Economy

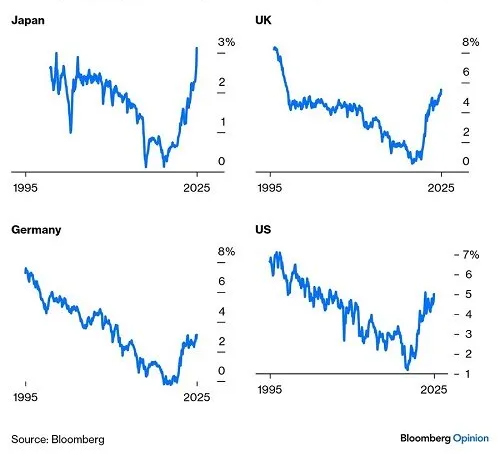

Bond vigilantes start to push interest rates higher – and impact auto/housing markets

Borrowing makes a lot of sense when interest rates and inflation are low. But now, both are returning to more normal levels. This will increase default risk, as companies and people with too much debt find it more difficult to make their repayments.

Apple set for double hit from Trump’s tariff war

China is Trump’s main target. He has claimed that China will pay the extra cost. But US consumers know better. They rushed to buy in March before prices rose. Q1 US sales were up 12% as Apple flew-in 1.5m iPhones ahead of the start of the tariffs.

Trump’s Tariff War risks empty US shelves at Walmart, Target, Home Depot

Last week, the CEOs of 3 of the largest US retailers told Trump that “His tariff and trade policy could disrupt supply chains, raise prices and empty shelves.” The heads of Wal-Mart, Target and Home Depot suggested the disruptions would become obvious in early May – only 2 weeks away.

Oil prices fall out of their ‘triangle’ as Trump’s trade war risks global recession

The Energy Transition is well underway California can now run for weeks at a time on 100% renewables. But President Trump’s ‘drill, baby, drill’ policy is hoping to turn back the clock. Oil markets market volatility is therefore inevitable, and will add to the volatility he has created in the economy and financial markets.

President Trump’s trade war risks crashing the global economy

Clearly, the US is most at risk from all these changes. Its ‘soft power’ depends on its global reputation. And its ‘hard power’ depends on its global alliances. But President Reagan’s warning applies to all of us: “Then the worst happens: Markets shrink and collapse; businesses and industries shut down; and millions of people lose their jobs.”

Europe may win if tariff war persists’

European producers may end up seeing major benefits. Local demand is clearly set for major expansion as a result of the recent massive German and EU spending packages. And competition will move to a more ‘local-for-local’ basis as tariffs remove the basis for globalisation.

Smartphone sales confirm how ‘value for money’ is starting to drive consumer demand

The smartphone market highlights how consumers are refocusing on ‘value for money’. New product sales are slowing in response to the cost-of-living crisis. More people are now happy buying a used model.

And global brands no longer have the same attraction if the local brand works as well, and is cheaper.

Trump launches trade war with US’s top 3 trade partners; says Europe & key business sectors are next

“The Dumbest Trade War in History. Trump will impose 25% tariffs on Canada and Mexico for no good reason.” Wall Street Journal editorial

Europe’s chemical industry, and its economy, face an existential challenge

Time is not on Europe’s side. Hopefully, this crisis will now lead policymakers to take the urgent actions that are now essential.