What’s your Plan B if China were to also become self-sufficient in specialities as well as commodities?

Asian Chemical Connections

A Personal View of the New Petrochemicals World

What follows is, as always on the blog, a personal view of how I see the petrochemicals world developing. There are no right answers, and the debate is the thing. That’s how we move forward together.

Supermajors versus Deglobalisation scenarios: The impact on petrochemicals and recycling

THERE ARE TWO scenarios or roads down which the petrochemicals industry could travel over the next ten years, with arrival either at Supermajors or Deglobalisation.

Demographics, sustainability and 1bn tonne less global polymers demand

Flat 2023-2050 demand growth in China and the developed world would leave the global market for nine synthetic resins 1bn tonnes smaller than the ICIS base case.

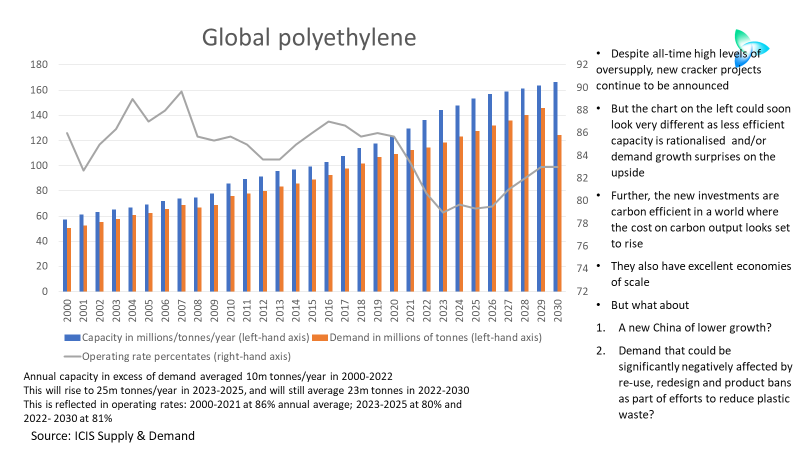

Cracker project announcements continue despite all-time high oversupply

Companies behind the crackers due on-stream over the next four years emphasise the low-carbon output. The planned new plant also have excellent economies of scale

Why European chemicals can emerge from this crisis as a winner

IT REALLY ISN’T doom and gloom if you take the longer-term view. Instead, for the chemical companies with the right strategies, the opportunities to build new sustainable business models are huge. The winners will make an awful lot of money while also doing the right things for humanity and our natural environment.

If you think this is a typical chemicals downcycle, think again

THERE IS A FEELING out there that the chemicals and polymers industry is undergoing a typical downcycle that will last a few years, followed by yet another spectacular fly-up in margins. But I believe a great deal more is happening beyond the usual cycles of over-building followed by under-building.

The rules of the chemicals game are changing as companies pay the penalty for “growth for growth’s sake”

Because companies in all manufacturing and service sectors haven’t been adequately charged for the natural resources they use, and the damage they cause to the environment, we face the risks of catastrophic climate change and more plastic in the oceans than fish.

Global chemicals: What I believe our industry must do in response to a deep and complex crisis

I WORRY that we face a crisis deeper and more complex than any of us have seen before because of the confluence of geopolitics, demographics, the changing nature of the Chinese economy as Common Prosperity reforms accelerate, China’s rising chemicals and polymers self-sufficiency, the high levels of global inflation with all its causes, and, last but certainly not least, climate change.

Chemicals companies face an unprecedented demand and supply crisis

THE GLOBAL CHEMICALS industry is, I believe, facing a demand and supply crisis on a scale and on a level of complexity that nobody has experienced before. This is a huge subjects requiring a series of posts. Let me start by looking at China’s role in this crisis. In later posts.