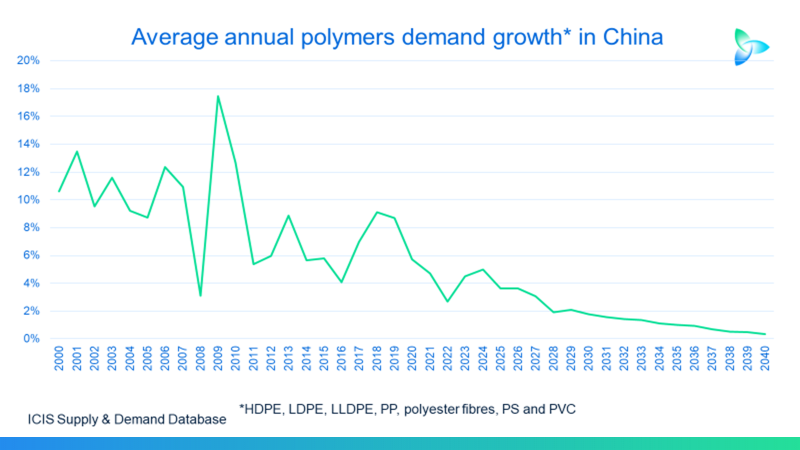

In my downside scenario for China’s HDPE demand in 2023-2040 is correct, the country’s total consumption during this period would be 134m tonnes lower than the ICIS Base Case.

Asian Chemical Connections

Beware of the “head fake” of an improving China and better Q2-Q4 chemicals financial results

YEAR-ON-YEAR chemical company financial results could we improve in Q2-Q4 2023; But this should not be seen as a return to the Old Normal.

Why European chemicals can emerge from this crisis as a winner

IT REALLY ISN’T doom and gloom if you take the longer-term view. Instead, for the chemical companies with the right strategies, the opportunities to build new sustainable business models are huge. The winners will make an awful lot of money while also doing the right things for humanity and our natural environment.

If you think this is a typical chemicals downcycle, think again

THERE IS A FEELING out there that the chemicals and polymers industry is undergoing a typical downcycle that will last a few years, followed by yet another spectacular fly-up in margins. But I believe a great deal more is happening beyond the usual cycles of over-building followed by under-building.

The rules of the chemicals game are changing as companies pay the penalty for “growth for growth’s sake”

Because companies in all manufacturing and service sectors haven’t been adequately charged for the natural resources they use, and the damage they cause to the environment, we face the risks of catastrophic climate change and more plastic in the oceans than fish.

Global chemicals: What I believe our industry must do in response to a deep and complex crisis

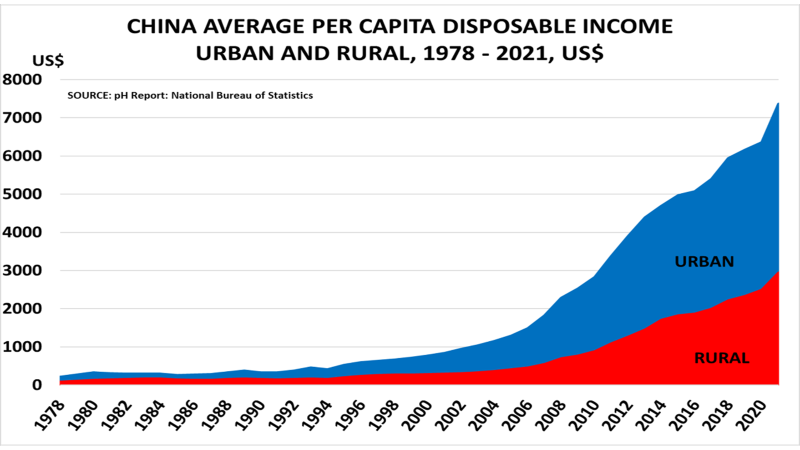

I WORRY that we face a crisis deeper and more complex than any of us have seen before because of the confluence of geopolitics, demographics, the changing nature of the Chinese economy as Common Prosperity reforms accelerate, China’s rising chemicals and polymers self-sufficiency, the high levels of global inflation with all its causes, and, last but certainly not least, climate change.

Ukraine: Oil prices, lost petrochemicals demand, changing trade flows and the impact of the four megatrends

By John Richardson IF WE ARE involved in a new protracted Cold War, this will change just about everything for the petrochemicals industry. Or, of course, we could go back to the Old Normal. Corporate planners must therefore press on with drawing up short, medium and long-term scenarios and then apply these scenarios to tactics […]

Risk of crude at $135/bbl may have increased on SWIFT sanctions decision

To follow all the breaking news on the crisis and the implications for petrochemicals and energy markets, please click here for the ICIS subscription topic page. If you need a trial of ICIS news, please let me know. By John Richardson WHETHER OIL PRICES will rise to a high of $135/bbl – the worst-case warning highlighted in […]

Petrochemicals transition to Net Zero to result in new margin and cost curve drivers

The petrochemicals or chemicals (depending what you prefer) transition to Net Zero is both connected and different from the energy transition for reasons I’ll detail in a series of blog posts, starting today with a few headline thoughts on how global margin and cost curve positions my change over the next few years – and […]

Calling all petchem C-suites: Key summary of China risks and opportunities

By John Richardson AS ALL THE CLAMOUR builds about inflation and rising energy costs – and absolutely, of course, these are major challenges which I shalll address in later posts – there’s a danger the petrochemicals industry will lose focus on charts such as the one above, courtesy of the pH Report. I am still […]