THE ECONOMIST HAS run a special briefing in its latest weekly issue on China that makes the same points on demographics and debt that I’ve been making in the blog since 2011.

“China’s working-age population has been declining for about a decade. Last year its population as a whole peaked, and India has now overtaken it. The Communist Party’s attempts to convince Chinese couples to have more children are not working,” wrote The Economist in its 12 May issue.

“As China ages, it will have to devote more of its economic energies to serving the elderly, leaving less to invest in new kit and capacity. What is more, after decades of rapid capital accumulation, the returns to new investments are diminishing,” the magazine added.

We can see these diminishing returns in the real estate sector, where oversupply in housing and the worryingly high levels of debt of property developers led to Beijing’s decision in August 2021 to restructure real estate.

A problem is that with births per mother at just 1.2 children in 2022, according to the UN Population Centre – and with births per mother in China below the population replacement rate of 2.1 since 2001 – fewer young couples are getting married. This is reducing the demand for housing.

Further, as I’ve been highlighting since August 2021 when property prices began to fall, the old government “put option” no longer applies. The put option -a government guarantee that real estate values would never fall – gave investors huge confidence to gamble on buying one or more properties.

The “economic energies” devoted to serving the elderly that The Economist refers to include higher savings rates to meet increasing healthcare and pension costs – another disincentive to invest in real estate.

Diminishing returns on new investments also applies to infrastructure, the old tried and trusted approach of boosting GDP growth. As The Economist again wrote in its latest issue “A new high-speed rail line across mountainous Tibet yields far smaller benefits at much greater cost than connecting Beijing and Shanghai, for instance.”

This makes the very interesting point that because China already has excellent infrastructure in the cities and provinces where most of its population is concentrated, the “bang for the buck” of building new rail lines etc. in less populous areas is lower.

And in the short term at least, as I discussed last week, problems with local government financing vehicles may limit Beijing’s ability to juice the economy. The vehicles used to issue highly popular bonds to pay for infrastructure because the bonds were underpinned by constantly rising land prices.

But since the property bubble burst, land prices have fallen, making the bonds much less popular. This has led to a rise in the use of less risky bank deposits as places to save money.

Also, because China’s population is ageing and its working age population is in decline, during the last decade it has been losing its position as the low-cost workshop of the world.

China and the history of global HDPE consumption

As I did with polypropylene (PP) in March, let me put these events into the context of another polymer – high-density polyethylene (HDPE). I plan to work my way through all the major polymers.

Let us begin with the historic context, represented by the chart below.

In 1992, the developing world ex-China’s per capita consumption of HDPE was at 0.8 kilograms compared with 0.6 in China.

But then three major events changed everything. First came Deng Xiaoping’s Southern Tour in 1992, after which private enterprises were given more freedom.

Vast sums of government money were poured into building great coastal infrastructure, and into creating export-focused manufacturing hubs.

Because births per mother had reached 7.5 in 1963, all these young people were joining the workforce from the 1980s onwards, creating a big pool of cheap labour.

And then, whoosh, the tariffs and quotas that had restricted China’s exports to the West were removed from late 2001 when China gained accession to the World Trade Organisation. This allowed it to take maximum advantage of its youthful population.

But by 2009, births per woman had fallen to 1.7 – below the population replacement rate of 2.1. China’s demographic problems had thus already started to build but were masked by the investment and lending bubble.

Just look at the increased angle of the line in the above chart that indicates China’s HDPE per consumption from 2009 onwards. This is clear evidence of the effect of stimulus on demand.

in the context of populations and demand turned into millions of tonnes, we were left with this extraordinary situation in 2022:

- Developing world ex-China demand in 2022 generated by 5.26bn people was 17.7m tonnes.

- China’s demand from just 1.45bn people was 17.3m tonnes.

Now let’s put this into the context of China versus the developed world, which is the chart below. Using the same three the major historic events as in the previous chart, this chart shows how China’s per capita HDPE consumption has outperformed its rise in per capita incomes.

Developed world demand in 2022 created by 1.14bn people was 17.1m tonnes from a per capita income of $48,000. China’s demand from 1.45bn people was 17.3m tonnes with a per capita income of only $13,000.

Coming to terms with the new China

Demographic and the debt conditions have deteriorated to the point where there is really no going back, as this week’s issue of The Economist makes clear.

This explains the chart below where we can see that HDPE injection grade China price spreads over naphtha feedstock costs collapsed in 2022 and remain very low this year. It a similar story in the other grades of HDPE.

Spreads never lie as they are the single best measure of supply and demand in any petrochemical market.

The average annual spread between 1993 and 2021 was $487/tonne, and so until spreads recover to around that level, it is wrong to talk about a market recovery, in my view.

The chart below shows that we could be heading for the lowest three consecutive years of average annual China HDPE demand growth in percentage terms since 1990.

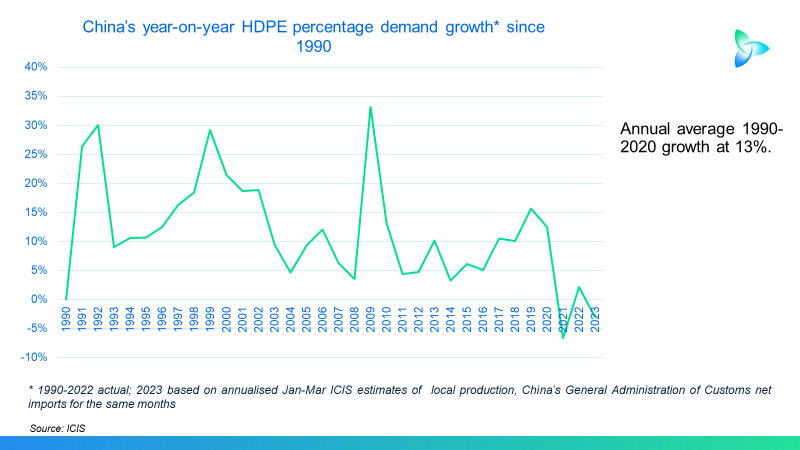

This next chart shows the pattern of annual percentage demand growth since 1990. Annual average growth in 1990-2020 was 13% versus possibly minus 3% in 2021-2023. You can see from the sharp decline in the trend line that it appears that we have entered a new era.

Conclusion: Plenty of time to prepare

As mentioned at the beginning of this post, I’ve been warning about the events highlighted in this week’s edition of The Economist since 2011. So, you have had plenty of time to prepare for the effects of the final chart in today’s blog.

The earlier data and analysis in this post suggest that China’s HDPE demand grew too quickly in 1990-2020 because of one-off historic factors. Growth could, as a result, now turn negative over the long-term.

In my downside scenario for China’s HDPE demand in 2023-2040 is correct, the country’s total consumption during this period would be 134m tonnes lower than the ICIS Base Case.