What does the current downturn in demand for recycled plastics mean for the packaging value chain?

Coming into 2020, recycled polymers were the most sought-after dance partner at the ball, increasingly demanded for by a consumer class focused on undoing the environmental damage wrought by plastic waste. That pushed the plastics value chain from bottom up to set sustainability targets first and ask questions (can we get enough recycled material?) later.

Coronavirus has altered that mindset, but fast-moving consumer goods (FMCG) companies, plastics converters and resin suppliers should not assume that consumers have necessarily pivoted in their thoughts about sustainability.

Consumers operating with a survival-mode mindset may not be scanning a product’s packaging right now looking for information on its recycled material content, but do not mistake that view as anything but temporary – or even that. To the contrary, consumers who pre-coronavirus demanded branded products get serious about plastic waste have done as many converters and FMCGs have – prioritized supply in the near term.

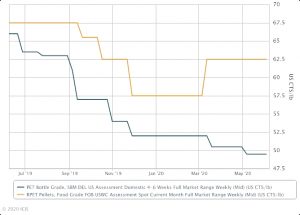

For the companies that make and package consumer goods, there also has been an economic prioritization, as virgin plastics such as polyethylene terephthalate (PET) have seen their values plummet due to the crude oil price collapse and deteriorating global economic conditions. With consumers spending less and the value chain feeling the pinch, there has been an undeniable economic incentive to make greater use of virgin materials. Then there is the growing price premium for recycled polymers due to supply tightness brought on by shutdowns of recycling pickup and processing operations due to virus contamination concerns. It makes for a strong list of reasons to package hand sanitizer right now with 100% virgin PET – and that is exactly what has happened.

For the companies that make and package consumer goods, there also has been an economic prioritization, as virgin plastics such as polyethylene terephthalate (PET) have seen their values plummet due to the crude oil price collapse and deteriorating global economic conditions. With consumers spending less and the value chain feeling the pinch, there has been an undeniable economic incentive to make greater use of virgin materials. Then there is the growing price premium for recycled polymers due to supply tightness brought on by shutdowns of recycling pickup and processing operations due to virus contamination concerns. It makes for a strong list of reasons to package hand sanitizer right now with 100% virgin PET – and that is exactly what has happened.

That is fine for now, but with consumers starting to feel less panicked about finding hand sanitizer, disinfectant wipes and cleaners, their sustainability concerns will soon return to the fore. Further, do not be surprised if they are annoyed that their favorite brand of hand sanitizer shelved its circular economy goals amid the pandemic’s surge. Many consumers take for granted that environmentally friendly packaging will only get more environmentally friendly – that the evolution of packaging runs in that direction without the possibility of going the other way.

Those FMCGs without a plan to address the deferment of their sustainability efforts stand to lose brand appeal and market share. Those brand owners with a strategy of how to meet that challenge head on as well as to analyse and create ways to maintain sustainability efforts during times of crisis stand to reap immense benefits.