Almost every day now sees a car company rushing to announce its plans to boost Electric Vehicle (EV) output. And key OPEC members – such as the UAE – are starting to recognise they have only a few years left to sell their oil, before the market disappears. Last May, the influential International Energy Agency […]

Chemicals and the Economy

Oil markets, OPEC, enter the endgame for the Age of Oil

2 major events shocked oil markets last week. They marked the start of (a) the endgame for the Age of Oil and (b) the paradigm shift to the Circular Economy and the new Age of Energy Abundance. The new ‘Net Zero by 2050’ report from the International Energy Agency (IEA) was the first shock: It […]

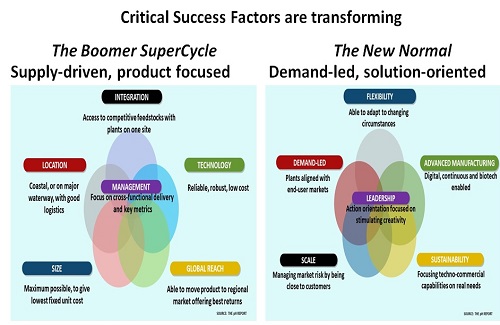

Supply chains set to transform as companies start to reshore

Major new opportunities are starting to appear in today’s New Normal world, as I describe in a new analysis for the Institution of Chemical Engineers. Please click here to read the full article. We are set to enter a “New Normal” world as economies slowly reopen again with the arrival of Covid-19 vaccines. This will […]

Biden’s Earth Day Summit puts plastics recycling on the fast track

Plastics has long been the ‘odd one out’ in terms of recycling. Steel, aluminium, glass, cardboard, rubber and paper routinely have up to a 70% rate of recycling. But plastics has been stuck at around 10% for a long time. President Biden’s Earth Day Summit is likely to change this picture, and quickly. The reason […]

Rising US interest rates, US$ and oil prices set to pressure financial markets

Everyone who has ever played the Beer Distribution Game on a training course knows what is happening in supply chains today. A small increase in underlying demand is rapidly leading to a massive increase in ‘apparent demand’. As the New York Times reports, “the pandemic has disrupted every stage of the (supply chain) journey.” And […]

Weak demand – and the illusion of a return to “normal”

My new interview with Real Vision focuses on the major changes underway in the economy. Our analysis of the chemical industry, auto market, and technology sector, suggests a return to the “old normal” is highly unlikely. Instead, major changes are underway in Demand Patterns, Reshoring, Energy Abundance, the Circular Economy and in Advanced Manufacturing. For […]

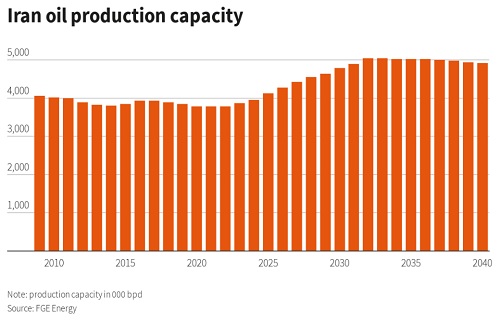

Iran highlights OPEC’s dilemma on output cuts

Saying you “won’t do something” may stop you digging a bigger hole for yourself. But it doesn’t help in deciding what you should do instead. That’s OPEC’s dilemma today on raising oil output. Everything seemed simple enough a year ago, as the pandemic took hold: Saudi Arabia’s first reaction was to assume it would have […]

Oil markets hit perfect storm as coronavirus cuts demand

Former Saudi Oil Minister Sheikh Yamani’s warning in 2000 looks increasingly prophetic today: “30 years from now, there will be a huge amount of oil – and no buyers. 30 years from now, there is no problem with oil. The Stone Age did not end because the world ran out of stones, and the Oil […]

Oil markets hold their ‘flag shape’ for the moment, as recession risks mount

Oil markets can’t quite make up their mind as to what they want to do, as the chart confirms. The are trapped in a major ‘flag shape’. Every time they want to move sharply lower, the bulls jump in to buy on hopes of a major US-China trade deal and a strong economy. But when […]

The End of “Business as Usual”

In my interview for Real Vision earlier this month, (where the world’s most successful investors share their thoughts on the markets and the biggest investment themes), I look at what data from the global chemical industry is telling us about the outlook for the global economy and suggest it could be set for a downturn. “We look at […]