Saying you “won’t do something” may stop you digging a bigger hole for yourself. But it doesn’t help in deciding what you should do instead. That’s OPEC’s dilemma today on raising oil output.

Everything seemed simple enough a year ago, as the pandemic took hold:

- Saudi Arabia’s first reaction was to assume it would have little impact on demand, and began a price war with Russia that took WTI prices into negative territory

- Reality then began to intrude, and on April 12, OPEC and Russia agreed to cut output by 9.7mb until June, by when normal demand levels were expected to return

- When demand still remained weak, OPEC+ was forced to maintain the 9.7mbd cut into July, and to then maintain 7.7mbd of cuts until year-end

- And last month, unsurprisingly, OPEC+ had to agree to maintain 7.2mbd of cuts into Q1, whilst Saudi agreed to cut its own output by an extra 1mb in February-March

It is already clear, however, that demand is unlikely to have returned to pre-pandemic levels by Easter.

The above chart provides up-to-date detail on vaccination progress in the main economies – USA, EU, China, India – plus the two leading vaccinators, Israel and the UK:

- Israel has vaccinated 2/3rds of residents, the UK has vaccinated 1/5th of its citizens

- The USA has vaccinated 14%, the EU 4%, China 3% and India 0.5%

- And as we all know, most vaccine companies are finding it difficult to scale production

- Plus there are rising concerns that new COVID variations may make vaccines less effective

Realistically, therefore, it is most unlikely there will be any major improvement in oil demand – or, indeed in the wider economy, before mid-year. And given the paradigm shifts taking place in demand patterns and the circular economy, it is most unlikely that the world will ever “go back to normal”.

This suggests OPEC, or at least key members of OPEC, are going to have to make some difficult decisions over the next few weeks. They have two specific problem areas to solve:

- The first is what to do about current output cuts, given that demand will not return by Easter? Will they just roll-on the current quotas, and hope that things might be better by the summer? That would already be a year after they had expected the downturn to end

- The second is what to do about the growth of Electric Vehicles?

- Q4 saw a major turning point in the EU, with VW joining Renault in the EV market – and helping EVs to take 25% of the core EU18 auto market in December

- In the other major markets, China expects 20% of auto sales to be EV by 2025, and GM have announced they plan to stop selling gasoline/diesel vehicles by 2035

OPEC NEEDS TO ACCEPT THE OIL AGE IS ENDING

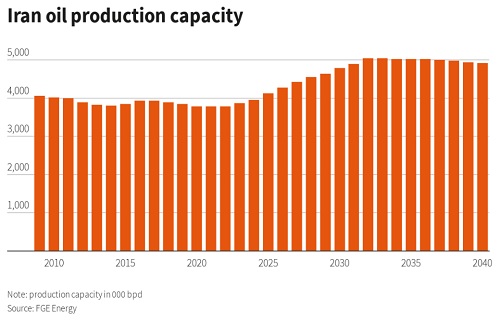

The key issue is summed up in the chart, showing Iran expects oil sales to continue beyond 2040. In reality, it is unlikely this will be possible, given the pressures to meet climate change targets.

So countries and companies have a stark choice. They can sell maximum volumes today, or risk their reserves becoming stranded assets in the future. As FGE energy have warned:

“The dominant narrative is still to keep production optimal long-term – without realising time is running short – and to avoid exporting oil as raw material – without appreciating the refining business may not be a profitable business in the long-term anyway.”

I have been warning here since last March that the pandemic was not going to be a 9-day wonder. I have also been highlighting former Saudi Oil Minister Yamani’s warning that by 2030 “there will be a huge amount of oil, and no buyers”.

OPEC and the oil industry may not like this message. But ignoring it, doesn’t make it go away.

As Shell, BP, TOTAL, Repsol and other oil companies are proving, first-mover advantage is critical when paradigms shift. Their opportunity comes at the expense of those who sit back and do nothing.