Everyone who has ever played the Beer Distribution Game on a training course knows what is happening in supply chains today. A small increase in underlying demand is rapidly leading to a massive increase in ‘apparent demand’.

As the New York Times reports, “the pandemic has disrupted every stage of the (supply chain) journey.” And so purchasing managers have been spooked by bottlenecks:

- The cost of containers has jumped to $8k for a move from China to Europe/USA

- Car plants are running out of semiconductors as chip manufacturers struggle with ‘rush orders’

- Supposedly “cheap” US ethylene is now 57c/lb ($1250/t) as Texas was unprepared for winter storms

So they are now over-ordering everything in sight. And in turn, investors are assuming a turbo-charged recovery from the pandemic is already underway. Although

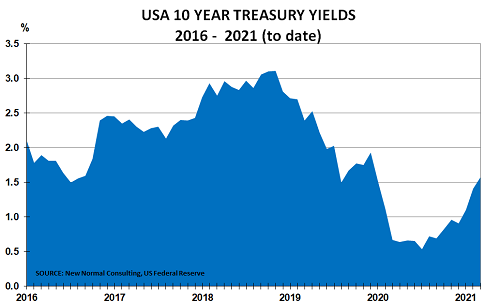

“Second order” disruption is now underway as interest rates start to soar, along with the value of the dollar. As the chart shows, the benchmark US 10-year rate has trebled in recent months from its all-time low of 0.5%, taking the value of the US$ higher as well.

RATES HAVE FOLLOWED THE “BOUNCING BALL” PRINCIPLE

The “tram-lines” in the second chart confirm that rates are simply repeating the patterns of the past 30 years. They tumble when the economy seems to be weakening. And then they rise when things seem to improve again. Essentially, they mimick a rubber ball bouncing down a staircase:

- They bounce downwards to a new low, and then pause

- They then bounce higher as lower rates stimulate new demand

- But they never bounce back to the previous high

- And their next bounce downwards always leads to a new low rate

After last year’s collapse, it is no surprise they are now bouncing higher again as the economy starts to reopen. And they could potentially double to 3% without breaking through the “tram-lines”. But even at today’s levels they will have a major impact on key areas of the economy.

Mortgage rates are rising, and will impact housing markets in the crucial spring selling season.

Similarly, higher rates are making auto loan defaults more likely. And OPEC+’s decision to squeeze the oil market will reduce consumer spending, as people are forced to cut back on the discretionary items that drive economic growth.

FINANCIAL MARKETS ARE AT MAJOR RISK

The key risk, however, is in financial markets. Investors now assume that central banks will never let markets fall. And so as the chart shows, they have borrowed a record $800bn in margin debt.

Unfortunately, they are only now starting to realise that Joe Biden, unlike his predecessors, is focused on jobs rather than stock markets. As a result, the Federal Reserve is now hoping to see higher rate and inflation as a sign of economic recovery. As the head of the Richmond Fed told the Wall Street Journal last week:

“In fact, I would be disappointed if we didn’t see yields, you know, rise as the outlook improves,” Mr. Barkin said, noting that bond yields remain meaningfully lower than pre-pandemic levels. Mr. Barkin also said he expects inflation to rise, but not to problematic levels, and that he isn’t worried that another round of fiscal aid will cause price pressure problems by overheating the economy.”

‘Bubble stocks’ such as Tesla are already feeling the pressure. It is down by a third since late January, as it has little chance of competing successfully with majors such as Ford, GM and VW, now these are focused on the Electric Vehicle market.

And the danger, as in all market downturns, is that the selling becomes self-fulfilling as realism returns. The key risk is focused on the likely response from the Exchange Traded Funds and high frequency traders who now dominate the major markets:

- They are passive investors – buying when prices move higher, and selling when prices move lower

- So when investors loaded up on margin, they all rushed to buy as well

- And when margin calls force investors to sell in a hurry, they will rush to follow

The end result will be a bubble-free market, driven by earnings and analysis rather than momentum and stock-market cheerleaders. But it will likely take a few years to unwind the damage that has been done over the past 20 years.