SHORT-TERM tactics should involve maximising returns within regions along with a greater focus on exports anywhere in the world

Asian Chemical Connections

Winners and losers as demographics, debt, sustainability, geopolitics and crude-to-chemicals rewrite the rules of success

I BELIEVE WE are heading for the biggest period of change in the global petrochemicals industry since the 1990s.

This was when globalisation took off with the formation of the World Trade Organisation (WTO), when China’s economic boom began, when the global population was more youthful and before climate change became a major threat to growth.

China could be a net exporter of 9m tonnes of PP by 2040

CHINA’S PP net imports could total 5m tonnes in 2040, or the country may instead be in a net export position of 9m tonnes.

Global HDPE capacity may have to be 13m tonnes/year lower in 2024-2030 to return to healthy operating rates

Global HDPE capacity in 2024-2030 would need to be a total of 13m tonnes/year lower than our base case to return to the 2000-2019 operating rate of 88%.

China’s 2024-2034 net HDPE imports: Either 105m tonnes or 19m tonnes

CHINA’S 2024-2034 HDPE net imports could total as much as 105m tonnes or as little a 19m tonnes

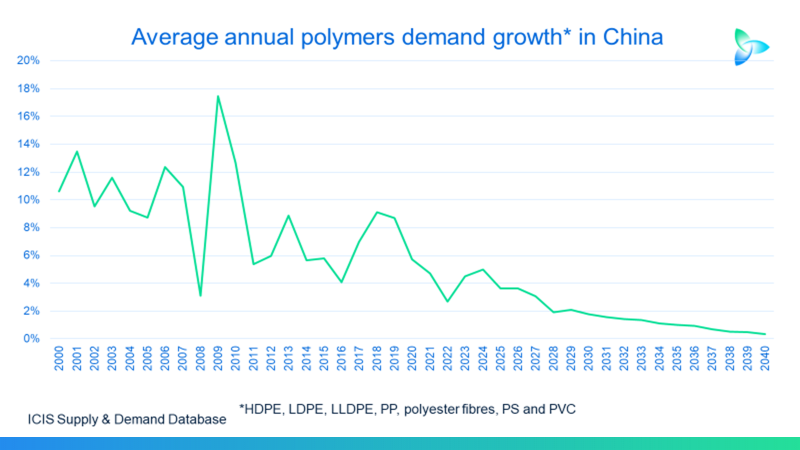

Demographics, sustainability and 1bn tonne less global polymers demand

Flat 2023-2050 demand growth in China and the developed world would leave the global market for nine synthetic resins 1bn tonnes smaller than the ICIS base case.

Competing voices and the chemicals challenge of cutting carbon

We don’t have much time. We must act quickly to prevent potentially catastrophic social, political and economic damage from climate change.

Why PP producers need to shift from maximising volumes to adding value through sustainability

Why dig more oil and gas out of the ground to make petrochemicals when the carbon cost is potentially ruinous for our climate? This might be a question increasingly asked by legislators, shareholders and the general public – rightly or wrongly.

Beware of the “head fake” of an improving China and better Q2-Q4 chemicals financial results

YEAR-ON-YEAR chemical company financial results could we improve in Q2-Q4 2023; But this should not be seen as a return to the Old Normal.

India, climate change, demographics and polymers demand growth

Climate change and demographics are economic destiny – their effects cannot be avoided. But the petrochemicals industry has a huge role to play in shaping favourable outcomes