Capacity growth of just 1.6m tonnes a year versus our base case of 5m tonnes a year would require substantial capacity closures in some regions. Closures are never easy and so take considerable time because of links with upstream refineries, environmental clean-up and redundancy costs – and the reluctance to be the “first plant out” in case markets suddenly recover.

Asian Chemical Connections

China PP exports could reach 2.6m tonnes in 2024 as markets become ever-more complex

As recently as 2020, China’s PP exports for the whole year were just 424,746 tonnes. Between 2021 and 2023 they ranged between 1.3m to 1.4m tonnes. If the January-May 2024 export momentum were to continue for the rest of this year, full-year 2024 exports would reach 2.6m tonnes, double last year’s level.

A Personal View of the New Petrochemicals World

What follows is, as always on the blog, a personal view of how I see the petrochemicals world developing. There are no right answers, and the debate is the thing. That’s how we move forward together.

Global PE demand in 2024 could have been 74m tonnes lower if incomes and population drove the market

If population and incomes drove growth, global PE demand could have been just 52m tonne in 2024 versus the ICIS forecast of 126m tonnes. The China market could have been just 10m tonnes versus 43m tonnes; the Developing World ex-China 13m tonnes versus 44m tonnes and the Developed World 29m tonnes versus 38m tonnes.

China’s average annual LLDPE net imports could be just 300,000 tonnes in 2024-2030

CHINA’S net LLDPE imports could average 6.5m tonnes a year of just 300,000 tonnes in 2024-2030

Global ethylene capacity growth would need to be 90% lower than the ICIS base case for healthy 2024-2030 operating rates

The blue line in the above chart involves annual average capacity growing at just 800,000 tonnes/year in each of the years between 2024 and 2030. This is versus our base case assumption of 7m tonnes/year of capacity growth during each of the years.

China’s 2023-2030 polyolefins demand growth and the new mood music

I think that China’s polyethylene (PE) demand growth averaged 2% across the three grades in 2023. I see this year’s growth at between 1-3%, and at the same levels up until 2030.

Why China may struggle to maintain 4-5% GDP growth: Implications for polymers

If GDP growth were a percentage point lower than ICIS forecasts during each of the years between 2023 and 2040, and assuming the same 0.7% polymer multiple over GDP, annual consumption of the nine synthetic resins would be around 10m tonnes a year lower than our base case.

The “National Champions” in the New Petrochemicals Landscape

SHORT-TERM tactics should involve maximising returns within regions along with a greater focus on exports anywhere in the world

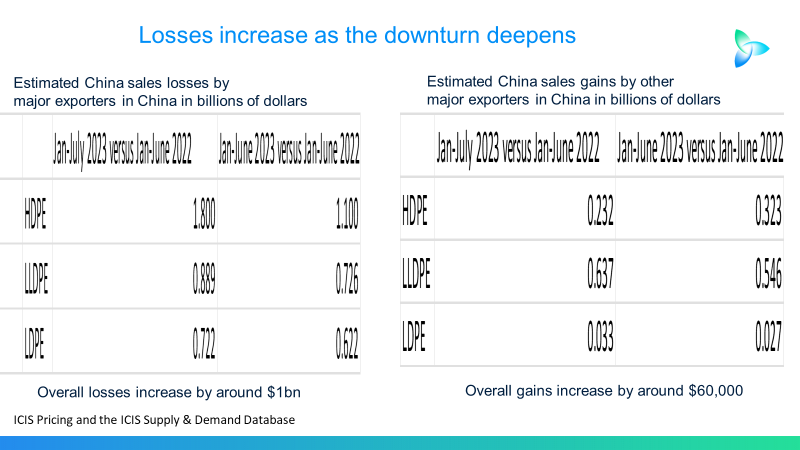

Major PE exporters to China see their sales fall by a further $1 billion

THE BIG PE exporters to China saw their sales to country decline by a further $1bn year-on-year in January-July 2023 versus January-June 2023.