SHORT-TERM tactics should involve maximising returns within regions along with a greater focus on exports anywhere in the world

Asian Chemical Connections

A fundamental shift in thinking on petrochemical plant closures

Environmental, social and political factors – along with integration into upstream petrochemicals – have held back plant closures. Now, things seems very different.

Overstocking may have boosted China PE demand as the US continues to win while others lose

THE US gains $296m in China HDPE sales as Asian and Middle East exporters lose $1.4bn.

Winners and losers as demographics, debt, sustainability, geopolitics and crude-to-chemicals rewrite the rules of success

I BELIEVE WE are heading for the biggest period of change in the global petrochemicals industry since the 1990s.

This was when globalisation took off with the formation of the World Trade Organisation (WTO), when China’s economic boom began, when the global population was more youthful and before climate change became a major threat to growth.

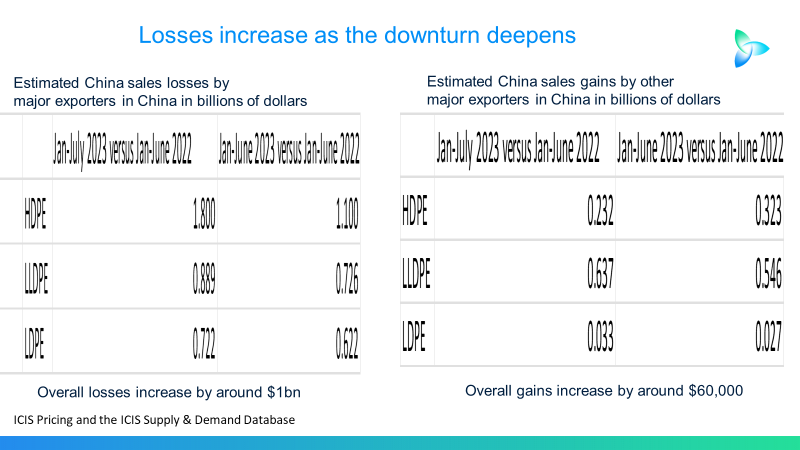

Major PE exporters to China see their sales fall by a further $1 billion

THE BIG PE exporters to China saw their sales to country decline by a further $1bn year-on-year in January-July 2023 versus January-June 2023.

Big HDPE exporters see another $700m of estimated China sales losses in one month

NINE OUT OF CHINA’S top 10 high density polyethylene (HDPE) import partners saw their sales to China fall by an estimated total of $1.8bn in January-July 2023 versus the same period last year. Meanwhile, the remaining member of the top 10, the US, saw its sales increase by $233m.

An almost perfect LLDPE buyers’ market as major producers see big China sales declines and losses in export volumes.

SEE ABOVE estimated LLDPE H1 2023 sales in China versus average H1 1999-2022 sales. Total estimated losses amounted to $594m among some of the big global producers.

China’s HDPE imports from the US surge more than triple as South Korea and Saudi Arabia and the UAE lose ground

As China’s overall high density PE (HDPE) imports fell to 2m tonnes in January-May 2023 from 2.5m tonnes during the same period last year, the US’s share of China’s import market jumped to 13% from 3%. Year-on-year imports from the US rose by 335% to 268,892 tonnes.

China imports 220% more LLDPE from the US as naphtha-based players lose market share

CHINA’S imports from the US surge by 220% in January-May 2023 as local production falls by 11% and as imports decline from Singapore, South Korea and Thailand.

The big challenges facing the world’s HDPE exporters

Saudi Arabia and South Korea must find alternative HDPE markets to China, as China’s demand weakens and it becomes more self-sufficient