A year ago, many were suggesting the lockdowns might produce a “baby boom” as couples spent more time together. But early data suggests the world is instead seeing a “baby bust”. As Nikkei Asia reports: “Births (in December/January) have fallen between 10% and 20% in such countries as Japan, France and Spain — and even […]

Chemicals and the Economy

A new recession era to emerge

Contingency planning has become mission-critical. The longer the coronavirus pandemic continues, the more it will expose the underlying fragility of today’s debt-laden global economy. Companies therefore have to move into crisis management mode, with a number of key areas requiring immediate attention: • Employee health and safety is the top priority. Governments are slowly waking […]

G7 births hit new record low, below Depression level in 1933

If a country doesn’t have any babies, then in time it won’t have an economy. But that’s not how the central banks see it. For the past 20 years, through subprime and now their stimulus policies, they have believed they could effectively “print babies”. Even today, they are still lining up to take global interest […]

Perennials set to defeat Fed’s attempt to maintain the stock market rally as deflation looms

Never let reality get in the way of a good theory. That’s been the policy of western central banks since the end of the BabyBoomer-led SuperCycle in 2000, when the oldest Boomer moved out of the Wealth Creator 25-54 age group and into the Perennial 55+ cohort. Inevitably this led to a slowdown in growth, […]

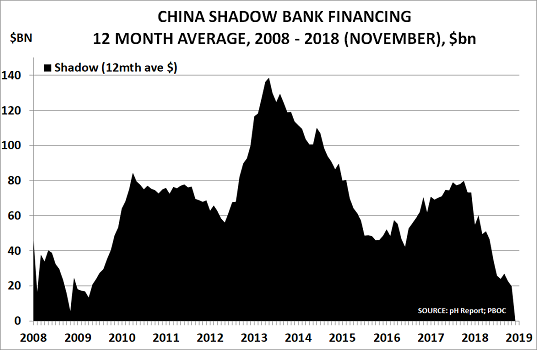

Chart of the Year – China’s shadow banking collapse means deflation may be round the corner

Last year it was Bitcoin, in 2016 it was the near-doubling in US 10-year interest rates, and in 2015 was the oil price fall. This year, once again, there is really only one candidate for ‘Chart of the Year’ – it has to be the collapse of China’s shadow banking bubble: It averaged around $20bn/month […]

US Treasury benchmark yield heads to 4% as 30-year downtrend ends

The US 10-year Treasury bond is the benchmark for global interest rates and stock markets. And for the past 30 years it has been heading steadily downwards as the chart shows: US inflation rates finally peaked at 13.6% in 1980 (having been just 1.3% in 1960) as the BabyBoomers began to move en masse into the […]

Budgeting for the Great Unknown in 2018 – 2020

“There isn’t anybody who knows what is going to happen in the next 12 months. We’ve never been here before. Things are out of control. I have never seen a situation like it.“ This comment from former UK Finance Minister, Ken Clarke, aptly summarises the uncertainty facing companies, investors and individuals as we look ahead […]

The Great Reckoning for policymakers’ failures has begun

Next week, I will publish my annual Budget Outlook, covering the 2018-2020 period. The aim, as always, will be to challenge conventional wisdom when this seems to be heading in the wrong direction. Before publishing the new Outlook each year, I always like to review my previous forecast. Past performance may not be a perfect […]

Chemical industry data shows reflation remains hope, not reality

Western central bankers are convinced reflation and economic growth are finally underway as a result of their $14tn stimulus programmes. But the best leading indicator for the global economy – capacity utilisation (CU%) in the global chemical industry – is saying they are wrong. The CU% has an 88% correlation with actual GDP growth, far […]

“Exponentially rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways”

Companies and investors have some big decisions ahead of them as we start the second half of the year. They can be summed up in one super-critical question: “Do they believe that global reflation is finally now underway?” The arguments in favour of this analysis were given last week by European Central Bank President, Mario Draghi: […]