Each year, it seems there is only one candidate for Chart of the Year. And 2020 is no exception. It has to be the CAPE Index developed by Nobel Prize winner, Prof Robert Shiller. As the chart shows, it is nearly at an all-time high with Tesla’s addition to the S&P 500. Only the peak […]

Chemicals and the Economy

Perennials set to defeat Fed’s attempt to maintain the stock market rally as deflation looms

Never let reality get in the way of a good theory. That’s been the policy of western central banks since the end of the BabyBoomer-led SuperCycle in 2000, when the oldest Boomer moved out of the Wealth Creator 25-54 age group and into the Perennial 55+ cohort. Inevitably this led to a slowdown in growth, […]

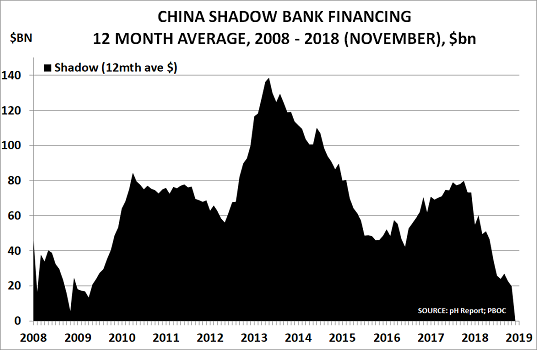

Chart of the Year – China’s shadow banking collapse means deflation may be round the corner

Last year it was Bitcoin, in 2016 it was the near-doubling in US 10-year interest rates, and in 2015 was the oil price fall. This year, once again, there is really only one candidate for ‘Chart of the Year’ – it has to be the collapse of China’s shadow banking bubble: It averaged around $20bn/month […]

Economy faces slowdown as oil/commodity prices slide

Oil and commodity markets long ago lost contact with the real world of supply and demand. Instead, they have been dominated by financial speculation, fuelled by the vast amounts of liquidity pumped out by the central banks. The chart above from John Kemp at Reuters gives the speculative positioning in the oil complex as published […]

The global economy and the US$ – an alternative view

Every New Year starts with optimism about the global economy. But as Stanley Fischer, then vice chair of the US Federal Reserve, noted back in August 2014: “Year after year we have had to explain from mid-year on why the global growth rate has been lower than predicted as little as two quarters back.” Will […]

US Treasury benchmark yield heads to 4% as 30-year downtrend ends

The US 10-year Treasury bond is the benchmark for global interest rates and stock markets. And for the past 30 years it has been heading steadily downwards as the chart shows: US inflation rates finally peaked at 13.6% in 1980 (having been just 1.3% in 1960) as the BabyBoomers began to move en masse into the […]

Anti-pollution drive hits China’s role as global growth engine

China is no longer seeking ‘growth at any cost’, with global implications, as I describe in my latest post for the Financial Times, published on the BeyondBrics blog A pedestrian covers up against pollution in Beijing © Bloomberg China’s President Xi Jinping faced two existential threats to Communist party rule when he took office 5 […]

The Great Reckoning for policymakers’ failures has begun

Next week, I will publish my annual Budget Outlook, covering the 2018-2020 period. The aim, as always, will be to challenge conventional wisdom when this seems to be heading in the wrong direction. Before publishing the new Outlook each year, I always like to review my previous forecast. Past performance may not be a perfect […]

Baby boomers’ spending decline has hit demand and inflation

The Financial Times has kindly printed my letter below, wondering why the US Federal Reserve still fails to appreciate the impact of the ageing BabyBoomers on the economy Sir, It was surprising to read that the US Federal Reserve is still puzzled by today’s persistently low levels of inflation, given that the impact of the ageing […]

Oil price weakness will unmask reflation and recovery myth

Oil markets have been at the centre of the recent myth that economic recovery was finally underway. The theory was that rising inflation, caused by rising oil prices, meant consumer demand was increasing. In turn, this meant that the central banks had finally achieved their aim of restoring economic growth via their zero interest rate […]