If population and incomes drove growth, global PE demand could have been just 52m tonne in 2024 versus the ICIS forecast of 126m tonnes. The China market could have been just 10m tonnes versus 43m tonnes; the Developing World ex-China 13m tonnes versus 44m tonnes and the Developed World 29m tonnes versus 38m tonnes.

Asian Chemical Connections

Demographics, sustainability and 1bn tonne less global polymers demand

Flat 2023-2050 demand growth in China and the developed world would leave the global market for nine synthetic resins 1bn tonnes smaller than the ICIS base case.

Why China’s HDPE demand could decline in 2023-2040

China’s cumulative HDPE demand under the downside scenario would be 97m tonnes lower than our base case. in the above chart

How to manage risks and opportunities during maybe the worst-ever PP downcycle

During this downturn, razor-like focus on fluctuating netbacks and supply and demand among all the different countries and regions will allow producers to ensure that they don’t make product for markets where there is no demand, while ensuring that they take maximum advantage of many brief periods of stronger demand and pricing.

Global oversupply of petrochemicals to hit 218m tonnes in 2023 – the highest in any other year since 1990

Capacity exceeding demand is forecast to reach 218m tonnes this year from a 1990-2022 annual average of 76m tonnes.

SEA Asia PE market dragged lower by China now container freight rates have fallen.

The decline in container freight rates has opened the SEA PE market to more competition – pulling the region’s spreads closer to the record-low China levels

A flood of PP no matter how what the 2023-2025 demand growth

EVEN if China’s PP demand growth is 14% this year – double our forecast – and growth in other regions is higher than we expect:

Global capacity in excess of demand would be 18m tonnes in 2023 compared with a 8m tonne/year average in 2000-2022,

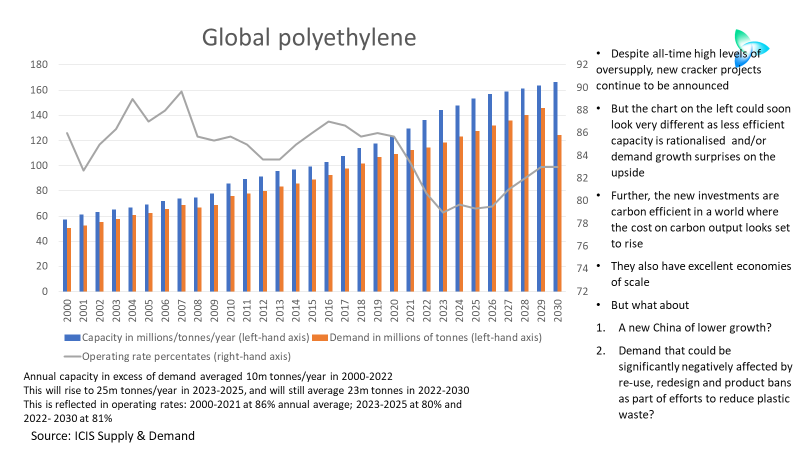

Cracker project announcements continue despite all-time high oversupply

Companies behind the crackers due on-stream over the next four years emphasise the low-carbon output. The planned new plant also have excellent economies of scale

Why European chemicals can emerge from this crisis as a winner

IT REALLY ISN’T doom and gloom if you take the longer-term view. Instead, for the chemical companies with the right strategies, the opportunities to build new sustainable business models are huge. The winners will make an awful lot of money while also doing the right things for humanity and our natural environment.

Overseas HDPE price premiums over China remain at historic highs, but maybe for not much longer

HDPE film grade price premiums for selected countries and regions over China recovered in September and October of this year. In 2020, premiums averaged just $36/tonne compared with $248/tonne in January 2021-October 2022.