CHINA’S PP net imports could total 5m tonnes in 2040, or the country may instead be in a net export position of 9m tonnes.

Asian Chemical Connections

Global PP crisis: Why capacity may need to be 18m tonnes/year lower in 2024-2030

GLOBAL PP capacity may have to be a total of 18m tonnes/year lower in 2024-2030 to return operating rates to the historically strong levels

China’s 2024-2034 net HDPE imports: Either 105m tonnes or 19m tonnes

CHINA’S 2024-2034 HDPE net imports could total as much as 105m tonnes or as little a 19m tonnes

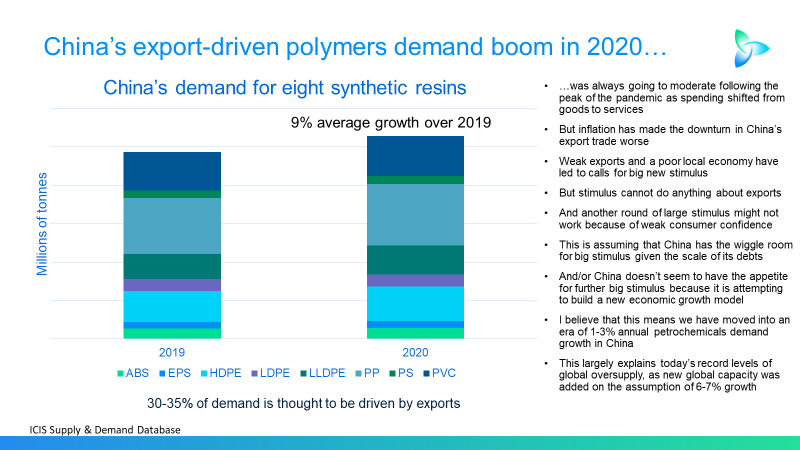

China and “pushing on a piece of string: The moderate impact of future economic stimulus

THE PHRASE “pushing on a piece of string” might best describe the logic behind calls for another round of big economic stimulus in China. Any extra money pumped into the economy could be largely saved rather than spent because of weak consumer confidence resulting from an ageing population and the end of the property bubble.

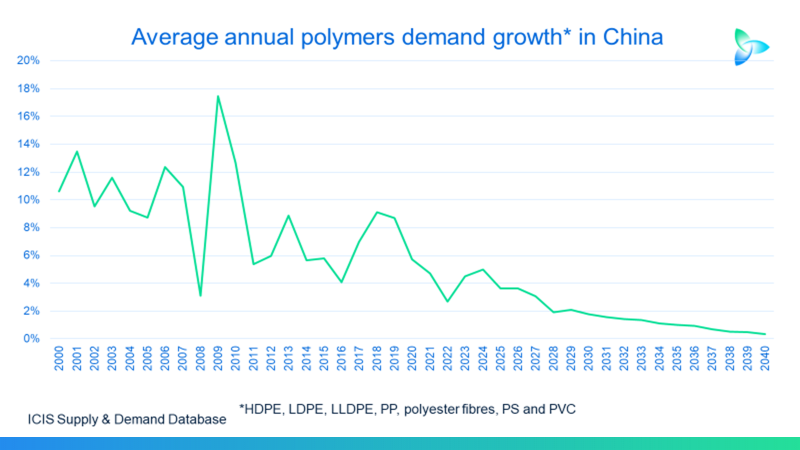

Demographics, sustainability and 1bn tonne less global polymers demand

Flat 2023-2050 demand growth in China and the developed world would leave the global market for nine synthetic resins 1bn tonnes smaller than the ICIS base case.

Competing voices and the chemicals challenge of cutting carbon

We don’t have much time. We must act quickly to prevent potentially catastrophic social, political and economic damage from climate change.

Why PP producers need to shift from maximising volumes to adding value through sustainability

Why dig more oil and gas out of the ground to make petrochemicals when the carbon cost is potentially ruinous for our climate? This might be a question increasingly asked by legislators, shareholders and the general public – rightly or wrongly.

Beware of the “head fake” of an improving China and better Q2-Q4 chemicals financial results

YEAR-ON-YEAR chemical company financial results could we improve in Q2-Q4 2023; But this should not be seen as a return to the Old Normal.

India, climate change, demographics and polymers demand growth

Climate change and demographics are economic destiny – their effects cannot be avoided. But the petrochemicals industry has a huge role to play in shaping favourable outcomes

China’s long-term PP demand growth may turn negative, shifting the focus to value from volumes

STRONG upside PP demand growth scenarios for the rest of the world might still not enough to cancel out negative growth in China