The good news for consumers is that the move to renewables is already set to save European consumers €100bn in 2021-23. The technologies needed in terms of wind, water, solar and storage can successfully deliver the cheaper and more reliable energy supply needed to support the global economy.

Chemicals and the Economy

Renewable electricity growth accelerates, as expansions account for 95% of global power increases through 2026

A new report from the International Energy Agency confirms that electricity is set to be the fuel of the future, powered by renewable sources. And the new German government’s decision to allocate 2% of Germany’s landmass to windfarms confirms the scale of the changes underway. The IEA’s chart above details the expansions now planned on […]

OPEC+ faces difficult decisions as Covid returns, recession risks rise, and oil prices crash

OPEC+ oil producers saw prices tumble $10/bbl (13%) on Friday as the world woke up to the fact that the next phase of the pandemic may be underway. And this is not the only challenge that they face. OIL PRICES HAVE ONLY BEEN HELD UP BY MAJOR SUPPLY CUTBACKS The first is the challenge from […]

Oil markets, OPEC, enter the endgame for the Age of Oil

2 major events shocked oil markets last week. They marked the start of (a) the endgame for the Age of Oil and (b) the paradigm shift to the Circular Economy and the new Age of Energy Abundance. The new ‘Net Zero by 2050’ report from the International Energy Agency (IEA) was the first shock: It […]

Rising US interest rates, US$ and oil prices set to pressure financial markets

Everyone who has ever played the Beer Distribution Game on a training course knows what is happening in supply chains today. A small increase in underlying demand is rapidly leading to a massive increase in ‘apparent demand’. As the New York Times reports, “the pandemic has disrupted every stage of the (supply chain) journey.” And […]

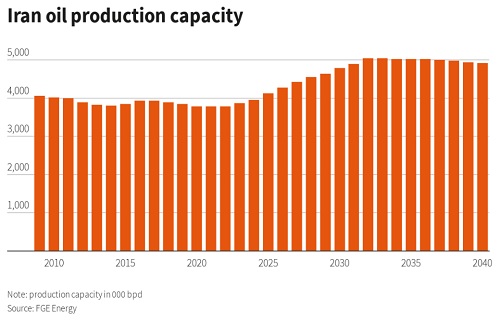

Iran highlights OPEC’s dilemma on output cuts

Saying you “won’t do something” may stop you digging a bigger hole for yourself. But it doesn’t help in deciding what you should do instead. That’s OPEC’s dilemma today on raising oil output. Everything seemed simple enough a year ago, as the pandemic took hold: Saudi Arabia’s first reaction was to assume it would have […]

Oil markets hit perfect storm as coronavirus cuts demand

Former Saudi Oil Minister Sheikh Yamani’s warning in 2000 looks increasingly prophetic today: “30 years from now, there will be a huge amount of oil – and no buyers. 30 years from now, there is no problem with oil. The Stone Age did not end because the world ran out of stones, and the Oil […]

Oil markets hold their ‘flag shape’ for the moment, as recession risks mount

Oil markets can’t quite make up their mind as to what they want to do, as the chart confirms. The are trapped in a major ‘flag shape’. Every time they want to move sharply lower, the bulls jump in to buy on hopes of a major US-China trade deal and a strong economy. But when […]

Oil market weakness suggests recession now more likely than Middle East war

Oil markets remain poised between fear of recession and fear of a US attack on Iran. But gradually it seems that fears about a war are reducing, whilst President Trump’s decision to ramp up the trade war with China makes recession far more likely. The chart of Brent prices captures the current uncertainties: It shows […]

Déjà vu all over again for oil markets as recession risks rise

Back in 2015, veteran Saudi Oil Minister Ali Naimi was very clear about Saudi’s need to adopt a market share-based pricing policy: “Saudi Arabia cut output in 1980s to support prices. I was responsible for production at Aramco at that time, and I saw how prices fell, so we lost on output and on prices […]