Blood bags, syringes, disposable hospital sheets, gowns and medicine packaging. Modern-day medicine, which has greatly extended the quantity and quality of our lives, would be impossible without the plastics industry.

Asian Chemical Connections

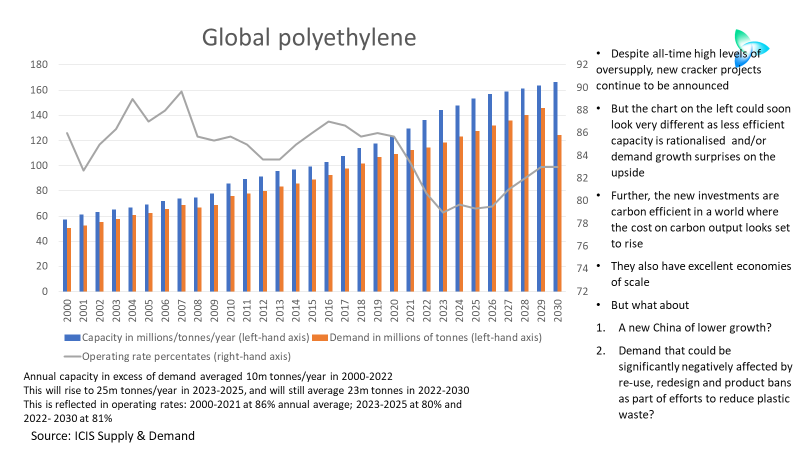

Cracker project announcements continue despite all-time high oversupply

Companies behind the crackers due on-stream over the next four years emphasise the low-carbon output. The planned new plant also have excellent economies of scale

China’s LLDPE demand weakness continues as net import prospects weaken

China’s LLDPE demand is in line to fall by 4% this year with its net imports 800,000 tonnes lower. This would follow a 1.1m tonne decline in net imports in 2021 over 2020.

After the COP26 disappointment, the “blame game” will get us nowhere

The implications of last week’s disappointing COP26 meeting in Glasgow are so complex and so numerous that is going to take more than one blog post to provide adequate coverage. In this first post, I look at the failure of COP26 to agree on a global carbon tax, in my view essential, and discuss the […]

Boom in petrochemicals demand guaranteed but we must grow sustainably

By John Richardson ONE OF THE GREATEST achievements of the last 30 years has been the fall in the number of people living in extreme poverty. In 1999, 1.9bn of the world’s population were living on less than $1.90, the Word Bank’s definition of extreme poverty. Despite setbacks caused by the pandemic, this had […]

Dow And DuPont: How A Merger Could Work

By John Richardson DOW Chemical and DuPont are companies with tremendous histories. It is no exaggeration to say that they have helped to build the American economy, right from the early days of Henry Herbert Dow and Eleuthère Irénée du Pont. Their innovations have not only created wealth for America, their employees and their shareholders […]

What A “Low Growth World” Really Looks Like

By John Richardson ONLY six new US crackers would be built over the next five years because of rising construction and labour costs, said Dow Chemical’s CEO, Andrew Liveris, in an earnings conference call last week. This would be out of the 12 crackers that have been announced (see the above table). Demand would therefore […]

Dow And Commodities-Specialities Integration

By John Richardson IS diversification itself a problem in commodity chemicals and speciality companies with operations under one roof, or is it more how this diversification is handled? This is a question raised by this excellent Insight article, from the blog’s ICIS colleague Joe Chang, which revisits the issue of hedge fund Third Point’s […]

Dow Chemical And Back To The Future

By John Richardson HOW the world has changed. Dan Loeb of the Hedge fund, Third Point, wrote in a letter proposing a spin-off of Dow Chemical’s petrochemicals assets: “We suspect that Dow’s push downstream has led the company to use its upstream assets to subsidise certain downstream derivatives, either by sacrificing operational efficiency or making […]

Credit Tightening The Key For China In 2014

By John Richardson WE have been on a magical mystery tour during the second of half 2013 in an effort to discover what has really driven the 14% year-on-year increase in polyethylene (PE) apparent demand in China in January-August – the latest data that is available to us. Apparent demand is imports plus domestic production. […]