The critical test is now ahead – making it happen. Companies, investors and policymakers need to borrow Winston Churchill’s famous motto, “Action this Day”. As Sir Jim Ratcliffe has highlighted, the penalty for doing nothing will be closure.

Chemicals and the Economy

China’s housing market moves from boom to bust

China’s housing inventory is now at a record 25 months. Prices/demand continue to fall. And local government land sale income has already fallen 1/3rd since 2021 to $800 billion, with a further 10% fall to expected this year. And so now services are having to be cut.

Scenario planning key amid volatility

Russia’s invasion is a major wake-up call about the danger of assuming business will always be “as usual”. The window for investing in future growth is starting to close. As Hemingway warned in “Fiesta”, major changes (such as Net Zero) occur “gradually, then suddenly”.

Prepare for a K-shaped recession with Winners & Losers

This is why we are facing a K-shaped recession. Companies and investors have a difficult time ahead. They not only have to navigate a potentially major downturn. But they also have to completely reposition their portfolios for the New Normal world that will follow.

The stock market bubble starts to burst

Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.

Industry now needs to step up, if Net Zero is to be achieved

Net Zero is clearly the key issue of our time. With COP26 about to start, 3 key elements need to come together to ensure success. Political leaders have to agree to meet the Net Zero targets, and to provide $100bn/year to help poorer nations fund the changes needed. But nothing will happen on the ground […]

Xi aims to “bring order out of chaos” by bursting China’s property bubble

China is at the start of its biggest economic shake-up since 1978, when Deng Xiaoping launched his post-Mao reform programme. President Xi Jinping’s ‘Common Prosperity’ policy aims to retain his focus on increasing living standards. But it wants to spread the wealth far more widely. The electricity rationing now underway across China highlights the need […]

The end of China’s real estate bubble will impact global supply chains, exports and growth

“How did you go bankrupt?” Bill asked. “Two ways,” Mike said. “Gradually, then suddenly.” These lines from Ernest Hemingway’s classic novel “Fiesta” (USA title ‘The Sun also Rises’), summarise where we now are with Evergrande’s likely default in China. It did indeed begin “gradually” at first – starting in February 2016. As I noted here […]

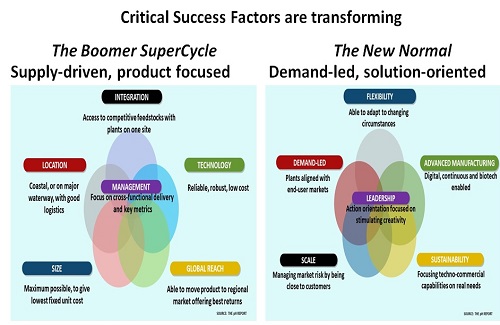

Supply chains set to transform as companies start to reshore

Major new opportunities are starting to appear in today’s New Normal world, as I describe in a new analysis for the Institution of Chemical Engineers. Please click here to read the full article. We are set to enter a “New Normal” world as economies slowly reopen again with the arrival of Covid-19 vaccines. This will […]

Pandemic leads to ‘baby bust’ as births decline in most countries

A year ago, many were suggesting the lockdowns might produce a “baby boom” as couples spent more time together. But early data suggests the world is instead seeing a “baby bust”. As Nikkei Asia reports: “Births (in December/January) have fallen between 10% and 20% in such countries as Japan, France and Spain — and even […]