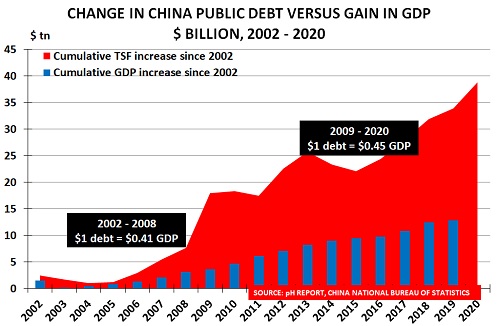

Every now and then, people wake up to the fact that debt is only good news when it adds to growth. Otherwise, it simply destroys value. China is usually the case study for this analysis, as the chart confirms. It shows the rise in debt from 2002, when official data begins, versus the rise in […]

Chemicals and the Economy

Rising US interest rates, US$ and oil prices set to pressure financial markets

Everyone who has ever played the Beer Distribution Game on a training course knows what is happening in supply chains today. A small increase in underlying demand is rapidly leading to a massive increase in ‘apparent demand’. As the New York Times reports, “the pandemic has disrupted every stage of the (supply chain) journey.” And […]

Welcome to the New Normal – a look ahead to 2030

10 years ago, I took a look ahead at what we could expect in the next decade, as discussed last week. Unfortunately, we now face the major economic and social crises that the chart predicted, if policymakers continued with ‘business as usual’. This week, I want to look ahead at what we can expect to […]

The New Normal for global industry

The global chemical industry is the third largest sector in the world behind agriculture and energy, and its outputs find their way into everything we consume. Paul Hodges, chairman of the pH Report, analyzes the chemical industry to give a unique perspective on the global economy to investors and corporations. In this timely discussion, he […]

The End of “Business as Usual”

In my interview for Real Vision earlier this month, (where the world’s most successful investors share their thoughts on the markets and the biggest investment themes), I look at what data from the global chemical industry is telling us about the outlook for the global economy and suggest it could be set for a downturn. “We look at […]

CEOs need new business models amid downturn

Many indicators are now pointing towards a global downturn in the economy, along with paradigm shifts in demand patterns. CEOs need to urgently build resilient business models to survive and prosper in this New Normal world, as I discuss in my 2019 Outlook and video interview with ICIS. Global recession is the obvious risk as we start […]

London house prices slip as supply/demand balances change

London house prices are “falling at the fastest rate in almost a decade” according to major property lender, Nationwide. And almost 40% of new-build sales were to bulk buyers at discounts of up to 30%, according of researchers, Molior. As the CEO of builders Crest Nicholson told the Financial Times: “We did this sale because we […]

Hurricane Harvey: lack of insurance will hit Houston’s recovery

“By Monday, the third straight day of flooding, the aftermath of Hurricane Harvey had left much of the region underwater, and the city of Houston looked like a sea dotted by small islands. ‘This event is unprecedented,’ the National Weather Service tweeted. ‘All impacts are unknown and beyond anything experienced.’” This summary from the New […]

US home-ownership returns to 1960’s levels

US home ownership is back at levels seen briefly in the mid-1980s, and before that in the mid-1960s. One key issue today is that while the US population is still growing, the younger population has quite a different profile from the Boomer generation, as the Pew Institute have reported. In 1980, only 1 in 10 young Boomers were […]

US housing sees major change as middle-market is squeezed

US house prices have recovering for 3 years, as the chart from the Wall Street Journal confirms. It shows two lines: The dark blue line is money of the day: prices rose steadily from 1989, peaking in 2006 at 141% of 1989 value The grey line adjusts for inflation: “real prices” were negative until 2000, […]