OPEC+ oil producers saw prices tumble $10/bbl (13%) on Friday as the world woke up to the fact that the next phase of the pandemic may be underway. And this is not the only challenge that they face. OIL PRICES HAVE ONLY BEEN HELD UP BY MAJOR SUPPLY CUTBACKS The first is the challenge from […]

Chemicals and the Economy

‘Watch out below!’ as supply chain chaos comes to an end

“What goes up, comes down” is usually a good motto when prices start to reach for the skies. As the great investor Bob Farrell noted in his 10 Rules, they usually go further than you think. But they don’t then correct by going sideways. The charts showing US lumber prices, China coal prices and the […]

The Fed’s stock market bubble is at risk as China bursts its real estate bubble

The US stock market bubble just keeps rising. And every investor “knows” that the US Federal Reserve will never let it burst. But the Fed can’t control the fallout from the bursting of China’s ‘subprime on steroids’ real estate bubble. Could this also mean the end of the Fed’s bubble? There is no doubt that […]

Xi aims to “bring order out of chaos” by bursting China’s property bubble

China is at the start of its biggest economic shake-up since 1978, when Deng Xiaoping launched his post-Mao reform programme. President Xi Jinping’s ‘Common Prosperity’ policy aims to retain his focus on increasing living standards. But it wants to spread the wealth far more widely. The electricity rationing now underway across China highlights the need […]

The end of China’s real estate bubble will impact global supply chains, exports and growth

“How did you go bankrupt?” Bill asked. “Two ways,” Mike said. “Gradually, then suddenly.” These lines from Ernest Hemingway’s classic novel “Fiesta” (USA title ‘The Sun also Rises’), summarise where we now are with Evergrande’s likely default in China. It did indeed begin “gradually” at first – starting in February 2016. As I noted here […]

An Evergrande default could reset the Chinese, and global, economy

China’s economy has been ‘subprime on steroids’ since the financial crisis in 2008. And essentially, this has morphed into a giant Ponzi scheme, where some property developers used deposits paid by new buyers to finance the construction of apartments they’d already sold. Now the world’s most indebted property developer, Evergrande, has warned it may default […]

Pandemic leads to ‘baby bust’ as births decline in most countries

A year ago, many were suggesting the lockdowns might produce a “baby boom” as couples spent more time together. But early data suggests the world is instead seeing a “baby bust”. As Nikkei Asia reports: “Births (in December/January) have fallen between 10% and 20% in such countries as Japan, France and Spain — and even […]

China’s dual circulation policy aims to reduce debt reliance

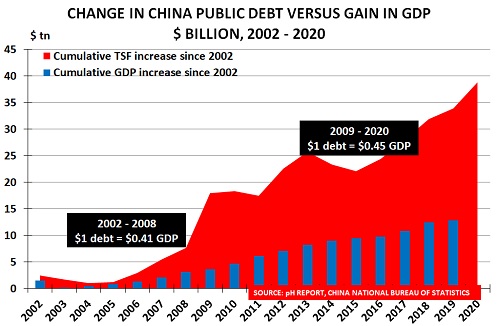

Every now and then, people wake up to the fact that debt is only good news when it adds to growth. Otherwise, it simply destroys value. China is usually the case study for this analysis, as the chart confirms. It shows the rise in debt from 2002, when official data begins, versus the rise in […]

Rising US interest rates, US$ and oil prices set to pressure financial markets

Everyone who has ever played the Beer Distribution Game on a training course knows what is happening in supply chains today. A small increase in underlying demand is rapidly leading to a massive increase in ‘apparent demand’. As the New York Times reports, “the pandemic has disrupted every stage of the (supply chain) journey.” And […]

Chart of the Year – CAPE Index signals negative S&P 500 returns to 2030

Each year, it seems there is only one candidate for Chart of the Year. And 2020 is no exception. It has to be the CAPE Index developed by Nobel Prize winner, Prof Robert Shiller. As the chart shows, it is nearly at an all-time high with Tesla’s addition to the S&P 500. Only the peak […]