By John Richardson

WE COULD now be in a destocking phase in petrochemicals markets as oil prices are falling on a surge in US production.

This would obviously mean lower petrochemicals pricing, leaving companies that have overbuilt raw material inventories with substantial financial losses. I hope that most companies have been prudent.

In January, the EIA estimated that the US would surpass 10 million barrels a day of crude production in February. But it hit that level last November as actual production in January hit 10.2 million barrels a day. The EIA’s February Short-Term Energy Outlook forecasts that US output will be above 11 million barrels a day in 2018. Only last month, the agency said that the US wouldn’t reach this amount until November 2019.

As the goalposts keep moving on US production levels, also hanging over the market is the record number of long positions held by the hedge funds.

The hedgies have made excellent money on buying crude and shorting the dollar. But they may soon start going short on crude whilst switching to long positions on the dollar. This would be in response to higher-than-expected US production and a “risk off” tactic if equity markets suffer further declines. The dollar is often a safe haven when stock markets slip.

Further, we are heading into the refinery maintenance season that will dampen demand for crude. Meanwhile, another major seasonal demand dampener is just around the corner both for oil and petrochemicals, which is the Lunar Year Holiday. This takes place in 15-21 February but activity in petrochemicals markets is already winding down.

I could be so easily wrong as forecasting oil markets is very often fool’s gold. An unexpected turn of events may send crude soaring again. But even if this is the case, the events of the last few days illustrate the risks ahead as we enter a period of what seems likely to be exceptionally volatile crude prices.

- Oil and equity markets (and they are both linked, of course) could suffer from repeated episodes of risk-on and risk-off. This would be the result of the ebb and flow of concerns over inflation and its impact on interest rates. A lot of focus will also be on the growing US budget deficit and its impact on the cost of borrowing.

- Unexpected events could easily include geopolitics. Risks here include the Saudi Arabia and Iran relationship and the North Korea nuclear weapons programme. We are living through a period of great geopolitical tension.

- I also believe that confusion over the direction of the global economy may add to uncertainty. Global economic fundamentals are not as good as conventional thinking suggests. In the case of China, its economy is likely to slow – albeit probably very moderately – in 2018.

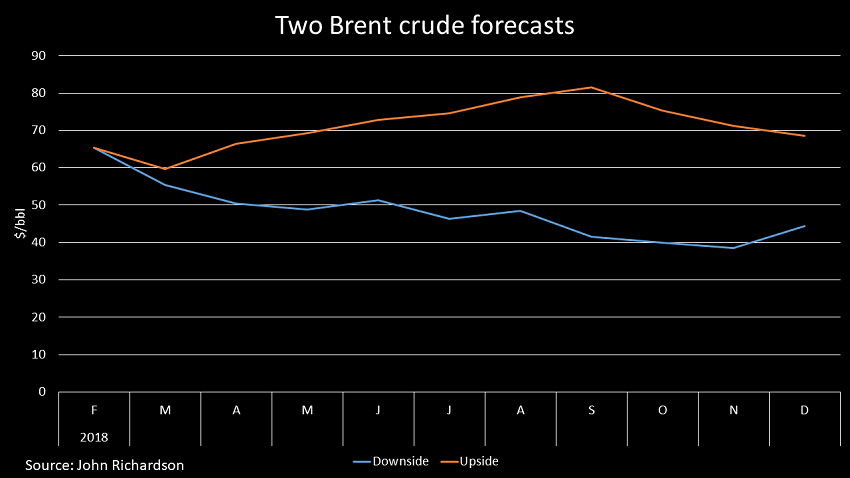

Scenario planning around crude rising to $80 a barrel during the rest this year or falling to below $40 a barrel might thus be sensible.