By John Richardson

CHINA’s real estate sector was responsible for 16% of the country’s GDP growth, 33% of fixed asset investment, 20% of outstanding loans, 26% of new loans, and contributed 39% to government revenues in 2013, according to Nomura.

And so the potential downside to chemicals demand from a correction in the property sector is significant.

For years, people wrongly predicted the bursting of China’s real-estate bubble. The reason why they were wrong was that, because of the kind of statistics detailed above, the Chinese government stepped in to rescue the property sector whenever it was at risk.

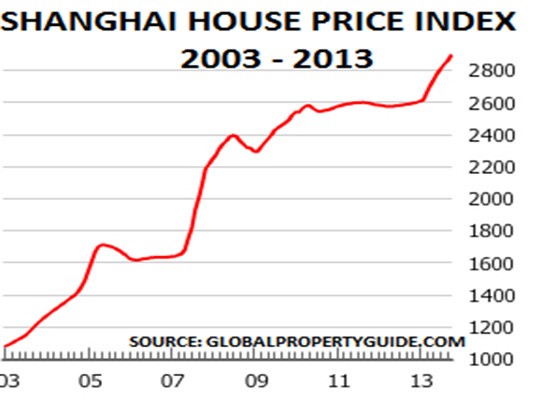

Why might this time be different? Because of the new government’s firm commitment to widespread economic reforms designed to rid the economy of unsustainable growth, including in the property sector (see the above chart).

Hundreds of millions of Chinese have been priced-out of owning their own homes.

And the real-estate boom has hugely widened the gap between the “haves and the “have nots”. For instance, Sydney University’s Dr John Lee estimates that 30% of China’s private housing wealth is owned by just 1% of people. The “wealth effect” has thus been mainly enjoyed by a tiny minority.

Further, as we shall discuss in detail on Monday, the imbalances in the property sector have to be dealt with as they are an intrinsic part of the country’s economically, socially and environmentally toxic growth model, including trade finance practices that have greatly distorted chemicals demand. In other words, unless you unravel all the imbalances in the property sector, you might as well not bother with economic reform at all.

Meanwhile, here is some worrying analysis and data:

- The government’s decision to allow Zhejiang Xingrun Real Estate to default on its US$565 million of debt is a firm indication that the property market is no longer a one-way bet, thanks to the guarantee of government support. “We believe more property developers will face similar pressures as transaction volumes slow and cash flow conditions tighten, and expect this problem to be more severe for unlisted developers in third- and fourth-tier cities with limited access to financing,” said Nomura economist, Zhiwei Zhang.

- The risk for developers is particularly high in third- and fourth-tier cities, which accounted for 67% of housing under construction in China in 2013, added Zhang. “This risk does not seem fully recognised in the market partly because data are not readily available for these cities, and some investors may be misled by the boom in first-tier cities,” he said, adding that most investors aren’t aware that first-tier cities (Beijing, Shanghai, Guangzhou and Shenzhen) only account for 5% of housing under construction.

- Nationwide, residential floor space per registered urban resident reached 37 square meters by 2013, compared with 35 in Japan and 33 in UK, according to Nomura. And, if the current trend holds, it could reach 51 square meters by 2017.

- More importantly, Nomura believes the pace of urbanisation has started to slow and is set to drop further. This will make it harder for real-estate supply to be absorbed by demand.