By John Richardson

THE US economy is in a debt-induced bubble that will sooner or later burst with of course major negative consequences for the rest of the world.

You cannot print babies. The huge amounts of money that the US Federal Reserve has pumped into the US economy since 2008 combined with last year’s tax cuts cannot reverse the fact that spending on housing, transportation and other goods and services declines when people retire – and the US population is ageing.

All that the stimulus money has done has brought forward demand from later years. People have been encouraged to spend now rather than later from a diminishing pool of total demand as the US population ages.

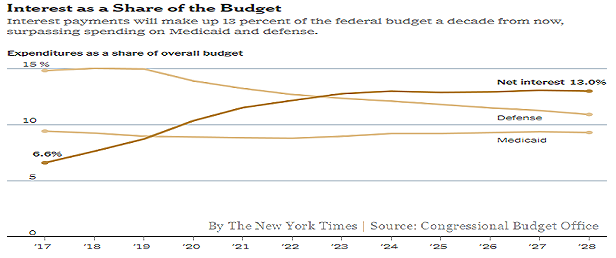

The above chart from the New York Times illustrates the core of the problem. As demand declines US interest costs are set to soar. They will rise from 6.6% of total federal government expenditure in 2017 to 13% in 2028. And as you can see from the trend-line the steep take-off in interest costs has already begun.

US debt default a major risk

What is truly shocking is the warning from the Congressional Budget office that the US will face decisions on whether to default on the Highway Trust Fund (2020), the Social Security Disability Insurance Trust Fund (2025), Medicare Hospital Insurance Trust Fund (2026) and then Social Security itself (2031).

If the US decides to bail these government services out it will either have to make cuts elsewhere, or raise taxes, or default on the debt itself. As you can see in the case of the Highway Trust Fund this is not a threat which is many years away. This is instead a threat for 2020.

Adding to the immediacy of the danger is rising US interest rates as the Fed withdraws stimulus. This is obviously one of the reasons why the trend-line on the on the New York Times chart is already taking off.

Paul Hodges and I have been warning of these risks since 2011 when we published our e-book, Boom Gloom & The New Normal. The book and subsequent research on the same themes have been the subject of many of our presentations at petrochemicals industry conferences and to individual petrochemicals companies.

A major new Deutsche Bank study, which was published last month, supports our arguments.

Impact on petrochemicals

The smart petchems companies will already be positioned to cope with the bursting of the US debt bubble.

They will have hedging strategies in place to deal with the subsequent volatility in oil prices and of course the downstream volatility in petrochemicals prices and demand. A risk is that as investors in stock and commodity markets flee to safety, equity and commodity markets, including oil, will see major sell-offs.

Longer term, the strategies that the smart companies will already have firmly in place will take into account more regional and less global markets. When the US debt bubble bursts, populist politics will become even more popular as voters will feel even more betrayed mainstream politicians. Trade barriers will thus rise from today’s already elevated levels.

Another demographics-related challenge that the smart companies will already be ready to deal with is sustainability. In the Babyboomer peak years anything seemed possible and so consumption exploded. As populations age in the West, spending habits will become more cautious and risk-averse. And from the 1970s through to the early 2000s, during the Babyboomer-led economic supercycle, we were less aware of the impact of our consumption behaviour on the environment.