By John Richardson

A NEW NORMAL for European (PE) markets could be underway, replacing the divided world of the last 10 months, as the chart below suggests.

The Old Normal involved very tight European PE markets and robust pandemic-driven demand. Supply was tight because of major US production losses (the US is structurally long, and Europe is the US’s main export destination) and lower imports from Asia and the Middle East because of container costs and shortages.

This occurred as Asian supply increased due to big new capacities in China and South Korea –- and as China’s economy began its long-term slowdown because of Common Prosperity.

Between the second week of January 2014, when our margin assessments began, until the first week of April 2021, the average premium for northwest Europe (NWE) high-density polyethylene (HDPE) margins over northeast Asia (NEA) was $385/tonne.

But from the second week of April 2021 until the first week of March 2022, the average premium rose to an astonishing $1,081/tonne.

For the week ending 11 March, the NWE premium over NEA fell to $723/tonne from the previous week’s $1,088/tonne. In what might not be a coincidence, $723/tonne was close to the same level as the first week of April 2021 – before the great run-up began.

The same patterns are detectable in low-density (LDPE) and linear-low density (LLDPE) margins.

Now let’s show this in terms of actual margins rather than differentials.

Northeast Asian margins are amidst their longest-ever run of consecutive weeks of negative values, which began in the second week of December 2021. During that week, NEA margins were at minus $95/tonne versus a positive $1,081//tonne in NWE.

But last week, NEA margins were minus $476/tonne – the second lowest level on record (the lowest level being the previous week) – with NWE margins at just $247/tonne.

What Europe’s New Normal could look like

We only have one month of US HDPE export data for 2022 – 253,722 tonnes for January. This is a sharp fall from January 2021 at 354,905 tonnes.

It is, of course, impossible to discern any trend from just one month’s data. But if there is no repeat of last year’s major production problems and with new capacity coming online, US HDPE exports could total 4.5m tonnes in 2022 compared with last year’s 2.9m tonnes.

This year’s US LLDPE and LDPE exports may also see significant increases if production returns to normal and as new capacity comes online.

But, as I said, it is too early to draw any conclusions on the effects of US exports on the European HDPE business in 2022. US exports clearly, however, need monitoring very closely.

The chart below is a reminder of the big feedstock-cost advantages that the ethane-based US producers often enjoy over their naphtha-based European competitors.

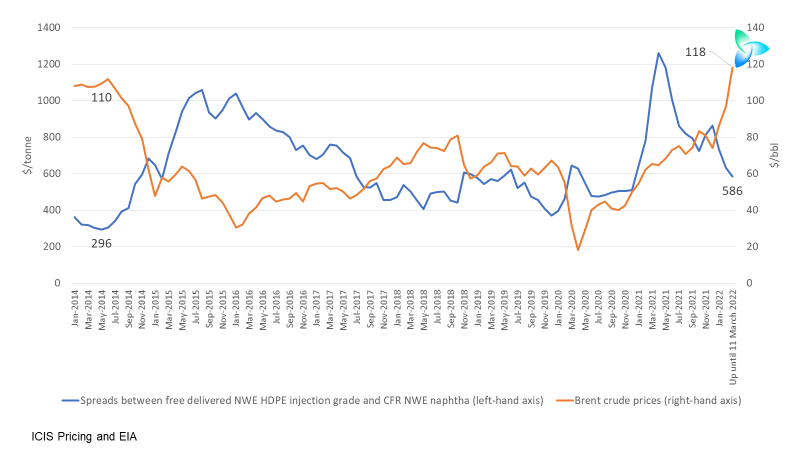

What we do know is that the big surge in naphtha feedstock costs in Europe is having a major negative effect on the region’s PE industry. The chart below shows the spread between tonnes of CFR NWE naphtha and tonnes of free delivered NWE injection grade HDPE –- along with Brent crude prices.

Spreads have so far in March this year averaged $586/tonne, comfortably higher than their lowest level since January 2014 of $296/tonne – which occurred in May of that year. This is despite Brent crude averaging $118/bbl in March 2022 versus $110/bbl in May 2014.

The Ukraine-related run-up in oil prices is combining with reported problems with European naphtha supply. Fifty per cent of Europe’s naphtha requirement comes from Russia.

Russian oil and naphtha shipments to Europe have not been sanctioned. But ICIS pricing reports that nobody is buying Russian naphtha, perhaps because of Russia’s expulsion from the SWIFT bank transactions system. European refinery operating rates are said to have been reduced on the high oil costs.

The coronavirus outbreak is getting worse in China. Cases had risen to 5,000 on Tuesday with 28 of China’s 31 mainland provinces affected by restrictions.

“The measures in China, home to about one-third of global manufacturing, are disrupting the production of finished goods like Toyota and Volkswagen cars and Apple’s iPhones, as well as components such as circuit boards and computer cables,” wrote the New York Times in this article.

China’s Yantian container port, the world’s third largest, is reported to have effectively shut down because of the lockdowns affecting the city of Shenzhen, where the port is located. Other ports may also be affected.

These new supply-chain problems could add to European inflation. Eurozone inflation had already reached 5.8% in February, way above the European Central Bank’s forecast for 2022 of 3.2% –- and well above its target range of 2%.

Such are the inflationary pressures that we could be into demand destruction territory for PE in Europe as people cut back on even grocery spending.

Another challenge for the European PE industry may arrive next winter when the weather turns cold, and as the EU tries to reduce dependence on Russian gas by two-thirds over the next 12 months.

Meeting this target is said to be aspirational rather than realistic, based on the availability of alternative supplies of gas, coal and nuclear energy.

So, could we see reduced electricity supply? If this were to happen, it is thought industrial rather than domestic users would see their supplies of electricity cut. Might the European refining and petrochemicals industries be affected? I have no idea, as the situation is so fluid and complex.

If Europe sees a recession, the fall in electricity demand might be sufficient to meet the EU target. As with US HDPE imports, watch the electricity supply space very closely.

In summary, the European PE New Normal may involve:

- More imports from feedstock-advantaged US PE producers.

- Further downward pressure on European PE margins due to high feedstock costs and demand destruction resulting from energy (Ukraine) and supply-chain driven (China’s latest coronavirus outbreak) inflation. The European premiums over Asian margins could continue to shrink as Asian profitability remains depressed.

- A search for alternatives to Russia naphtha which meets 50% of European demand.

- A very complex electricity supply outlook that needs to be monitored very closely as next winter approaches. The EU wants to reduce dependence on Russian gas by two-third in 12 months. This may involve reduced electricity supply, if a recession doesn’t make the target easier to meet because of lower demand.

Conclusion: how we can support you

The Ukraine crisis is so fluid that of course what you’ve just read will likely be very quickly out of date. But I hope that the above comments will help European PE producers plan for the risks ahead.

What I see as vital is integrating oil, natural gas, petrochemicals feedstock and PE market intelligence and data to an extent that has rarely, if ever, been needed before.

For support from ICIS in how to achieve this, contact me at john.richardson@icis.com.