Guest blogger today is Ajay Parmar. He is a chemical engineering professional with 5 years of industrial experience in oil refining, primarily in a process engineering capacity. He joined ICIS in 2018 as a Senior Analyst and currently works on developing a price forecasting model for crude oil and refined products.

Guest blogger today is Ajay Parmar. He is a chemical engineering professional with 5 years of industrial experience in oil refining, primarily in a process engineering capacity. He joined ICIS in 2018 as a Senior Analyst and currently works on developing a price forecasting model for crude oil and refined products.

ICIS 2019 Crude Oil Outlook

Whilst global economic growth will continue to be positive in 2019, it is likely to grow at a slower rate. But what impact, if any, will this have on the crude oil price? Decelerating growth isn’t the only thing on the minds of crude buyers. Upcoming fuel oil sulphur specification changes will be on most crude buyers’ minds throughout 2019, whilst the changing suppliers’ market is likely to ensure a price floor and ceiling for crude in the near term.

Slower Growth

Ten years on from ‘The Great Recession’, the world economy is finally entering the final stages of this economic cycle. But in December 2018, the results of the China PMI, which provides an indication of a country’s manufacturing health, fell to the lowest figure since February 2016. Moreover, the months between May and December 2018 recorded almost constant declines, with those months just prior to December hovering around 50, the expansion/contraction tipping point, and ultimately breaching this point in December, falling to 49.7.

Manufacturing contraction has long been a strong indicator of economic slowdown and so contraction in the world’s leading industrial producer presents a serious global economic concern.

In addition to the ongoing US-China trade war (which has been discussed by John Richardson in previous blog posts), market participants will be keenly watching how these trends continue to develop throughout the year.

IMO 2020

We’ve discussed the key factors pointing towards dampening economic growth, but there is another key trend which will have a monumental effect on markets in 2019: the IMO’s upcoming regulations (IMO2020), which will mandate a reduction of sulphur emissions from shipping.

Market analysts here at ICIS generally agree that the upcoming changes will lead to a rise in crude oil prices, beginning Q3 2019. But why should the crude oil market be so impacted by a simple change on a fuel oil product? The reason lies with the types of crudes that refineries can process.

There are generally two types of crude oil: low and high sulphur. Low sulphur crude tends to be easier to process and yields a much higher quantity of transportation fuels, which is where refiners make the bulk of their revenues.

Conversely, high sulphur crude tends to contain significantly less valuable components; this means additional processes are required to transform the lower value residues into transportation fuels.

These contrasting qualities mean that high sulphur crude oil attracts a price discount over its low sulphur alternatives. This also means that when the IMO implements its new regulations, the demand for low sulphur crude will skyrocket, since many refineries cannot produce low sulphur fuel oil products without low sulphur crude. It is for this reason that the price of low sulphur crude will likely substantially rise, whilst the price difference between low and high sulphur crude is also likely to increase.

Changing Suppliers’ Market

Today’s oil market vastly differs from that only 10 years ago. Historically, there has been a single cohort which had the ability to affect the crude oil price: OPEC.

In more recent years though, a new player has been growing at an unprecedented rate: the US shale producers. Between 2008 to the 2014 price crash, the US rig count grew by over 7x and today, the US is the largest oil producer in the world thanks to shale oil production. They are now the world’s oil ‘swing producer’. Yet with prices of US WTI crude oil hovering below $50 per barrel, many shale oil companies struggle to break even and so halt production.

At the same time, Saudi Arabia, the de-facto leader of OPEC, cannot balance its budgets with the oil price less than $80. Since OPEC still holds significant sway on the market, it can cut supply to the market to help raise the price of oil: beginning January 2019, OPEC has agreed to continue its supply cuts policy to the middle of the year.

However, at such high prices those US shale rigs that have temporarily stopped production due to oil prices below their breakeven price, return to full production again. This new dynamic leads us to believe there now exists a floor and ceiling in crude oil prices.

Crude Oil Price Effects

So what effects will the above trends have on the crude oil supply/demand dynamic and price?

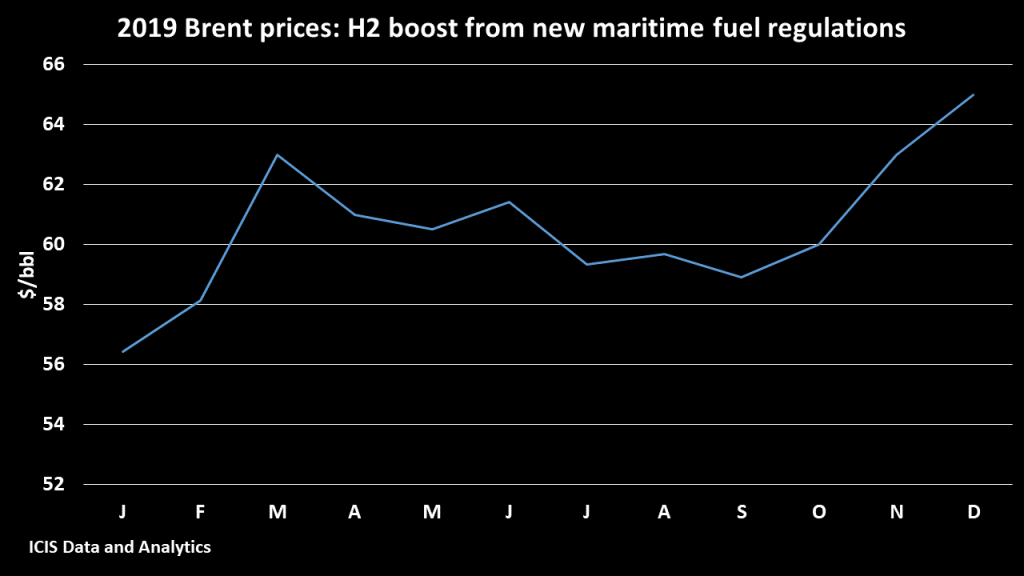

Worries over the economic climate will be pervasive throughout the year. Even if we do not actually experience a severe weakening of economic growth in 2019, we expect negative market sentiment to be enough to have some level of depressive effect on oil prices, particularly in H1 2019. With China’s economic growth forecast to slow, demand will be muted throughout the year.

However, OPEC’s supply cuts of 1.2 million barrels per day should provide some price buoyancy. The second half of the year will be the period when preparations for the IMO regulations will begin to take prominence in the minds of market participants. Refiners tend to agree crude contracts 30-60 days before delivery of the crude, but given the substantial effect that IMO will have on the markets, preparations will likely begin earlier than this. Therefore, we expect prices to rise beginning in September, and anticipate the 2019 price of crude will range between the mid-$50’s to mid-$60’s per barrel.